Zynga 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

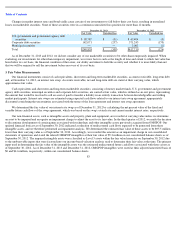

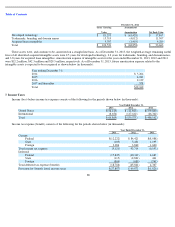

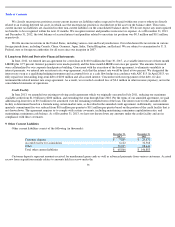

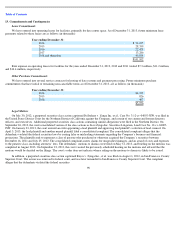

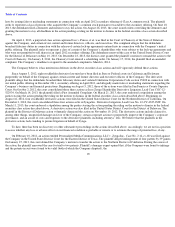

In determining the need for a valuation allowance, we weigh both positive and negative evidence in the various taxing jurisdictions in

which it operates to determine whether it is more likely than not that deferred tax assets are recoverable. In assessing the ultimate realizability of

net deferred tax assets, we consider our past performance, available tax strategies, and expected future taxable income. At December 31, 2013

and December 31, 2012, we recorded a valuation allowance of $92.1 million and $90.4 million, respectively, against our net deferred tax assets,

as we believe it is more likely than not that these benefits will be not be realized.

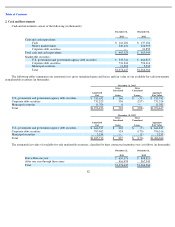

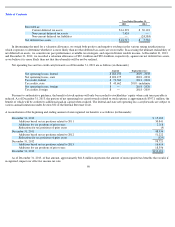

Net operating loss and tax credit carryforwards as of December 31, 2013 are as follows (in thousands):

Pursuant to authoritative guidance, the benefit of stock options will only be recorded to stockholders’ equity when cash taxes payable is

reduced. As of December 31, 2013, the portion of net operating loss carryforwards related to stock options is approximately $397.1 million, the

benefit of which will be credited to additional paid-in capital when realized. The federal and state net operating loss carryforwards are subject to

various annual limitations under Section 382 of the Internal Revenue Code.

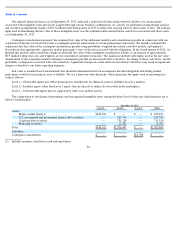

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows (in thousands):

As of December 31, 2013, of that amount, approximately $61.8 million represents the amount of unrecognized tax benefits that would, if

recognized, impact our effective income tax rate.

90

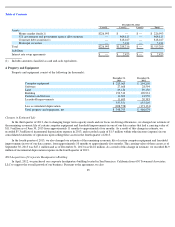

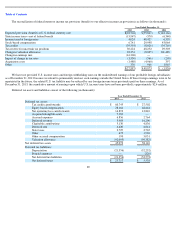

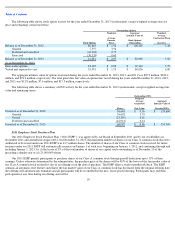

Year Ended December 31,

2013

2012

Recorded as:

Current deferred tax assets

$

16,293

$

30,122

Non

-

current deferred tax assets

7,424

—

Non

-

current deferred tax liabilities

—

(

24,584

)

Net deferred tax assets

$

23,717

$

5,538

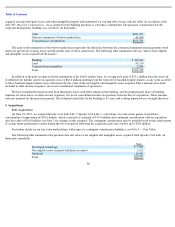

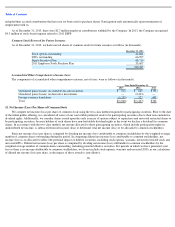

Amount

Expiration years

Net operating losses, federal

$

283,150

2029

-

2033

Net operating losses, state

$

203,175

2022

-

2033

Tax credit, federal

$

73,560

2021

-

2023

Tax credits, state

$

43,662

2018

-

indefinite

Net operating losses, foreign

$

—

2018

-

2020

Tax credits, foreign

$

—

2018

-

2019

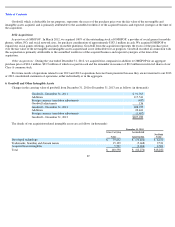

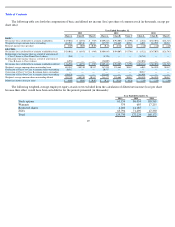

December 31, 2010

$

15,183

Additions based on tax positions related to 2011

30,841

Additions for tax positions of prior years

2,318

Reductions for tax positions of prior years

(9

)

December 31, 2011

48,334

Additions based on tax positions related to 2012

51,222

Reductions for tax positions of prior years

(835

)

December 31, 2012

98,721

Additions based on tax positions related to 2013

16,414

Additions for tax positions of prior years

18,356

December 31, 2013

$

133,491