Zynga 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

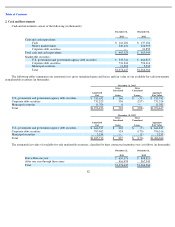

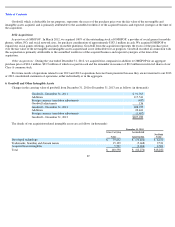

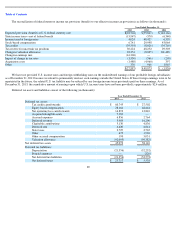

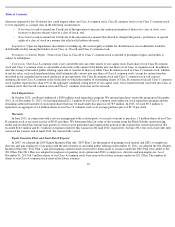

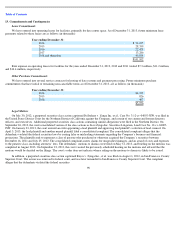

These assets were, and continue to be, amortized on a straight-line basis. As of December 31, 2013, the weighted-

average remaining useful

lives of all identified acquired intangible assets were 2.5 years for developed technology, 2.2 years for trademarks, branding, and domain names,

and 3.8 years for acquired lease intangibles. Amortization expense of intangible assets for the years ended December 31, 2013, 2012 and 2011

were $12.2 million, $42.3 million and $29.5 million, respectively. As of December 31, 2013, future amortization expense related to the

intangible assets is expected to be recognized as shown below (in thousands):

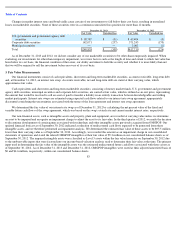

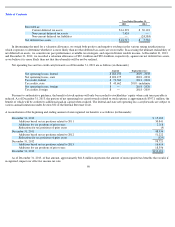

7. Income Taxes

Income (loss) before income tax expense consists of the following for the periods shown below (in thousands):

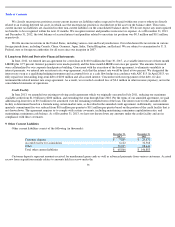

Income tax expense (benefit) consists of the following for the periods shown below (in thousands):

88

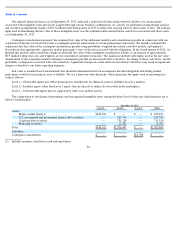

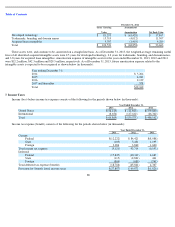

December 31, 2012

Gross Carrying

Value

Accumulated

Amortization

Net Book Value

Developed technology

$

81,295

$

(63,428

)

$

17,867

Trademarks, branding and domain names

15,519

(4,012

)

11,507

Acquired lease intangibles

5,707

(1,418

)

4,289

Total

$

102,521

$

(68,858

)

$

33,663

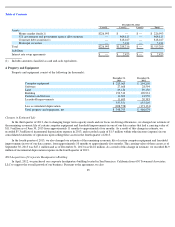

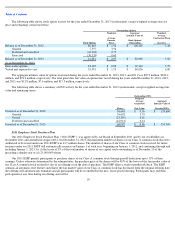

Year ending December 31:

2014

$

5,264

2015

4,181

2016

2,139

2017 and thereafter

578

Total

$

12,162

Year Ended December 31,

2013

2012

2011

United States

$

(56,215

)

$

(41,963

)

$

(379,800

)

International

(8,654

)

(117,612

)

(26,342

)

Total

$

(64,869

)

$

(159,575

)

$

(406,142

)

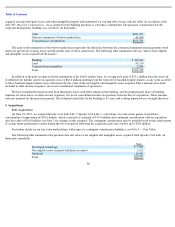

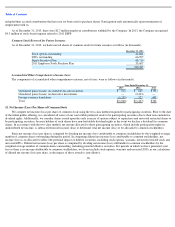

Year Ended December 31,

2013

2012

2011

Current:

Federal

$

(12,222

)

$

84,421

$

(8,988

)

State

(105

)

5,431

1,195

Foreign

3,206

3,862

1,600

Total current tax expense

(9,121

)

93,714

(6,193

)

Deferred:

Federal

(17,847

)

(40,331

)

4,687

State

(115

)

(2,821

)

441

Foreign

(804

)

(689

)

(761

)

Total deferred tax expense (benefit)

(18,766

)

(43,841

)

4,367

Provision for (benefit from) income taxes

$

(27,887

)

$

49,873

$

(1,826

)