Zynga 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Furthermore, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the

market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the operating

performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions

such as recessions, interest rate changes or international currency fluctuations, may negatively impact the market price of our Class A common

stock. In the past, companies that have experienced volatility in the market price of their stock have been subject to securities class action

litigation. We have been the target of this type of litigation as described in the section titled “Legal Matters’ included in Note 12 —

“Commitments and Contingencies”

in the notes to the consolidated financial statements. Securities litigation against us could result in substantial

costs and divert our management’s attention from other business concerns, which could harm our business.

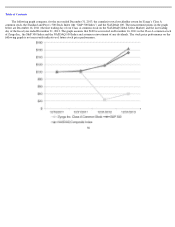

In addition, in October 2012, we announced that our Board authorized us to repurchase up to $200 million of our Class A common stock.

As of December 31, 2013, we had repurchased approximately $21.1 million of our Class A common stock. The timing and amount of any stock

repurchases will be determined based on market conditions, share price and other factors. The program does not require us to repurchase any

specific number of shares of our Class A common stock, and may be modified, suspended or terminated at any time without notice. The stock

repurchase program will be funded from existing cash on hand. Repurchases of our Class A common stock in the open market could result in

increased volatility in our stock price.

Our Class A common stock price may be volatile due to third-party data regarding our games.

Third parties, such as AppData, publish daily data about us and other social game companies with respect to DAUs and MAUs and other

information concerning social game usage, in particular on Facebook. These metrics can be volatile, particularly for specific games, and in many

cases do not accurately reflect the actual levels of usage of our games across all platforms and may not correlate to our bookings or revenue from

the sale of virtual goods. There is a possibility that third parties could change their methodologies for calculating these metrics in the future. To

the extent that securities analysts or investors base their views of our business or prospects on such third-party data, the price of our Class A

common stock may be volatile and may not reflect the performance of our business.

If securities or industry analysts do not publish research about our business, or publish negative reports about our business, our share price

and trading volume could decline.

The trading market for our Class A common stock, to some extent, depends on the research and reports that securities or industry analysts

publish about our business. We do not have any control over these analysts. If one or more of the analysts who cover us downgrade our shares or

lower their opinion of our shares, our share price would likely decline. If one or more of these analysts cease coverage of our company or fail to

regularly publish reports on us, we could lose visibility in the financial markets, which could cause our share price or trading volume to decline.

Future sales or potential sales of our Class A common stock in the public market could cause our share price to decline.

If the existing holders of our Class B common stock particularly our directors and officers, sell a large number of shares, they could

adversely affect the market price for our Class A common stock. Sales of substantial amounts of our Class A common stock in the public market,

or the perception that these sales could occur, could cause the market price of our Class A common stock to decline. For example, in connection

with the filing of our Registration Statement on Form S-3 in February 2014, covering the resale of shares issued to the security holders of

NaturalMotion prior to our acquisition, we registered 28,178,201 shares of our Class A common stock, which were eligible to be resold

immediately thereafter. In addition, in connection with the assumption of certain outstanding equity awards held by the employees of

NaturalMotion prior to the acquisition, we filed a Registration Statement on Form S

-8 covering up to 6,850,973 shares of our Class A common

stock which vest over three years at a rate of 40% after one year and 30% on each of the second and third anniversaries. In addition, certain

holders of our

33