Western Union 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

7474

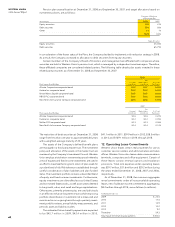

Term Loan

On December 5, 2008, the Company entered into a senior,

unsecured, 364-day term loan in an aggregate principal

amount of $500 million (the “Term Loan”) with a syndicate

of lenders. The Term Loan contains covenants which,

among other things, limit or restrict the Company’s ability

to sell or transfer assets or enter into a merger or consoli-

date with another company, grant certain types of security

interests, incur certain types of liens, impose restrictions

on subsidiary dividends, enter into sale and leaseback

transactions, or incur certain subsidiary level indebted-

ness. The Company is also required to maintain compli-

ance with a consolidated interest coverage ratio covenant.

Prepayments of loans are allowed and are required based

on the cash proceeds from other indebtedness, issuance

of equity, or sale of assets over $250 million.

The Term Loan allows the selection between two dif-

ferent respective interest rate calculations. For the current

interest rate, the Company selected an interest rate cal-

culated using the one-month LIBOR plus a 2% applicable

margin (3.875% at December 31, 2008). A loan fee is also

payable quarterly, beginning December 31, 2008, on the

total loan (50 basis points as of December 31, 2008). The

applicable margin and loan fee percentage are deter-

mined based on our credit ratings assigned by S&P and/

or Moody’s. A duration fee is payable 90 days and 180

days after the closing date of December 5, 2008 equal

to 0.25% and 0.50%, respectively, of the loan balance on

each date.

Notes

On September 29, 2006, the Company issued to First Data

$1.0 billion aggregate principal amount of unsecured

notes maturing on October 1, 2016 in partial consider-

ation for the contribution by First Data to the Company of

its money transfer and consumer payments businesses in

connection with the Spin-off.

Interest on the 2016 Notes is payable semiannually

on April 1 and October 1 each year based on a fixed per

annum interest rate of 5.930%. The indenture governing

the 2016 Notes contains covenants that, among other

things, limit or restrict the ability of the Company and other

significant subsidiaries to grant certain types of security

interests, incur debt (in the case of significant subsidiar-

ies) or enter into sale and leaseback transactions. The

Company may redeem the 2016 Notes at any time prior

to maturity at the applicable treasury rate plus 20 basis

points.

On November 17, 2006, the Company issued $2 billion

aggregate principal amount of the Company’s unsecured

fixed and floating rate notes, comprised of $500 million

aggregate principal amount of the Company’s Floating

Rate Notes due 2008 (the “Floating Rate Notes”), $1 billion

aggregate principal amount of 5.400% Notes due 2011

and $500 million aggregate principal amount of 6.200%

Notes due 2036 (the “2036 Notes”). The Floating Rate

Notes were redeemed upon maturity in November 2008.

Interest with respect to the 2011 Notes and 2036 Notes

is payable semiannually on May 17 and November 17

each year based on fixed per annum interest rates of

5.400% and 6.200%, respectively. The indenture govern-

ing the 2011 Notes and 2036 Notes contains covenants

that, among other things, limit or restrict the ability of the

Company and other significant subsidiaries to grant cer-

tain types of security interests, incur debt (in the case of

significant subsidiaries), or enter into sale and leaseback

transactions. The Company may redeem the 2011 Notes

and the 2036 Notes at any time prior to maturity at the

applicable treasury rate plus 15 basis points and 25 basis

points, respectively.

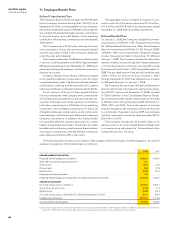

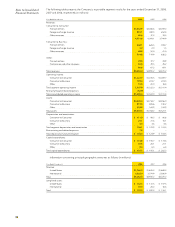

16. Stock Compensation Plans

Stock Compensation Plans

The Western Union Company 2006 Long-Term

Incentive Plan

The Western Union Company 2006 Long-Term Incentive

Plan (“2006 LTIP”) provides for the granting of stock

options, restricted stock awards and units, unrestricted

stock awards, and other equity-based awards, to employ-

ees and other key individuals who perform services for the

Company. A maximum of 120.0 million shares of common

stock may be awarded under the 2006 LTIP, of which

37.3 million shares are available as of December 31, 2008.

Options granted under the 2006 LTIP are issued with

exercise prices equal to the fair market value of Western

Union common stock on the grant date, have 10-year

terms, and vest over four equal annual increments begin-

ning 12 months after the date of grant. Compensation

expense related to stock options is recognized over the

requisite service period. The requisite service period for

stock options is the same as the vesting period, with the

exception of retirement eligible employees, who have

shorter requisite service periods ending when the employ-

ees become retirement eligible.

Restricted stock awards and units granted under the

2006 LTIP typically become 100% vested on the three year

anniversary of the grant date. The fair value of the awards

granted is measured based on the fair market value of the

shares on the date of grant, and the related compensation

expense is recognized over the requisite service period

which is the same as the vesting period.

On September 29, 2006, the Company awarded a

founders’ grant of either restricted stock awards or units

to certain employees who are not otherwise eligible to

receive stock-based awards under the 2006 LTIP. These

awards vested in two equal annual increments on the

first and second anniversary of the grant date. The fair

value of the awards granted was measured based on the

when-issued closing price of the Company’s common

stock of $19.13 on the grant date and was recognized

ratably over the vesting period. Included in the 3.5 million

restricted stock awards and units issued under the 2006

LTIP described in the preceding paragraph, were 0.3 mil-

lion restricted stock awards or units issued in connection

with the founders’ grant.

The Western Union Company 2006 Non-Employee

Director Equity Compensation Plan

The Western Union Company 2006 non-employee director

equity compensation plan (“2006 Director Plan”) provides

for the granting of equity-based awards to non-employee

directors of the Company. Options granted under the