Zynga 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

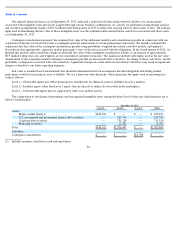

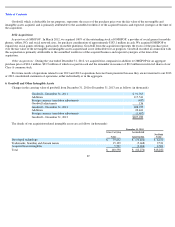

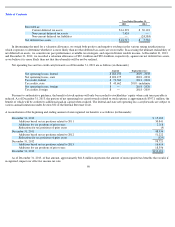

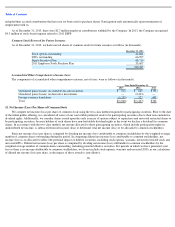

We classify uncertain tax positions as non-current income tax liabilities unless expected to be paid within one year or otherwise directly

related to an existing deferred tax asset, in which case the uncertain tax position is recorded net of the asset on the balance sheet. These non-

current income tax liabilities are classified in other non-

current liabilities on the consolidated balance sheets. We do not expect any unrecognized

tax benefits to be recognized within the next 12 months. We recognize interest and penalties in income tax expense. As of December 31, 2013

and December 31, 2012, the total balance of accrued interest and penalties related to uncertain tax positions was $0.5 million and $0.1 million,

respectively.

We file income tax returns in the United States, including various state and local jurisdictions. Our subsidiaries file tax returns in various

foreign jurisdictions, including Canada, China, Germany, Japan, India, United Kingdom, and Ireland. We are subject to examination by U. S.

Federal, state or foreign tax authorities for all years since our inception in 2007.

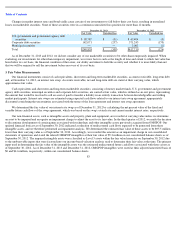

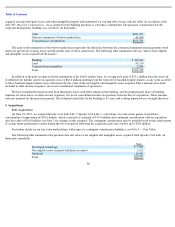

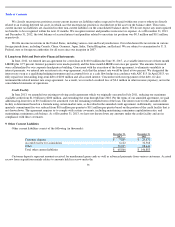

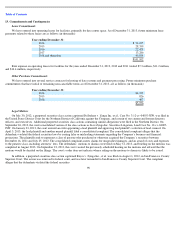

8. Long-term Debt and Derivative Financial Instruments

In June, 2012, we entered into an agreement for a term loan of $100.0 million due June 30, 2017, at a variable interest rate of three month

LIBOR plus 0.75 percent. Interest payments were made quarterly and the three month LIBOR reset once per quarter. The amounts borrowed

were collateralized by our corporate headquarters building. Concurrent with the execution of the loan agreement, to eliminate variability in

interest payments, we entered into an interest rate swap agreement, such that the interest rate would be fixed at two percent. We designated the

interest rate swap as a qualifying hedging instrument and accounted for it as a cash flow hedge in accordance with ASC 815. In April 2013, we

fully repaid our outstanding long-term debt of $100 million and all accrued interest. Concurrent with our repayment of the debt, we also

terminated the related interest rate swap agreement. As a result, we recorded a realized loss of $2.4 million in other income (expense), net in the

consolidated statements of operations.

Credit Facility

In June 2013, we amended our existing revolving credit agreement which we originally executed in July 2011, reducing our maximum

available credit from $1.0 billion to $200 million, and extending the term through June 2018. Per the terms of our amended agreement, we paid

additional up-front fees of $0.3 million to be amortized over the remaining extended term of the loan. The interest rate for the amended credit

facility is determined based on a formula using certain market rates, as described in the amended credit agreement. Additionally, our minimum

quarterly commitment fee was reduced from $0.6 million per quarter to $0.1 million per quarter based on the portion of the credit facility that is

not drawn down. The agreement requires us to comply with certain covenants, including maintaining a minimum capitalization ratio, and

maintaining a minimum cash balance. As of December 31, 2013, we have not drawn down any amounts under the credit facility and are in

compliance with these covenants.

