Western Union 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

7070

Cash Dividends Paid

During the fourth quarter of 2008, the Company’s Board

of Directors declared a cash dividend of $0.04 per com-

mon share, representing $28.4 million which was paid

on December 31, 2008 to shareholders of record on

December 22, 2008.

During the fourth quarter of 2007, the Company’s

Board of Directors declared a cash dividend of $0.04

per common share, representing $30.0 million which was

paid on December 28, 2007 to shareholders of record on

December 14, 2007.

During the fourth quarter of 2006, the Company’s

Board of Directors declared a cash dividend of $0.01 per

common share, representing $7.7 million which was paid

in December 2006.

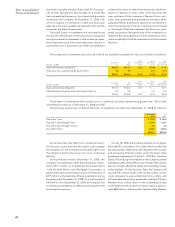

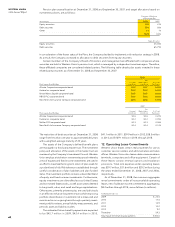

Share Repurchases

Since September 2006, the Board of Directors has autho-

rized common stock repurchases of up to $3.0 billion con-

sisting of a $1.0 billion authorization in June 2008 (“2008

Authorization”), a $1.0 billion authorization in December

2007 (“2007 Authorization”) and a $1.0 billion authorization

in September 2006. Both the 2007 Authorization and the

authorization in September 2006 have been fully utilized.

During the years ended December 31, 2008, 2007 and

2006, 58.1 million, 34.7 million and 0.9 million shares,

respectively, have been repurchased for $1,313.9 million,

$726.5 million and $19.9 million, respectively, exclud-

ing commissions, at an average cost of $22.60, $20.93

and $22.78 per share, respectively. As of December 31,

2008, $939.7 million remains available under the 2008

Authorization for purchases through December 31, 2009.

During December 2007, the Company’s Board of

Directors adopted resolutions to retire all of its existing trea-

sury stock, thereby restoring the status of the Company’s

common stock held in treasury as “authorized but unis-

sued.” The resulting impact to the Company’s Consolidated

Balance Sheet was the elimination of $462.0 million held

in “Treasury stock” and a decrease in “Common stock” of

$0.2 million and “Retained earnings” of $461.8 million.

There is no change to the Company’s overall equity posi-

tion as a result of this retirement. All shares repurchased

by the Company subsequent to this resolution will also

be retired at the time such shares are reacquired.

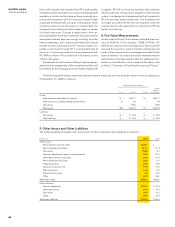

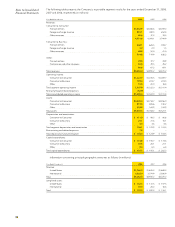

14. Derivatives

The Company is exposed to foreign currency risk resulting

from fluctuations in exchange rates, primarily the euro, and

to a lesser degree the British pound, Canadian dollar, other

European currencies, and the Australian dollar, related to

forecasted revenues and also on settlement assets and

obligations denominated in these and other currencies.

Additionally, the Company is exposed to interest rate

risk related to changes in market rates both prior to and

subsequent to the issuance of debt. The Company uses

derivatives to minimize its exposures related to adverse

changes in foreign currency exchange rates and interest

rates and not to engage in speculative derivative activi-

ties. Foreign currency forward contracts and interest rate

swaps of varying maturities are used in these risk man-

agement activities.

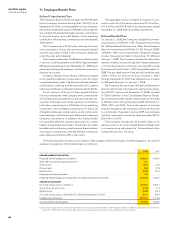

The Company executes derivative financial instru-

ments, which it designates as hedges, with established

financial institutions having credit ratings of “A” or better

from major rating agencies. The credit risk inherent in

these agreements represents the possibility that a loss

may occur from the nonperformance of a counterparty

to the agreements. The Company performs a review of

the credit risk of these counterparties at the inception of

the hedge, on a quarterly basis and as circumstances war-

rant. The Company also monitors the concentration of its

contracts with any individual counterparty. The Company

anticipates that the counterparties will be able to fully

satisfy their obligations under the agreements, but takes

action (including termination of contracts) when doubt

arises about the counterparties’ ability to perform. The

Company’s foreign currency exposures are in liquid cur-

rencies, consequently there is minimal risk that appropriate

derivatives to maintain the hedging program would not

be available in the future.

The details of each designated hedging relationship are

formally documented at the inception of the arrangement,

including the risk management objective, hedging strategy,

hedged item, specific risks being hedged, the derivative

instrument, how effectiveness is being assessed and how

ineffectiveness, if any, will be measured. The derivative must

be highly effective in offsetting the changes in cash flows

or fair value of the hedged item, and effectiveness is evalu-

ated quarterly on a retrospective and prospective basis.

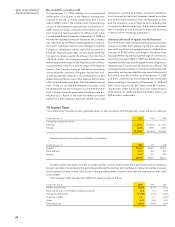

Foreign Currency Hedging

The Company’s policy is to use longer-term foreign cur-

rency forward contracts, with maturities of up to three years

at inception and a targeted weighted-average maturity of

approximately one year at any point in time, to mitigate

some of the risk that changes in foreign currency exchange

rates compared to the United States dollar could have on

forecasted revenues denominated in other currencies. At

December 31, 2008, the Company’s longer-term foreign

currency forward contracts had maturities of a maximum

of 24 months with a weighted average maturity of one

year. The Company assesses the effectiveness of these

foreign currency forward contracts based on changes in

the spot rate of the affected currencies during the period

of designation. Accordingly, all changes in the fair value

of the hedges not considered effective or portions of the

hedge that are excluded from the measure of effective-

ness are recognized immediately in “Derivative (losses)/

gains, net” within the Company’s Consolidated Statements

of Income. Differences between changes in the forward

rates and spot rates, along with all changes in the fair

value during periods in which the instrument was not des-

ignated as a hedge, were excluded from the measure of

effectiveness. Prior to September 29, 2006, the Company

did not have derivatives that qualified for hedge account-

ing in accordance with SFAS No. 133. As such, the effect

of the changes in the fair value of these hedges prior to

September 29, 2006 is included in “Derivative (losses)/

gains, net.” On September 29, 2006 and during the fourth

quarter of 2006, the Company began entering into new

derivative contracts in accordance with its revised foreign

currency derivatives and hedging processes, which

were designated and qualify as cash flow hedges under

SFAS No. 133.