Western Union 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5757

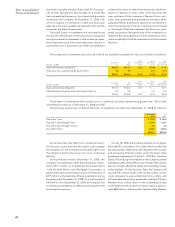

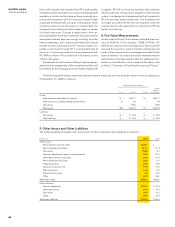

Notes to Consolidated

Financial Statements

All stock-based compensation to employees is required

to be measured at fair value and expensed over the req-

uisite service period and also requires an estimate of

forfeitures when calculating compensation expense. The

Company recognizes compensation expense on awards

on a straight-line basis over the requisite service period

for the entire award. Refer to Note 16 for additional dis-

cussion regarding details of the Company’s stock-based

compensation plans.

New Accounting Pronouncements

In March 2008, the FASB issued SFAS No. 161, “Disclosures

about Derivative Instruments and Hedging Activities, an

amendment of SFAS No. 133” (“SFAS No. 161”). SFAS No.

161 is required for financial statements issued for fiscal

years and interim periods beginning after November 15,

2008 and early adoption is permitted. SFAS No. 161

requires additional disclosures about how and why the

companies use derivatives, how derivatives and related

hedged items are accounted for under SFAS No. 133,

and how derivatives and related hedged items affect a

company’s financial position, results of operations, and

cash flows. The Company’s derivative disclosures already

incorporate many of the provisions outlined in SFAS

No. 161. Accordingly, the Company does not expect that

the adoption of this pronouncement in 2009 will have a

significant impact on the Company’s financial position,

results of operations and cash flows.

In December 2007, the FASB issued SFAS No. 141R,

“Business Combinations” (“SFAS No. 141R”). This state-

ment establishes a framework to disclose and account for

business combinations. The adoption of the requirements

of SFAS No. 141R applies prospectively to business com-

binations for which the acquisition date is on or after fiscal

years beginning after December 15, 2008 and may not be

early adopted. The impact of the adoption of SFAS No.

141R will depend upon the nature and terms of business

combinations that the Company consummates on or after

January 1, 2009.

In December 2007, the FASB issued SFAS No. 160,

“Noncontrolling Interests in Consolidated Financial

Statements—an amendment of ARB No. 51” (“SFAS No.

160”). The statement establishes accounting and report-

ing standards for a noncontrolling interest in a subsidiary.

The adoption of the requirements of SFAS No. 160 is

effective for fiscal years and interim periods within those

fiscal years, beginning after December 15, 2008 and may

not be early adopted. The Company does not expect the

impact of the adoption of SFAS No. 160 to be significant

on the financial position, results of operations and cash

flows, as the Company’s current non-controlling interests

are immaterial.

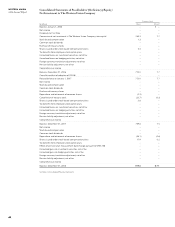

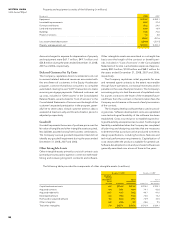

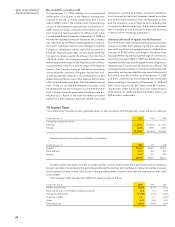

3. Restructuring and Related Expenses

Missouri and Texas Closures

On February 25, 2008, the Company decided to pursue

decision bargaining negotiations with our union employ-

ees regarding the possible closure of the Company’s

facilities in Missouri and Texas. On March 14, 2008, the

Company announced its decision to close substantially

all of its facilities in Missouri and Texas and enter into

effects bargaining with the union regarding severance

and other benefits for the approximately 650 affected

union employees, responsible for performing certain call

center, settlement and operational accounting functions.

On May 29, 2008, the Company and the union entered

into a Memorandum of Agreement which resolved the

effects of the restructuring decisions on the affected union

employees and concluded that the Company’s collec-

tive bargaining agreement with the union would not be

renewed. The decision also resulted in the elimination of

certain management positions in these same facilities. The

Company completed the transition of these operations

to existing Company facilities and third-party providers

during the fourth quarter of 2008.

In conjunction with the decision, the Company incurred

severance and employee related benefit expenses for all

union and certain affected management employees, facility

closure expenses and other expenses associated with the

relocation of these operations to existing Company facilities

and third-party providers, including costs related to hiring,

training, relocation, travel and professional fees. Included

in the facility closure expenses are non-cash expenses

related to fixed asset and leasehold improvement write-

offs and acceleration of depreciation and amortization.

Other Reorganizations

During 2008, in addition to the Missouri and Texas clo-

sures, the Company restructured some of its operations

and relocated or eliminated certain shared service and

call center positions. The relocated positions were moved

to the Company’s existing facilities or outsourced service

providers. The Company has incurred all of the expenses

related to these reorganization activities during 2008

and expects substantially all remaining accruals, primar-

ily related to severance for terminated employees, to be

paid in 2009.