Zynga 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

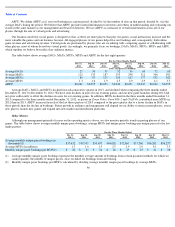

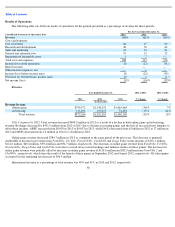

Stock-based expense included in the statements of operations data above was as follows:

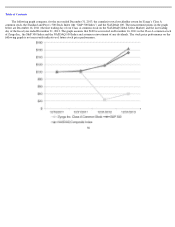

Non-GAAP Financial Measures

Bookings

To provide investors with additional information about our financial results, we disclose within this Annual Report on Form 10-K,

bookings, a non-GAAP financial measure. We have provided below a reconciliation between bookings and revenue, the most directly

comparable GAAP financial measure.

Bookings is a non-GAAP financial measure that is equal to revenue recognized during the period plus the change in deferred revenue

during the period. We record the sale of virtual goods and mobile downloads as

40

(1) See the section titled “Non-GAAP Financial Measures” below for how we define and calculate bookings, a reconciliation between bookings

and revenue, the most directly comparable GAAP financial measure and a discussion about the limitations of bookings and adjusted

EBITDA.

(2) See the section titled “Non-GAAP Financial Measures” below for how we define and calculate adjusted EBITDA, a reconciliation between

adjusted EBITDA and net income (loss), the most directly comparable GAAP financial measure and a discussion about the limitations of

bookings and adjusted EBITDA.

(3) DAUs is the number of individuals who played one of our games during a particular day, as recorded by our internal analytics systems.

Average DAUs is the average of the DAUs for each day during the period reported. See the section titled “Management’s Discussion and

Analysis of Financial Condition and Results of Operations—Key Metrics—Key Operating Metrics—DAUs” for more information on how

we define and calculate DAUs. This reflects 2009 data commencing on July 1, 2009.

(4) MAUs is the number of individuals who played a particular game during a 30-day-period, as recorded by our internal analytics systems.

Average MAUs is the average of the MAUs at each month-end during the period reported. See the section titled “Management’s Discussion

and Analysis of Financial Condition and Results of Operations—Key Metrics—Key Operating Metrics—MAUs” for more information on

how we define and calculate MAUs. This reflects 2009 data commencing on July 1, 2009.

(5) MUUs is the number of unique individuals who played any of our games on a particular platform during a 30-

day period, as recorded by our

internal analytics systems. Average MUUs is the average of the MUUs at each month-end during the period reported. See the section titled

“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Metrics—Key Operating Metrics—

MUUs

”

for more information on how we define and calculate MUUs. This reflects 2009 data commencing on July 1, 2009.

(6) ABPU is defined as (i) our total bookings in a given period, divided by (ii) the number of days in that period, divided by (iii) the average

DAUs during the period. See the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—

Key Metrics—Key Operating Metrics—ABPU” for more information on how we define and calculate ABPU. This reflects 2009 data

commencing on July 1, 2009.

Year Ended December 31,

2013

2012

2011

2010

2009

Cost of revenue

$

468

$

12,116

$

17,660

$

2,128

$

443

Research and development

61,931

200,640

374,920

10,242

1,817

Sales and marketing

8,079

24,684

81,326

7,899

518

General and administrative

13,915

44,546

126,306

5,425

1,212

Total stock

-

based compensation

$

84,393

$

281,986

$

600,212

$

25,694

$

3,990

Year Ended December 31,

2013

2012

2011

2010

2009

Consolidated Balance Sheet Data:

Cash, cash equivalents and marketable securities

$

1,541,970

$

1,652,313

$

1,917,606

$

738,090

$

199,958

Property and equipment, net

348,793

466,074

246,740

74,959

34,827

Working capital

964,897

975,225

1,355,224

385,564

(12,496

)

Total assets

2,279,085

2,576,320

2,516,646

1,112,572

258,848

Deferred revenue

189,915

347,005

480,645

465,236

223,799

Total stockholders

’

equity (deficit)

1,877,271

1,825,503

1,749,539

482,215

(21,478

)