Western Union 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4141

Management’s

Discussion and

Analysis of Financial

Condition and

Results of Operations

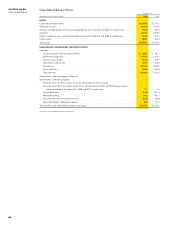

On September 15, 2008, we requested redemption

of our shares in the Reserve International Liquidity

Fund, Ltd., a money market fund, (the “Fund”) totaling

$298.1 million. We did not receive any portion of the

redemption payment prior to December 31, 2008, and

accordingly, we have reclassified the total amount due from

“Cash and cash equivalents” to “Other assets” in the consol-

idated balance sheet as of December 31, 2008. At the time

the redemption request was made, we were informed by

the Fund’s investment advisor that our redemption trades

would be honored at a $1.00 per share net asset value.

On January 30, 2009, we received a partial distribution

from the Fund of $193.6 million. We expect to receive

the remaining redemption amount based on written and

verbal representations from the Manager to date and our

current legal position regarding our redemption priority.

We expect to receive the remaining payment based on

the maturities of the underlying investments in the Fund

and the outcome of the litigation process. There is a risk

the redemption process could be delayed and that we

could receive less than the $1.00 per share net asset value

should pro-rata distribution occur. Based on the net asset

information provided by the Fund, our exposure related

to pro-rata distribution could be $12 million, excluding

settlement costs incurred by the Fund. However, based on

written and verbal representations from the manager to

date and our current legal position regarding our redemp-

tion priority, we believe that we are entitled to such funds

and are vigorously pursuing collection of the remaining

distribution.

To manage our exposures to credit risk with respect to

investment securities, money market fund investments and

other credit risk exposures resulting from our relationships

with banks and financial institutions, we regularly review

investment concentrations, trading levels, credit spreads

and credit ratings, and we maintain our largest relationships

with globally diversified financial institutions. We also limit

our investment level with respect to individual funds.

We are also exposed to credit risk related to receivable

balances from agents in the money transfer, walk-in bill

payment and money order settlement process. In addi-

tion, we are exposed to credit risk directly from consumer

transactions particularly through our online services and

electronic consumer-to-business channels, where trans-

actions are originated through means other than cash,

and therefore are subject to “chargebacks,” insufficient

funds or other collection impediments, such as fraud.

We perform a credit review before each agent signing

and conduct periodic analyses when an agent’s balance

exceeds a minimum threshold. Our losses associated with

agent and consumer bad debts have been less than 1%

of our annual revenue in all periods presented.

Regulatory

Our business is subject to a wide range of laws and regu-

lations enacted by the United States federal government,

each of the states, many localities and other countries.

These include financial services regulations, consumer

disclosure and consumer protection laws, currency con-

trol regulations, money transfer and payment instrument

licensing regulations, escheat laws and laws covering con-

sumer privacy, data protection and information security.

Our services also are subject to an increasingly strict set

of legal and regulatory requirements intended to help

detect and prevent money laundering, terrorist financing

and other illicit activity. Failure to comply with any of these

requirements—by either Western Union or its agents (who

are third parties, over whom Western Union has limited

legal and practical control)—could result in the suspension

or revocation of a license or registration required to pro-

vide money transfer services, the limitation, suspension

or termination of services, the seizure of our assets, and/

or the imposition of civil and criminal penalties, including

fines and restrictions on our ability to offer services. We

continue to implement policies and programs and adapt

our business practices and strategies to help us comply

with current and evolving legal standards and industry

practices. These programs include dedicated compliance

personnel, training and monitoring programs, suspicious

activity reporting, regulatory outreach and education, and

support and guidance to our agent network on regula-

tory compliance.