Western Union 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5959

Notes to Consolidated

Financial Statements

to change after the valuation of identifiable assets and

certain other assets and liabilities is finalized. In addition,

the Company has the option to acquire the remaining 20%

of the money transfer agent and the money transfer agent

has the option to sell the remaining 20% to the Company

within 12 months after December 2013 at fair value.

On August 1, 2008, the Company acquired the money

transfer assets from its existing money transfer agent in

Panama for a purchase price of $18.3 million. The consid-

eration paid was $14.3 million, net of a holdback reserve

of $4.0 million. The $4.0 million holdback reserve is sched-

uled to be paid $0.5 million, $1.2 million, $1.2 million and

$1.1 million in February 2009, August 2009, August 2010

and August 2011, respectively, subject to the terms of the

agreement. The results of operations of the acquiree have

been included in the Company’s consolidated financial

statements since the acquisition date. The preliminary

purchase price allocation resulted in $5.6 million of identifi-

able intangible assets, a significant portion of which were

attributable to the acquiree’s network of subagents. The

identifiable intangible assets are being amortized over

three to seven years and goodwill of $14.2 million was

recorded, which is not expected to be deductible for

income tax purposes. The purchase price allocation is

preliminary and subject to change after the valuation of

identifiable assets and certain other assets and liabilities

is finalized.

In October 2007, the Company entered into agree-

ments totaling $18.3 million to convert its non-participating

interest in an agent in Singapore to a fully participating

49% equity interest and to extend the agent relationship

at more favorable commission rates to Western Union. As

a result, the Company earns a pro-rata share of profits and

has enhanced voting rights. The Company also has the

right to add additional agent relationships in Singapore.

In addition, in October 2007, the Company completed

an agreement to acquire a 25% ownership interest in an

agent in Jamaica and to extend the term of the agent rela-

tionship for $29.0 million. The aggregate consideration

paid resulted in $20.2 million of identifiable intangible

assets, including capitalized contract costs, which are

being amortized over seven to 10 years. Western Union’s

investments in these agents are accounted for under the

equity method of accounting.

In December 2006, the Company acquired Servicio

Electronico de Pago S.A. and related entities (“SEPSA”),

which operates under the brand name Pago Fácil

SM

, for

a total purchase price of $69.8 million, less cash acquired

of $3.0 million. Pago Fácil provides consumer-to-business

payments and prepaid mobile phone top-up services in

Argentina. Previously, the Company held a 25% interest

in Pago Fácil, which was treated as an equity method

investment. As a result of acquiring the additional 75%

ownership, the Company’s entire investment in and results

of operations of Pago Fácil have been included in the

consolidated financial statements since the acquisition

date. The purchase price allocation resulted in

$28.1 million of identifiable intangible assets, a signifi-

cant portion of which were attributable to the Pago Fácil

service mark and acquired agent and biller relationships.

The identifiable intangible assets were calculated based

on the additional 75% ownership interest acquired, and

are being amortized over two to 25 years. After adjusting

the additional acquired net assets to fair value, goodwill

of $44.5 million was recorded, substantially all of which is

eligible for amortization for tax purposes across various

jurisdictions.

The pro forma impact of all acquisitions on net income

in 2008, 2007 and 2006 was immaterial.

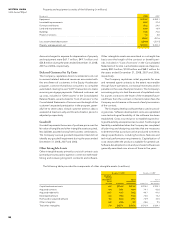

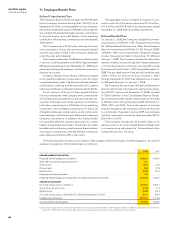

The following table presents changes to goodwill for the years ended December 31, 2008 and 2007 (in millions):

Consumer-to- Consumer-to-

Consumer Business Other Total

January1, 2007 balance $1,392.0 $243.1 $12.9 $1,648.0

Purchase price adjustments (3.0) (5.9) 1.7 (7.2)

Currency translation — (1.3) — (1.3)

December31, 2007 balance $1,389.0 $235.9 $14.6 $1,639.5

Acquisitions 39.0 — — 39.0

Purchase price adjustments (1.0) — — (1.0)

Currency translation — (3.2) (0.1) (3.3)

December31, 2008 balance $1,427.0 $232.7 $14.5 $1,674.2

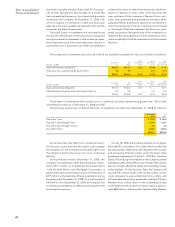

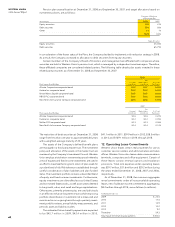

5. Related Party Transactions

Related Party Transactions with First Data

The Consolidated Statement of Income for the year ended

December 31, 2006 prior to the Spin-off includes expense

allocations for certain corporate functions historically pro-

vided to Western Union by First Data. If possible, these

allocations were made on a specific identification basis.

Otherwise, the expenses related to services provided to

Western Union by First Data were allocated to Western

Union based on relative percentages, as compared to First

Data’s other businesses, of headcount or other appropri-

ate methods depending on the nature of each item or

cost to be allocated.

Charges for functions historically provided to Western

Union by First Data are primarily attributable to First Data’s

performance of many shared services that the Company

utilized prior to the Spin-off. First Data continued to provide

certain of these services subsequent to the Spin-off through

a transition services agreement until September 29, 2007.

In addition, prior to the Spin-off, the Company participated

in certain First Data insurance, benefit and incentive plans,

and it received services directly related to the operations

of its businesses such as call center services, credit card

processing, printing and mailing. The Consolidated