Western Union 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7777

Notes to Consolidated

Financial Statements

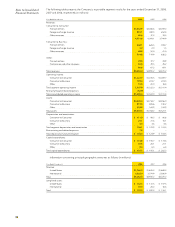

As discussed previously, the Company incurred a pretax

charge of $22.3 million during the year ended December 31,

2007 upon the completion of the acquisition of First Data

on September 24, 2007 by an affiliate of KKR. Also included

in stock-based compensation expense above for the year

ended December 31, 2006 is $6.8 million of allocated

stock-based compensation related to employees of First

Data providing administrative services to the Company

prior to the Spin-off. There was no stock-based compen-

sation capitalized during the years ended December 31,

2008, 2007 and 2006.

As of December 31, 2008, there was $33.4 million of

total unrecognized compensation cost, net of assumed

forfeitures, related to non-vested stock options which

is expected to be recognized over a weighted-average

period of 2.6 years, and there was $10.0 million of total

unrecognized compensation cost, net of assumed forfei-

tures, related to non-vested restricted stock awards and

restricted stock units which is expected to be recognized

over a weighted-average period of 1.8 years.

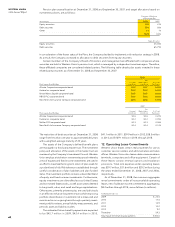

Fair Value Assumptions

The Company used the following assumptions for the

Black-Scholes option pricing model to determine the

value of First Data stock options and ESPP rights granted

to Western Union employees before the Spin-off and the

value of Western Union options granted to such employ-

ees after the Spin-off.

Year Ended December 31, 2008 2007 2006

STOCK OPTIONS GRANTED (POST-SPIN GRANTS):

Weighted-average risk-free interest rate 3.0% 4.5% 4.6%

Weighted-average dividend yield 0.2% 0.2% 0.2%

Volatility 31.8% 23.8% 26.4%

Expected term (in years) 5.9 6.2 6.6

Weighted-average fair value $7.57 $7.35 $ 7.12

STOCK OPTIONS GRANTED (PRE-SPIN GRANTS):

Weighted-average risk-free interest rate — — 4.6%

Weighted-average dividend yield — — 0.6%

Volatility — — 23.5%

Expected term (in years) — — 5

Weighted-average fair value (pre-spin) — — $12.39

ESPP:

Weighted-average risk-free interest rate — — 4.9%

Weighted-average dividend yield — — 0.6%

Volatility — — 23.0%

Expected term (in years) — — 0.25

Weighted-average fair value (pre-spin) — — $ 8.94

For periods presented prior to the spin-off date of

September 29, 2006, all stock-based compensation awards

were made by First Data, and used First Data assumptions

for volatility, dividend yield and term. Western Union

assumptions, which are described in the paragraphs

below, were utilized for grants made by Western Union

on September 29, 2006 and subsequent thereto.

EXPECTED VOLATILITY—Expected volatility varies by group

based on the expected option term. For the Company’s

Board of Directors and executives, the expected volatil-

ity for the 2008, 2007 and 2006 grants was 31.3%, 26.9%

and 28.4%, respectively. The expected volatility for the

Company’s non-executive employees was 31.9%, 22.8%

and 24.7% for the 2008, 2007 and 2006 grants, respec-

tively. Beginning in 2008, Western Union used a blend

of implied volatility and peer group historical volatility.

The Company’s peer group historical volatility was deter-

mined using companies in similar industries and/or mar-

ket capitalization. The Company’s implied volatility was

calculated using the market price of traded options on

Western Union’s common stock. Prior to 2008, Western

Union’s volatility was determined based entirely on the

calculated peer group historical volatility since there

was not sufficient trading history for Western Union’s

common stock or traded options. Beginning in 2006,

First Data used the implied volatility method for estimat-

ing expected volatility for all stock options granted and

ESPP rights. First Data calculated its implied volatility

using the market price of traded options on First Data’s

common stock.

EXPEC TED DIVIDEND YIELD —The Company’s expected

annual dividend yield is the calculation of the annualized

Western Union dividend of $0.04 per common share

divided by a rolling 12 month average Western Union

stock price on each respective grant date. First Data’s

dividend yield was the calculation of the annualized First

Data dividend amount of $0.24 divided by a rolling 12

month average First Data stock price as of the most recent

grant date for which First Data granted options to Western

Union employees.

EXPECTED TERM—

Western Union’s expected term is

5.8 years for non-executive employees, and 7.5 years for

the Board of Directors and executives. The Company’s

expected term of options was based upon, among other

things, historical exercises (including the exercise history

of First Data’s awards), the vesting term of the Company’s

options, the cancellation history of the Company’s employ-

ees options in First Data stock and the options’ contractual

term of ten years. First Data has also aggregated stock

option awards into classes. For each class, the expected