Western Union 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

18

Certain expenses related to being a stand-alone com-

pany, reflected in the consolidated statements of income,

are higher than the historical amounts prior to the spin-off.

The financial information presented in this Annual Report

on Form 10-K prior to the spin-off date of September 29,

2006 does not reflect what our consolidated financial posi-

tion, results of operations or cash flows would have been

as a stand-alone company during the periods presented

and is not necessarily indicative of our future consolidated

financial position, results of operations or cash flows.

Subsequent Event

In February 2009, we entered into an agreement to acquire

the money transfer business of European-based FEXCO,

one of our largest agents providing services in the United

Kingdom, Spain, Ireland and other European countries.

Prior to the acquisition, we hold a 24.65% interest in FEXCO

Group Holdings (FEXCO Group), which is a holding com-

pany for both the money transfer business as well as various

unrelated businesses. We will surrender our 24.65% interest

in FEXCO Group and pay €123.1 million (approximately

$160 million based on currency exchange rates at deal

signing) as consideration for the overall money transfer

business. The acquisition is expected to close in the first half

of 2009, subject to regulatory approvals and satisfaction

of closing conditions. The acquisition will be recognized

at 100% of the fair value of the money transfer business,

which will exceed the cash consideration of €123.1 million

given the non-cash consideration conveyed via the sale of

our interest in FEXCO Group. The fair value of the money

transfer business will be determined upon closing and is

subject to fluctuation due to changes in exchange rates

and other valuation inputs.

Adoption of Accounting Standards

Statement of Financial Accounting Standards

(“SFAS”) No. 157

Effective January 1, 2008, we determine the fair market

values of our financial assets and liabilities, as well as

non-financial assets and liabilities that are recognized or

disclosed at fair value on a recurring basis, based on the

fair value hierarchy established in SFAS No. 157, “Fair

Value Measurements” (“SFAS No. 157”). The standard

describes three levels of inputs that may be used to mea-

sure fair value.

ºLEVEL 1: Quoted prices in active markets for identical

assets or liabilities. Western Union’s financial instru-

ments that base fair value determinations on Level 1

inputs are not material.

º

LEVEL 2:

Observable inputs other than Level 1 prices

such as quoted prices for similar assets or liabilities;

quoted prices in markets that are not active; or other

inputs that are observable or can be corroborated by

observable market data for substantially the full term

of the assets or liabilities. Most of our assets and liabili-

ties fall within Level 2 and include state and municipal

debt instruments, other foreign investment securities,

and derivative assets and liabilities. We utilize pricing

services to value our Level 2 financial instruments.

For most of these assets, we utilize pricing services

that use multiple prices as inputs to determine daily

market values.

º

LEVEL 3: Unobservable inputs that are supported by

little or no market activity and that are significant to

the fair value of the assets or liabilities. Level 3 assets

and liabilities include items where the determination of

fair value requires significant management judgment

or estimation. We currently have no Level 3 assets or

liabilities that are measured at fair value on a recur-

ring basis.

Pursuant to the Financial Accounting Standards Boards

(“FASB”) Staff Position No. 157-2, “Effective Date of FASB

Statement No. 157” (“FSP No. 157-2”), the effective date

of SFAS No. 157 for certain non-financial assets and liabili-

ties that are measured at fair value but are recognized or

disclosed at fair value on a non-recurring basis has been

deferred to fiscal years beginning after November 15, 2008.

We are primarily impacted by this deferral as it relates to

non-financial assets and liabilities initially measured at fair

value in a business combination (but not measured at fair

value in subsequent periods) and fair value measurements

in impairment testing. We adopted these remaining pro-

visions of SFAS No. 157 effective January 1, 2009. We do

not expect the impact to be significant on our financial

position, results of operations and cash flows.

Due to the nature of our investment securities, there

have been no material changes to our valuation techniques

during the year ended December 31, 2008.

FASB Interpretation No. 48

We adopted the provisions of the FASB Interpretation No.

48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”),

on January 1, 2007. FIN 48 addresses the determination of

how tax benefits claimed or expected to be claimed on a

tax return should be recorded in the consolidated financial

statements. Under FIN 48, we recognize the tax benefits

from an uncertain tax position only when it is more likely

than not, based on the technical merits of the position,

that the tax position will be sustained upon examination,

including the resolution of any related appeals or liti-

gation. The tax benefits recognized in the consolidated

financial statements from such a position are measured

as the largest benefit that has a greater than fifty percent

likelihood of being realized upon ultimate resolution. As a

result of the implementation of FIN 48, we recognized an

increase in our liability for unrecognized tax benefits plus

associated accrued interest and penalties of $0.6 million,

which was accounted for as a reduction to the January 1,

2007 balance of retained earnings.

Refer to “Note 10—Income Taxes” in our historical con-

solidated financial statements for a more detailed discus-

sion of the adoption of FIN 48.

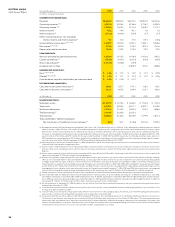

Components of Revenue and Expenses

The following briefly describes the components of revenue

and expenses as presented in the consolidated statements

of income. Descriptions of our revenue recognition policies

are included in Note 2—“Summary of Significant Accounting

Policies” in our consolidated financial statements.

TRANSACTION FEES —

Transaction fees are charged for

sending money transfers and consumer-to-business pay-

ments. Consumer-to-consumer transaction fees generally

vary according to the principal amount of the money

transfer and the locations from and to which the funds

18