Western Union 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

7878

term is primarily based on the results of a study performed

on the historical exercise and post-vesting employment ter-

mination behavior for similar grants. First Data’s expected

terms were as follows: 4.5 years for non-executive employ-

ees, 7 years for the Board of Directors and 7.5 years for its

executives. The expected term of ESPP rights were deter-

mined to be 0.25 years as purchase rights are achieved

over the course of the quarter in which the employee

participated in the ESPP. Once the shares have been pur-

chased, the employee can sell their respective shares.

RISK-FREE INTEREST RATE—The risk-free rate for stock

options granted during the period is determined by using

a U.S. Treasury rate for the period that coincided with the

expected terms listed above.

The assumptions used to calculate the fair value of

options granted will be evaluated and revised, as neces-

sary, to reflect market conditions and the Company’s histori-

cal experience and future expectations. The calculated fair

value is recognized as compensation cost in the Company’s

financial statements over the requisite service period of the

entire award. Compensation cost is recognized only for

those options expected to vest, with forfeitures estimated

at the date of grant and evaluated and adjusted periodi-

cally to reflect the Company’s historical experience and

future expectations. Any change in the forfeiture assump-

tion will be accounted for as a change in estimate, with

the cumulative effect of the change on periods previously

reported being reflected in the financial statements of

the period in which the change is made. In the future, as

more historical data is available to calculate the volatility of

Western Union stock and the actual terms Western Union

employees hold options, expected volatility and expected

term may change which could substantially change the

grant-date fair value of future stock option awards and,

ultimately, the recorded compensation expense.

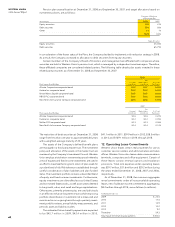

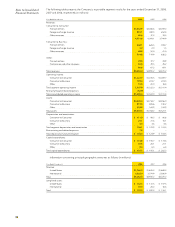

17. Segments

As previously described in Note 1, the Company classifies

its businesses into two reportable segments: consumer-

to-consumer and consumer-to-business. Operating seg-

ments are defined by SFAS No. 131, “Disclosures About

Segments of an Enterprise and Related Information,” as

components of an enterprise which constitute businesses,

about which separate financial information is available that

is evaluated regularly by the Company’s chief operating

decision maker (“CODM”) in deciding where to allocate

resources and in assessing performance.

The consumer-to-consumer reporting segment is

viewed as one global network where a money transfer

can be sent from one location to another, anywhere in

the world. The segment is now managed as two regions,

primarily to coordinate agent network management and

marketing activities. The CODM makes decisions regard-

ing resource allocation and monitors performance based

on specific corridors within and across these regions,

but also reviews total revenue and operating profit of

each region. These regions frequently interact on trans-

actions with consumers and share processes, systems

and licenses, thereby constituting one global consumer-

to-consumer money transfer network. Each region and

corridor also offer generally the same services distrib-

uted by the same agent network, have the same types

of customers, are subject to similar regulatory require-

ments, are processed on the same system, and have simi-

lar economic characteristics, allowing the geographic

regions to be aggregated into one reporting segment.

Consumer-to-consumer segment revenue typically

increases sequentially from the first quarter to the fourth

quarter each year and declines from the fourth quarter to

the first quarter of the following year. This seasonal fluctua-

tion is related to the holiday season in various countries

in the fourth quarter.

All businesses that have not been classified into

consumer-to-consumer or consumer-to-business are

reported as “Other.” These businesses primarily include the

Company’s money order and prepaid services businesses.

The Company’s reportable segments are reviewed

separately below because each reportable segment repre-

sents a strategic business unit that offers different products

and serves different markets. The business segment mea-

surements provided to, and evaluated by, the Company’s

CODM are computed in accordance with the following

principles:

º

The accounting policies of the reportable segments

are the same as those described in the summary of

significant accounting policies.

º

Corporate and other overhead is allocated to the seg-

ments primarily based on a percentage of the seg-

ments’ revenue.

º

Expenses incurred in connection with the development

of certain new service offerings, including costs to

develop mobile money transfer services, new prepaid

service offerings and non-recurring costs incurred to

effect the Spin-off are included in “Other.”

º

Restructuring and related activities of $82.9 million for

the year ended December 31, 2008 have not been allo-

cated to the segments. While these items are identifi-

able to the Company’s segments, they are not included

in the measurement of segment operating profit pro-

vided to the CODM for purposes of assessing seg-

ment performance and decision making with respect

to resource allocation. For additional information on

restructuring and related activities refer to Note 3.

º

In connection with the change in control of First Data,

the Company incurred an accelerated stock-based com-

pensation vesting charge of $22.3 million during the

year ended December 31, 2007. Of the $22.3 million

charge, $18.9 million, $3.0 million and $0.4 million were

allocated to the consumer-to-consumer, consumer-to-

business and other segments, respectively.

º

All items not included in operating income are

excluded.