Zynga 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

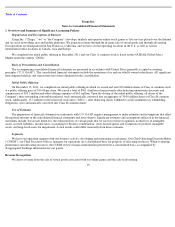

Table of Contents

events that have been recognized in our financial statements or tax returns. The measurement of current and deferred tax assets and liabilities is

based on provisions of enacted tax laws; the effects of future changes in tax laws or rates are not anticipated. If necessary, the measurement of

deferred tax assets is reduced by the amount of any tax benefits that are not expected to be realized based on available evidence. We account for

uncertain tax positions by reporting a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be taken

in a tax return. We recognize interest and penalties, if any, related to unrecognized tax benefits in income tax expense.

Foreign Currency Transactions

Generally, the functional currency of our international subsidiaries is the U.S. dollar. For these subsidiaries, foreign currency denominated

monetary assets and liabilities are remeasured into U.S. dollars at current exchange rates and foreign currency denominated nonmonetary assets

and liabilities are remeasured into U.S. dollars at historical exchange rates. Gains or losses from foreign currency remeasurement are included in

other income (expense), net in the consolidated statements of operations. For foreign subsidiaries where the functional currency is the local

currency, we use the period-end exchange rates to translate assets and liabilities, and the average exchange rates to translate revenues and

expenses into U.S. dollars. We record translation gains and losses in accumulated other comprehensive income (loss) as a component of

stockholders’ equity.

Concentration of Credit Risk and Significant Customers

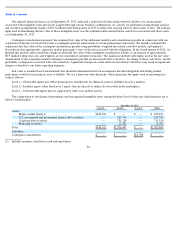

Financial instruments, which potentially expose us to concentrations of credit risk, consist primarily of cash and cash equivalents, short-

term and long-term marketable securities, and accounts receivable. Substantially all of our cash, cash equivalents and short-term marketable

securities are maintained with three financial institutions with high credit standings. We perform periodic evaluations of the relative credit

standing of these institutions.

Accounts receivable are unsecured and represent amounts due to us based on contractual obligations where a signed and executed contract

or click-through agreement exists. In cases where we are aware of circumstances that may impair a specific customer’s ability to meet its

financial obligations, we record a specific allowance as a reduction to the accounts receivable balance to reduce it to its net realizable value.

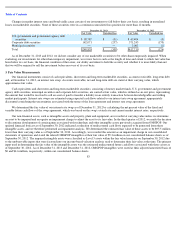

Facebook is a significant distribution, marketing, promotion and payment platform for our social games. A significant portion of our 2013,

2012 and 2011 revenue was generated from players who accessed our games through Facebook. As of December 31, 2013 and December 31,

2012, 41% and 58% of our accounts receivable, respectively, were amounts owed to us by Facebook.

Advertising Expense

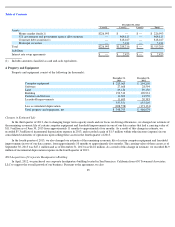

Costs for advertising are expensed as incurred. Advertising costs, which are included in sales and marketing expense, primarily consisting

of player acquisition costs, totaled $60.6 million, $102.2 million and $102.6 million for the years ended December 31, 2013, 2012 and 2011,

respectively.

Recent Accounting Pronouncements

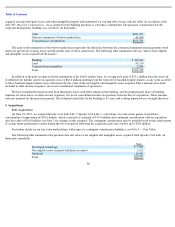

In June 2013, the Financial Accounting Standards Board ratified Emerging Issues Task Force (“EITF”) Issue 13-C, “Presentation of an

Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists”

which concludes

an unrecognized tax benefit should be presented as a reduction of a deferred tax asset when settlement in this manner is available under the tax

law. We will adopt this amendment in the first quarter of 2014. We do not expect our adoption of this standard to have a material impact on our

financial statements.

81