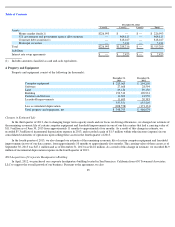

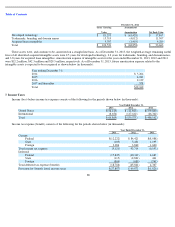

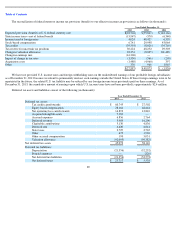

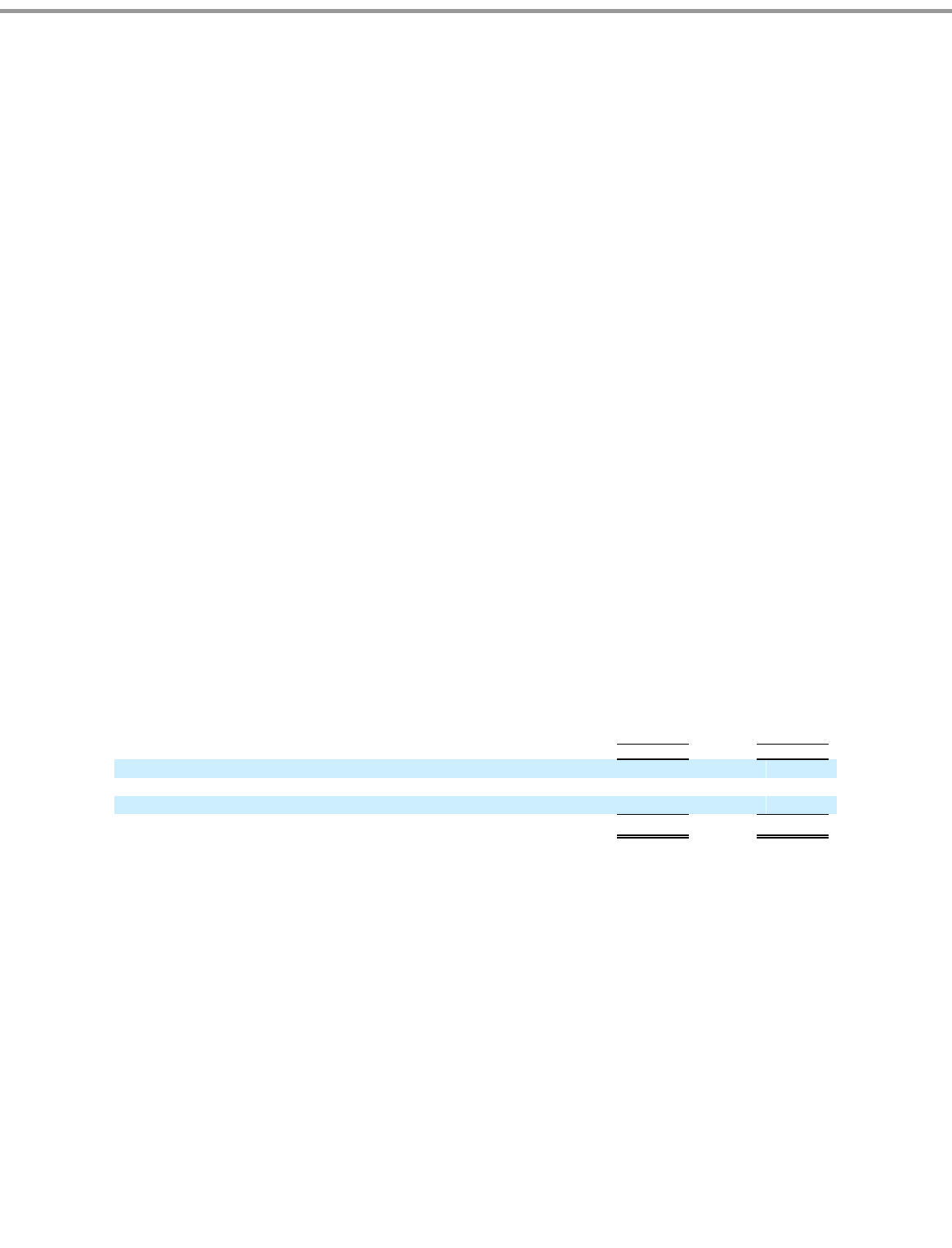

9. Other Current Liabilities

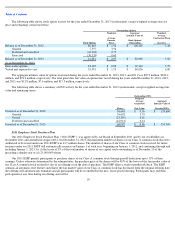

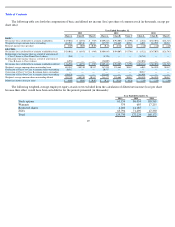

Other current liabilities consist of the following (in thousands):

Customer deposits represent amounts received for unredeemed game cards as well as advanced payments from various customers. Accrued

escrow from acquisitions mainly relates to amounts held in escrow under the

91

December 31,

December 31,

2013

2012

Customer deposits

$

5,809

$

25,671

Accrued escrow for acquisitions

6,122

32,568

Other

56,935

88,644

Total other current liabilities

$

68,866

$

146,883