Zynga 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

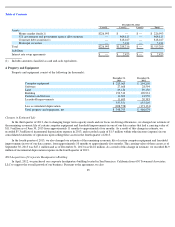

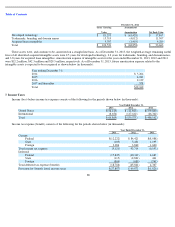

4. Property and Equipment

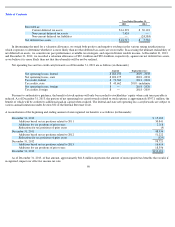

Property and equipment consist of the following (in thousands):

Changes in Estimated Life

In the third quarter of 2013, due to changing longer term capacity needs and our focus on driving efficiencies, we changed our estimate of

the remaining economic life of certain computer equipment and leasehold improvements in one of our data centers that had a carrying value of

$11.9 million as of June 30, 2013 from approximately 11 months to approximately four months. As a result of this change in estimate, we

recorded $5.3 million of incremental depreciation expense in 2013, and recorded a gain of $1.5 million within other income (expense) in our

consolidated statements of operations upon selling these assets in the fourth quarter of 2013.

In the fourth quarter of 2013, we also changed our estimate of the remaining economic life of certain computer equipment and leasehold

improvements in two of our data centers, from approximately 10 months to approximately five months. The carrying value of these assets as of

September 30, 2013 was $27.1 million and as of December 31, 2013 was $14.6 million. As a result of this change in estimate, we recorded $4.9

million of incremental depreciation expense in the fourth quarter of 2013.

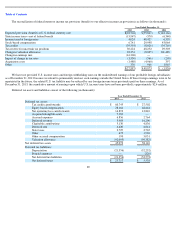

2012 Acquisition of Corporate Headquarters Building

In April, 2012, we purchased our corporate headquarters building located in San Francisco, California from 650 Townsend Associates,

LLC to support the overall growth of our business. Pursuant to the agreement, we also

85

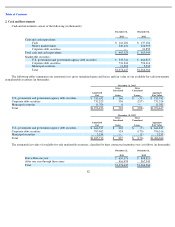

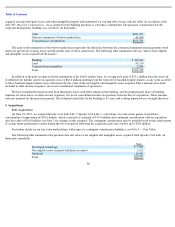

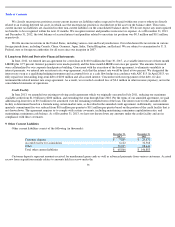

December 31, 2012

Level 1

Level 2

Level 3

Total

Assets:

Money market funds(1)

$

226,993

$

—

$

—

$

226,993

U.S. government and government agency debt securities

—

464,815

—

464,815

Corporate debt securities(1)

—

818,167

—

818,167

Municipal securities

—

5,234

—

5,234

Total

$

226,993

$

1,288,216

$

—

$

1,515,209

Liabilities

Interest rate swap agreements

$

—

$

2,423

$

—

$

2,423

(1)

Includes amounts classified as cash and cash equivalents.

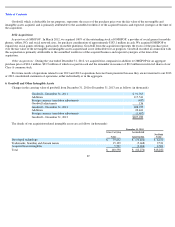

December 31,

December 31,

2013

2012

Computer equipment

$

225,063

$

294,208

Software

27,668

28,594

Land

89,130

89,130

Building

192,512

190,931

Furniture and fixtures

11,303

13,959

Leasehold improvements

11,695

20,383

557,371

637,205

Less accumulated depreciation

(208,578

)

(171,131

)

Total property and equipment, net

$

348,793

$

466,074