Western Union 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

s h a rp e n ed fo c u s

Across the business, we are sharpening our focus and directing investments to meet market share

opportunities. Our ability to gain an estimated 120 basis points of market share in the cross-border

remittance market in 2008(1) was a demonstration of our global team of approximately 5,900 employees

executing on our four key strategies—strategies that will continue to drive our business forward:

° Accelerate profitable growth in the global cash money transfer business

° Expand and globalize the consumer-to-business payments business

° Innovate new products and services for our target customers

° Improve profitability by leveraging scale, reducing costs and effectively using capital

t h e st r o n g g e t s t rong e r

We also see an exciting opportunity emerging for our business with the upcoming implementation

of the Payment Services Directive (PSD) in the European Union in late 2009. This regulatory

change will make it possible for us to operate in 27 countries under a single license and will allow

us to expand money transfer services to other classes of trade in certain countries.

Another meaningful contributor to our future growth is the broader Asia Pacific region,

which encompasses not only China and the Philippines but countries where we have been

expanding our presence, including Thailand, Vietnam, Malaysia and Indonesia—the world’s

fourth most populous country. The opportunity here is tremendous. Today our Asia Pacific

region makes up only 7% of Western Union revenue, yet according to the World Bank 2008

Migration and Remittances fact book this market currently represents 19% of the world’s cross-

border remittance market.

In The Americas region we are implementing a new “go-to-market” strategy. Specifically,

we have combined our U.S. and Latin American organizations, including the Western Union®

,

VigoSM and Orlandi Valuta® sales forces. We reported progress with our ScotiaBank “account-to-

cash” program in Canada and expect further advances in the banking category during 2009.

Within the C2B segment, Pago Fácil continued to perform well in Argentina with 2008

revenue growth above 30%. However, nearly 90% of our C2B revenue is generated in the U.S.,

and the ongoing impact of the recession on the American consumer, is pressuring the segment.

This makes our focus on international expansion and product diversification, including

acquisitions, all the more important. In an effort to diversify, we have introduced our own bill

payment service in Peru and Panama and are also working on obtaining a license to offer this

service in Brazil.

We also will be evaluating strategic acquisitions complementary to our core business and

are optimistic about the evolving landscape. We believe we can participate in consolidation with

the goal of strengthening money transfer, diversifying further into payments, and adding value

through technology.

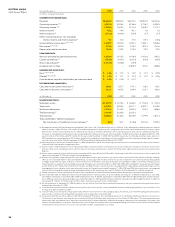

2002

27%

46%

20%

5%

2008

1%

2%

44%

34%

14%

7%

Total Western

Union Revenue

EMEASA

AMERICAS

C2B

APAC

Other

WESTERN UNION

2008 Annual Report