Zynga 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

December 31, 2013, the remaining authorized amount of stock repurchases that may be made under the program was $178.9 million. The timing

and amount of any stock repurchases will be determined based on market conditions, share price and other factors.

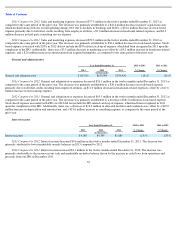

Operating Activities

Operating activities provided $28.7 million of cash during the twelve months ended December 31, 2013, as our net loss of $37.0 million in

the twelve months ended December 31, 2012 is adjusted to exclude non-cash items. Significant non-cash items included depreciation and

amortization of $129.0 million, stock-based expense of $84.4 million, accretion and amortization on marketable securities of $17.6 million and

impairment of intangible assets of $10.2 million. Depreciation and amortization decreased by $12.5 million as compared to the twelve months

ended December 31, 2012 as a result of fixed assets that were fully depreciated and disposed of and intangible assets that were fully amortized or

impaired in 2013. Stock-based expense decreased by $197.6 million in the twelve months ended December 31, 2013 as compared to the same

period of the prior year primarily due to increased forfeiture credits resulting from employee attrition in 2013. Net cash provided by operating

activities declined $165.0 million primarily due to changes in our operating assets and liabilities in the twelve months ended December 31, 2013,

including a $157.1 million decline in deferred revenue offset by increases in accounts receivable and other assets.

Operating activities provided $195.8 million of cash during the twelve months ended December 31, 2012 as our loss of $209.5 million in

the twelve months ended December 31, 2011 is adjusted to exclude non-cash items. Significant non-cash items included stock-based expense of

$282.0 million, depreciation and amortization of $141.5 million and impairment of intangible assets of $95.5 million. Stock-based expense was

composed primarily of employee ZSU and stock option expense and decreased by $318.2 million in the twelve months ended December 31,

2012 as compared to the same period of the prior year due to expense related to ZSU’s in 2011 as a result of our IPO. Depreciation and

amortization increased by $46.1 million as compared to the twelve months ended December 31, 2011 as a result of our continued investment in

property and equipment, including the purchase of our corporate headquarters building, and business acquisitions. Changes in our operating

assets and liabilities used $67.8 million of cash in the twelve months ended December 31, 2012 , primarily due to a decrease in deferred revenue

offset by increases in accounts receivable, other assets and other liabilities. Changes in operating assets and liabilities provided $77.4 million of

cash during the twelve months ended December 31, 2011, primarily due to increases in other liabilities, deferred revenue and accounts payable

offset by a decrease in income tax receivable.

Operating activities provided $389.2 million of cash in the year ended December 31, 2011. The cash flow from operating activities

primarily resulted from our net income, adjusted for non-cash items, and changes in our operating assets and liabilities. We had a net loss in the

year ended December 31, 2011 of $404.3 million, which included non

-cash stock-based compensation expense of $600.2 million, composed

primarily of expense associated with ZSUs that vested upon our IPO, stock awards issued in connection with business acquisitions and expense

associated with stock warrants and employee stock options. Non-cash depreciation and amortization expense was $95.4 million during 2011, an

increase from prior years due to our continued investment in property and equipment and business acquisitions. Changes in our operating assets

and liabilities provided $77.4 million of cash during 2011, primarily due to increases in other liabilities, deferred revenue and accounts payable

and a decrease in income tax receivable. The increase in other liabilities was mainly due to an increase of $44.5 million in customer deposits

which includes advance payments from certain customers and unredeemed game cards. The favorable components of cash provided by operating

activities were partially offset by increases in accounts receivable and other assets. The increases in accounts payable were the result of increased

spending due to the growth of our business. The increase in our deferred revenue and accounts receivable was primarily due to our bookings

growth in 2011, which increased by $316.6 million from 2010. Additionally, our accounts receivable balance increased as we completed the

transition of our primary in-game payment method to Facebook from other payment processors, who generally remitted payments faster. Our

income tax receivable balance decreased during 2011 as we received federal and state tax refunds. Our other assets balance increased primarily

due to an increase in prepaid expenses, which was driven by the growth of our business during the year.

58