Zynga 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

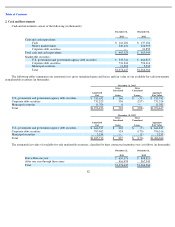

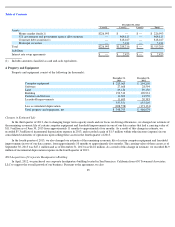

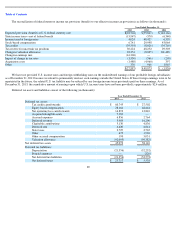

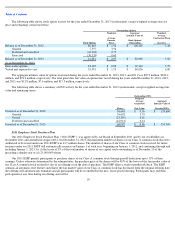

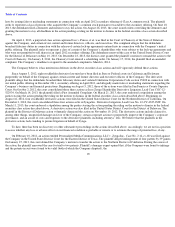

The reconciliation of federal statutory income tax provision (benefit) to our effective income tax provision is as follows (in thousands):

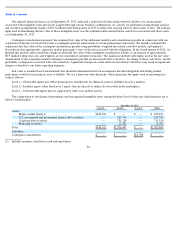

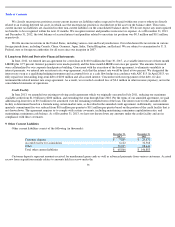

We have not provided U.S. income taxes and foreign withholding taxes on the undistributed earnings of our profitable foreign subsidiaries

as of December 31, 2013 because we intend to permanently reinvest such earnings outside the United States. If these foreign earnings were to be

repatriated in the future, the related U.S. tax liability may be reduced by any foreign income taxes previously paid on these earnings. As of

December 31, 2013, the cumulative amount of earnings upon which U.S. income taxes have not been provided is approximately $2.4 million.

