Zynga 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

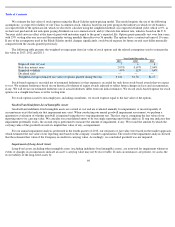

We estimate the fair value of stock options using the Black-Scholes option-pricing model. This model requires the use of the following

assumptions: (i) expected volatility of our Class A common stock, which is based on our peer group in the industry in which we do business;

(ii) expected life of the option award, which we elected to calculate using the simplified method; (iii) expected dividend yield, which is 0%, as

we have not paid and do not anticipate paying dividends on our common stock; and (iv) the risk-free interest rate, which is based on the U.S.

Treasury yield curve in effect at the time of grant with maturities equal to the grant’s expected life. Option grants generally vest over four years,

with 25% vesting after one year and the remainder vesting monthly thereafter over 36 months. The options have a contractual term of 10 years.

If any of the assumptions used in the Black-Scholes model changes significantly, stock-based expense for future awards may differ materially

compared with the awards granted previously.

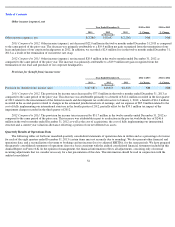

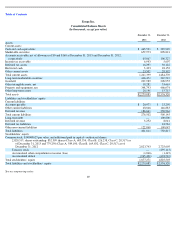

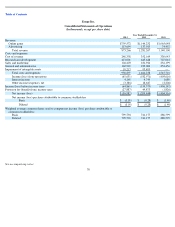

The following table presents the weighted-average grant date fair value of stock options and the related assumptions used to estimate the

fair value in 2013, 2012 and 2011:

Stock-based expense is recorded net of estimated forfeitures so that expense is recorded for only those stock-based awards that we expect

to vest. We estimate forfeitures based on our historical forfeiture of equity awards adjusted to reflect future changes in facts and circumstances,

if any. We will revise our estimated forfeiture rate if actual forfeitures differ from our initial estimates. We record stock-based expense for stock

options on a straight-line basis over the vesting term.

For stock options issued to non-employees, including consultants, we record expense equal to the fair value of the options

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and indefinite-lived intangible assets are carried at cost and are evaluated annually for impairment, or more frequently if

circumstances exist that indicate that impairment may exist. When conducting our annual goodwill impairment assessment, we perform a

quantitative evaluation of whether goodwill is impaired using the two-step impairment test. The first step is comparing the fair value of our

reporting unit to its carrying value. We consider our consolidated entity to be our single reporting unit for this analysis. If step one indicates that

impairment potentially exists, the second step is performed to measure the amount of impairment, if any. We record the amount by which the

carrying value of the goodwill exceeds its implied fair value, if any, as impairment.

For our annual impairment analysis performed in the fourth quarter of 2013, our estimates of fair value were based on the market approach,

which estimated the fair value of our reporting unit based on the company’s market capitalization. The result of the impairment analysis showed

that the estimated fair value of the Company exceeded its carrying value. Accordingly, we concluded goodwill was not impaired.

Impairment of Long-Lived Assets

Long-lived assets, including other intangible assets (excluding indefinite-lived intangible assets), are reviewed for impairment whenever

events or changes in circumstances indicate an asset’s carrying value may not be recoverable. If such circumstances are present, we assess the

recoverability of the long-lived assets by

64

Year Ended December 31,

2013

2012

2011

Expected term, in years

7

6

6

Risk

-

free interest rates

2.05

%

0.67

%

2.04

%

Expected volatility

49

%

62

%

64

%

Dividend yield

—

—

—

Weighted

-

average estimated fair value of options granted during the year

$

1.82

$

1.58

$

4.17