Zynga 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the consolidated financial

statements and the related notes included elsewhere in this Annual Report on Form 10-K. The following discussion contains forward-looking

statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking

statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this Annual Report on

Form 10

-K, particularly in “Special Note Regarding Forward-Looking Statements” and “Risk Factors.”

Overview

We are a leading online social game developer with approximately 112 million average MAUs for the three months ended December 31,

2013. We have launched some of the most successful social games in the industry. Our games are accessible on Facebook and other social

networks, mobile platforms and Zynga.com. Our games are generally available for free, and we generate revenue through the in-game sale of

virtual goods, mobile game download fees and advertising services.

We are a pioneer and innovator of social games and a leader in making play a core activity on the Internet. Our objective is to become the

worldwide leader in play by connecting the world through games.

Consistent with our free-to-play business model, compared to all players who play our games in any period, only a small portion of our

players are payers. Because the opportunity for social interactions increases as the number of players increases, we believe that maintaining and

growing our overall number of players, including the number of players who may not purchase virtual goods, is important to the success of our

business. As a result, we believe that the number of players who choose to purchase virtual goods will continue to constitute a small portion of

our overall players.

The games that constitute our top games vary over time but historically the top three revenue-generating games in any period contributed

the majority of our revenue. Our top three games accounted for 54%, 55% and 57% of our online game revenue in 2013, 2012 and 2011,

respectively. The percentage of online game revenue related to our top three games has declined during these periods as we continue to launch

new games. These more recently launched games increased our total online game revenue without necessarily being included as a top three

game.

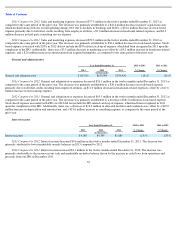

During 2013 we drove efficiencies to properly align our cost-structure with our key strategic initiatives and to better position us to execute

on our strategy and achieve long-term growth. Our headcount decreased from 3,058, as of December 31, 2012, to 2,034, as of December 31,

2013, we began to consolidate certain facilities and data centers, and reduced our total costs and expenses by $525.3 million in 2013. We

continue to invest in game development, creating both new games and new features and content in existing games designed to engage our

players on the web and on mobile devices.

On February 11, 2014, we completed the acquisition of 100% of the equity interests in NaturalMotion, pursuant to the share purchase

agreement, dated January 30, 2014, by and among us, Zynga Game International Limited, NaturalMotion, NaturalMotion’s shareholders and

Shareholder Representative Services LLC, as sellers’ representative. NaturalMotion’s shareholders and vested option holders received an

aggregate of $391 million in cash and 39.8 million shares of our Class A common stock.

How We Generate Revenue

We operate our games as live services that allow players to play for free. We generate revenue primarily from the in-game sale of virtual

goods and advertising. Revenue growth will depend largely on our ability to

43