Zynga 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

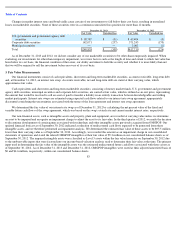

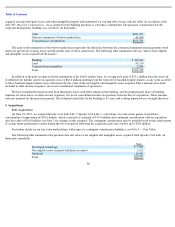

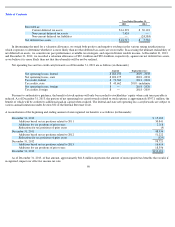

Our updated financial forecast as of September 30, 2013, indicated a reduction of future undiscounted cash flows for certain games

associated with intangible assets previously acquired through various business combinations. As a result, we performed an impairment analysis

and recorded an impairment charge of $10.2 million in the third quarter of 2013 to reduce the carrying value of these assets to zero. The primary

input used in determining the fair value of these intangible assets was the estimated undiscounted future cash flows associated with those assets

as of September 30, 2013.

Contingent consideration represents the estimated fair value of the additional variable cash consideration payable in connection with our

acquisition of Spooky Cool Labs LLC that is contingent upon the achievement of certain performance milestones. We initially estimated the

acquisition date fair value of the contingent consideration payable using probability-weighted discounted cash flow models, and applied a

discount rate that appropriately captured a market participant’s view of the risk associated with the obligations. In the fourth quarter of 2013, we

updated this analysis and recorded the change in estimated fair value of the contingent consideration liability as an expense of approximately

$0.9 million within total costs and expenses in our consolidated statement of income. The significant unobservable inputs used in the fair value

measurement of the acquisition-

related contingent consideration payable are forecasted future cash flows, the timing of those cash flows, and the

probability assumptions associated with such cash flows. Significant changes in actual and forecasted future cash flows may result in significant

charges or benefits to our future operating expenses.

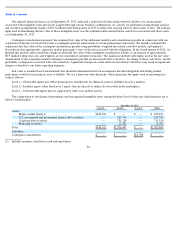

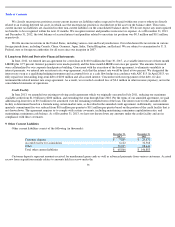

Fair value is a market-based measurement that should be determined based on assumptions that knowledgeable and willing market

participants would use in pricing an asset or liability. We use a three-tier value hierarchy, which prioritizes the inputs used in measuring fair

value as follows:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2—Includes inputs, other than Level 1 inputs, that are directly or indirectly observable in the marketplace.

Level 3—Unobservable inputs that are supported by little or no market activity.

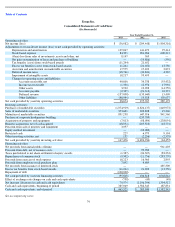

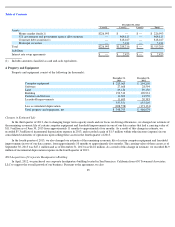

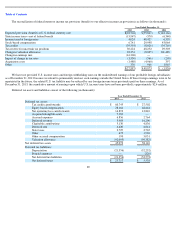

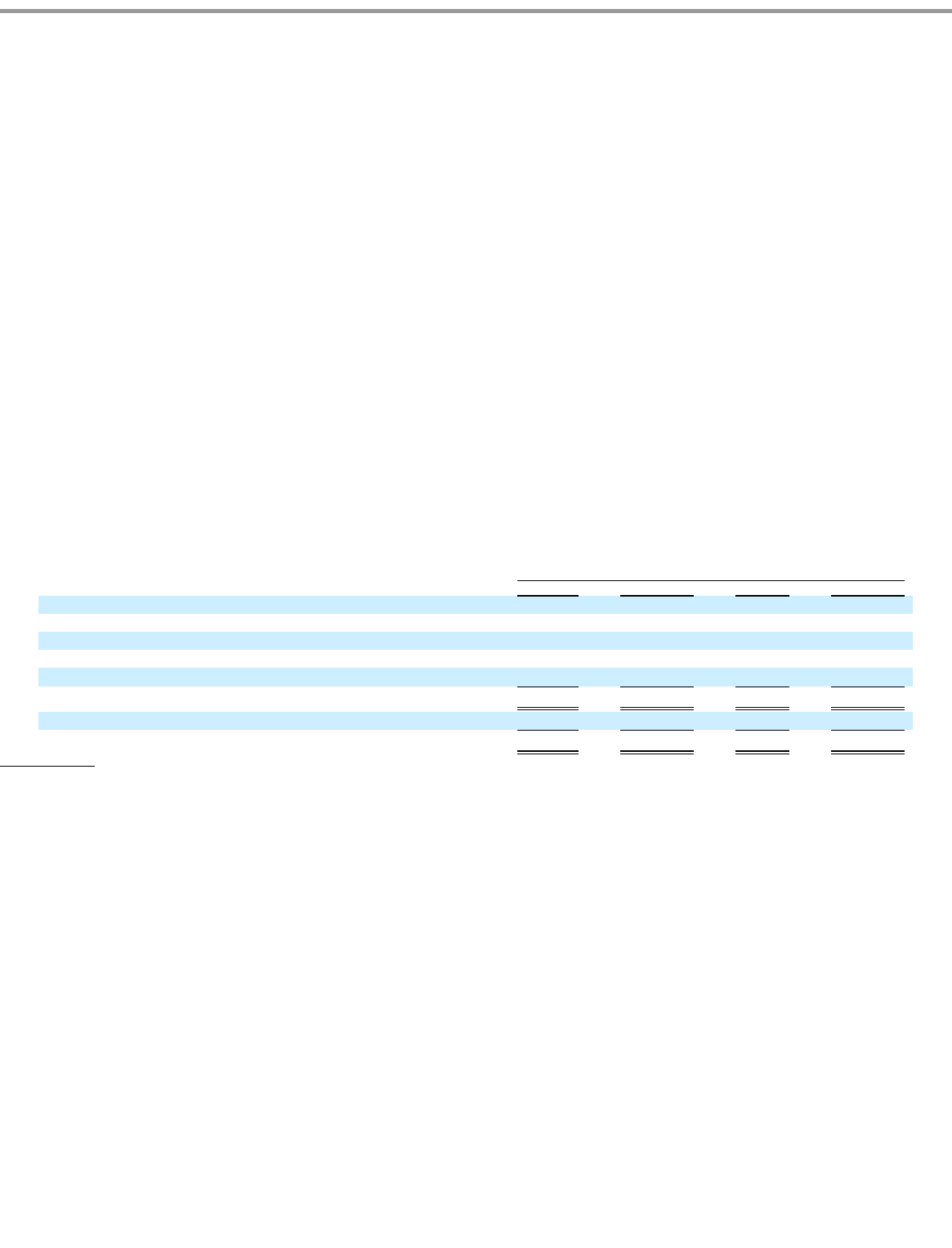

The composition of our financial instruments and our impaired intangible assets among the three Levels of the fair value hierarchy are as

follows (in thousands):

84

December 31, 2013

Level 1

Level 2

Level 3

Total

Assets:

Money market funds(1)

$

349,421

$

—

$

—

$

349,421

U.S. government and government agency debt securities

—

333,741

—

333,741

Corporate debt securities

—

731,324

—

731,324

Municipal securities

—

11,382

—

11,382

Total

$

349,421

$

1,076,447

$

—

$

1,425,868

Liabilities

Contingent consideration

$

—

$

—

$

11,720

$

—

(1)

Includes amounts classified as cash and equivalents