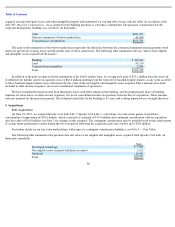

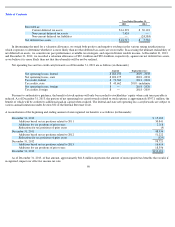

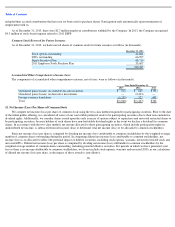

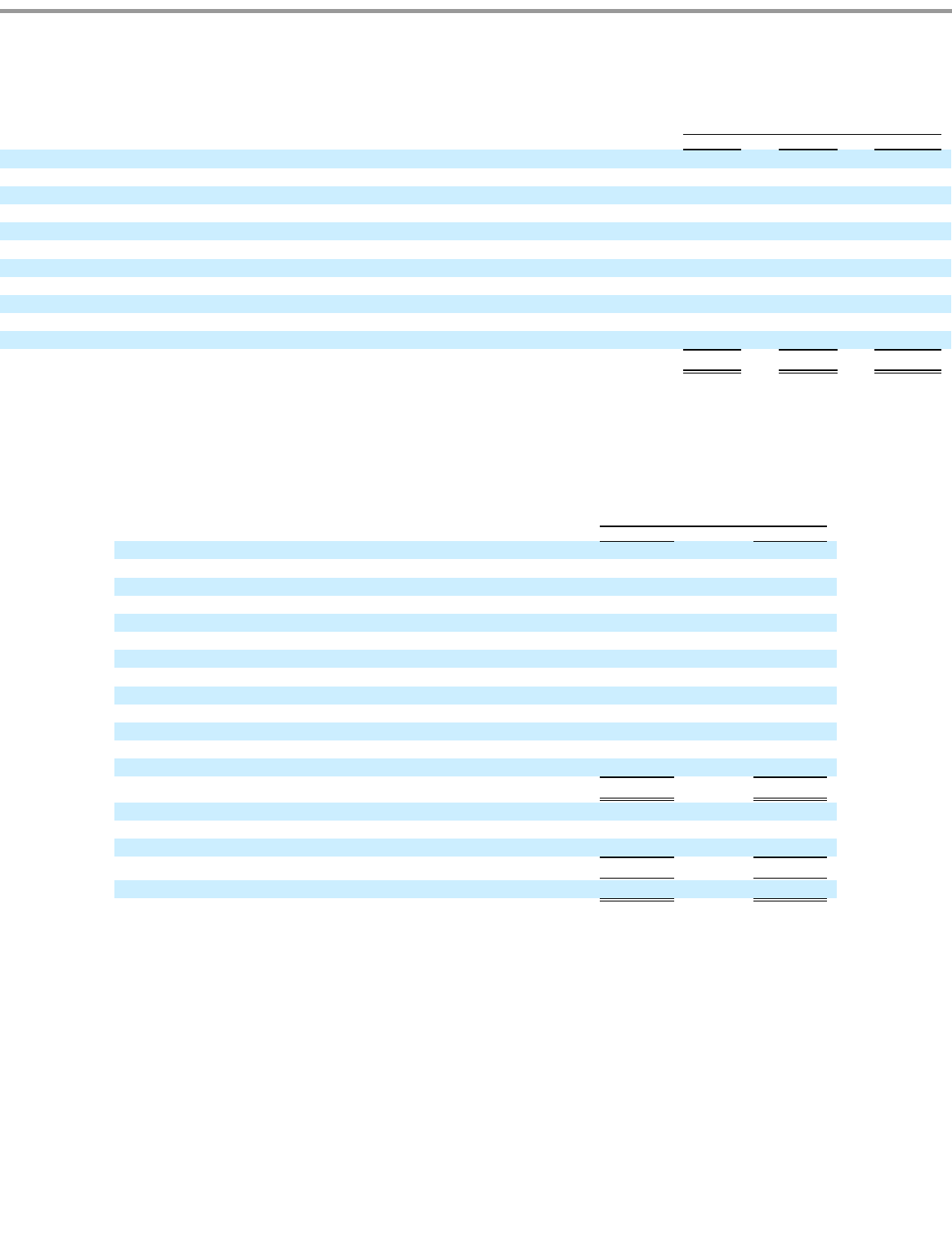

Deferred tax assets and liabilities consist of the following (in thousands):

89

Year Ended December 31,

2013

2012

2011

Expected provision (benefit) at U.S. federal statutory rate

$

(22,704

)

$

(55,837

)

$

(142,166

)

State income taxes

—

net of federal benefit

(15,947

)

(370

)

(6,340

)

Income taxed at foreign rates

4,024

48,427

6,338

Stock

-

based compensation

6,741

29,998

43,064

Tax credits

(39,593

)

(8,026

)

(34,769

)

Tax reserve for uncertain tax positions

30,224

48,252

29,303

Change in valuation allowance

28,354

(8,005

)

101,489

Change in earnings mix

(16,306

)

—

—

Impact of change in tax rates

(1,530

)

(566

)

(205

)

Acquisition costs

(1,480

)

(4,960

)

397

Other

330

960

1,063

$

(27,887

)

$

49,873

$

(1,826

)

Year Ended December 31,

2013

2012

Deferred tax assets:

Tax credit carryforwards

$

60,745

$

27,502

Equity based compensation

28,164

68,644

Net operating loss carryforwards

14,892

12,810

Acquired intangible assets

7,183

—

Accrued expenses

6,856

2,764

Deferred revenue

5,984

16,200

Charitable contributions

5,130

4,836

Deferred rent

4,620

6,014

State taxes

2,725

2,765

Other

679

1,926

Other accrued compensation

190

5,031

Valuation allowance

(92,095

)

(90,382

)

Net deferred tax assets

45,073

58,110

Deferred tax liabilities:

Depreciation

(21,356

)

(52,252

)

Prepaid expenses

—

(

320

)

Net deferred tax liabilities

(21,356

)

(52,572

)

Net deferred taxes

$

23,717

$

5,538