Western Union 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

8080

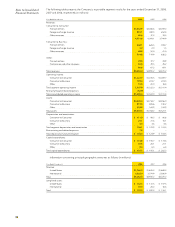

The geographic split of revenue above has been deter-

mined based upon the country where a money transfer is

initiated and the country where a money transfer is paid

with revenue being split 50% between the two countries.

Long-lived assets, consisting of “Property and equipment,

net,” are presented based upon the location of the assets.

A majority of Western Union’s consumer-to-consumer

transactions involve at least one non-United States location.

Based on the method used to attribute revenue between

countries described in the paragraph above, no individual

country outside the United States accounted for more than

10% of segment revenue for the years ended December 31,

2008, 2007 and 2006. In addition, no individual agent or

biller accounted for greater than 10% of consumer-to-

consumer or consumer-to-business segment revenue,

respectively, during these periods.

18. Subsequent Event

In February 2009, the Company entered into an agreement

to acquire the money transfer business of European-based

FEXCO, one of the Company’s largest agents providing

services in the United Kingdom, Spain, Ireland and other

European countries. Prior to the acquisition, the Company

holds a 24.65% interest in FEXCO Group Holdings (FEXCO

Group), which is a holding company for both the money

transfer business as well as various unrelated businesses.

The Company will surrender its 24.65% interest in FEXCO

Group and pay €123.1 million (approximately $160 mil-

lion based on currency exchange rates at deal signing)

as consideration for the overall money transfer business.

The acquisition is expected to close in the first half of

2009, subject to regulatory approvals and satisfaction

of closing conditions. The acquisition will be recognized

at 100% of the fair value of the money transfer business,

which will exceed the cash consideration of €123.1 million

given the non-cash consideration conveyed via the sale of

our interest in FEXCO Group. The fair value of the money

transfer business will be determined upon closing and is

subject to fluctuation due to changes in exchange rates

and other valuation inputs.

19. Quarterly Financial Information (Unaudited)

Summarized quarterly results for the years ended December 31, 2008 and 2007 are as follows (in millions):

Year Ended

December 31,

2008 by Quarter: Q1 Q2 Q3 Q4 2008

Revenues $1,265.9 $1,347.1 $1,377.4 $1,291.6 $5,282.0

Expenses

(a) 956.6 1,010.9 1,002.2 957.3 3,927.0

Other expense, net 16.8 28.2 42.2 29.1 116.3

Income before income taxes 292.5 308.0 333.0 305.2 1,238.7

Provision for income taxes 85.4 76.5 92.2 65.6 319.7

Net income $ 207.1 $ 231.5 $ 240.8 $ 239.6 $ 919.0

Earnings per share:

Basic $ 0.28 $ 0.31 $ 0.33 $ 0.34 $ 1.26

Diluted $ 0.27 $ 0.31 $ 0.33 $ 0.34 $ 1.24

Weighted-average shares outstanding:

Basic 746.7 736.5 724.9 712.5 730.1

Diluted 756.8 747.5 737.2 713.8 738.2

(a) Includes $24.2 million in the first quarter, $22.9 million in the second quarter, $3.2 million in the third quarter and $32.6 million in the fourth quarter of restructuring

and related expenses. For more information, see Note 3, “Restructuring and Related Expenses.”

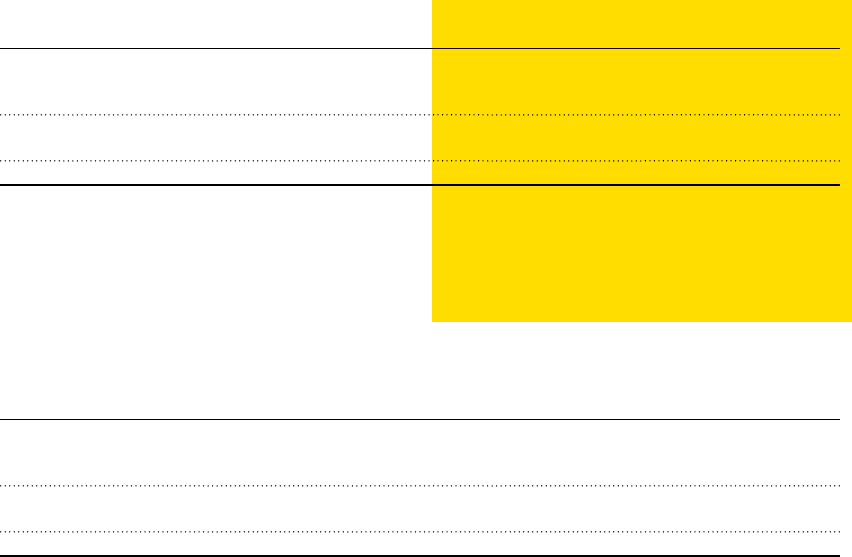

Year Ended

December 31,

2007 by Quarter: Q1 Q2 Q3 Q4 2007

Revenues $1,131.0 $1,202.9 $1,257.2 $1,309.1 $4,900.2

Expenses

(b) 826.4 880.2 927.1 944.5 3,578.2

Other expense, net 22.5 24.5 23.2 29.4 99.6

Income before income taxes 282.1 298.2 306.9 335.2 1,222.4

Provision for income taxes 88.9 93.7 90.6 91.9 365.1

Net income $ 193.2 $ 204.5 $ 216.3 $ 243.3 $ 857.3

Earnings per share:

Basic $ 0.25 $ 0.27 $ 0.29 $ 0.32 $ 1.13

Diluted $ 0.25 $ 0.26 $ 0.28 $ 0.32 $ 1.11

Weighted-average shares outstanding:

Basic 768.2 764.8 757.5 749.5 760.2

Diluted 783.3 779.0 767.4 761.7 772.9

(b) Includes a non-cash pretax stock compensation accelerated vesting charge of $22.3 million during the third quarter of 2007. For more information, see Note 16.