Western Union 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

26

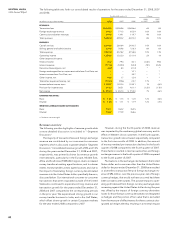

benefit to transaction fee and foreign exchange revenue of

$96 million, over the previous year, net of foreign currency

hedges, that would not have occurred had there been con-

stant currency rates. The positive impact to operating profit

derived from foreign currency exchange rates increasing

against the United States dollar during the year was offset

by the impact of foreign currency derivative losses for those

foreign currency derivatives not designated as hedges and

the portion of fair value that is excluded from the measure

of effectiveness for these contracts designated as hedges

thereby resulting in a minimal impact to overall earnings

per share. Transactions in the euro, which represent the

majority of the Company’s foreign currency denominated

business, benefited revenue by $82 million and operating

income by $19 million during the year. If exchange rates

between the United States dollar and other currencies

remain constant with those experienced at the end of

2008, or if the euro and certain other currencies continue

to weaken against the United States dollar, we expect a

negative impact on our revenue in 2009. However, the

impact to earnings per share is expected to be less due to

the impact of translation on our expenses and our hedg-

ing program.

Americas revenue declined 1% for the year ended

December 31, 2008 compared to the corresponding

period in 2007 but transactions grew 2% for the same

period. The United States domestic and the United States

outbound revenue continued to decline, due to the overall

weakening in the United States economy and rising unem-

ployment, for the year ended December 31, 2008. Within

the Americas region, revenue declines in our domestic

(transactions between and within the United States and

Canada) business, which represents approximately 10%

of consolidated revenue for the year ended December 31,

2008, continued to occur due to the factors described

above. Although the domestic and United States outbound

revenue declines experienced in 2008 have moderated

compared to those experienced in 2007, we did experi-

ence increased revenue declines in the fourth quarter of

2008 compared to the third quarter of 2008, due to the

further weakening in the United States economy.

Domestic revenue declined 6% on transaction declines

of 3% for the year ended December 31, 2008 compared

to the corresponding period in 2007. In addition, United

States telephone money transfer revenues continued to

decline, and website money transfer revenues were flat

for the year ended December 31, 2008.

Revenue in our Mexico business was down 2% on trans-

action declines of 1% for the year ended December 31,

2008 compared to the same period in 2007. The Mexico

business continues to be impacted by the weakening

in the United States economy, noted earlier, with such

declines increasing in the fourth quarter of 2008. During

a few weeks in the fourth quarter 2008, the value of the

Mexican peso decreased dramatically against the United

States dollar and, as a result, we experienced a spike in

transactions as United States senders took advantage of

the more favorable exchange rates. As the devaluation of

the peso was sudden and unusual, we needed to acquire

pesos at less favorable rates in order to meet the demand

for immediate payout in Mexico, which impacted the overall

decline in revenue by less than $5 million.

In early July 2008, the Arizona Court of Appeals over-

turned a trial court’s ruling in Western Union’s favor regard-

ing the authority of the Arizona Attorney General to seize

money transfers originated in states other than Arizona

and intended for payment in Mexico. In December, the

Arizona Supreme Court agreed to hear the case, which was

argued on January 13, 2009. However, a decision has not

yet been rendered. The Arizona Attorney General has not

attempted to resume the type of seizures that are at issue

in this litigation. However, we remain subject to scrutiny

in Arizona by law enforcement and regulatory agencies.

The Arizona Attorney General has and continues to make

extensive data requests of us regarding our operations,

our agents and our consumers. On January 8, 2009, the

Arizona Superior Court ruled in Western Union’s favor and

held that certain subpoenas for Western Union transaction

data issued by the Arizona Attorney General were over-

broad and unenforceable. However, the legal and regu-

latory environment in Arizona remains challenging, and

we could become subject to additional civil and possibly

criminal actions. To date, we have not experienced any

measurable impact to our Americas business as a result

of the recent Arizona Court of Appeals decision or the

data requests by the Arizona Attorney General. However,

additional civil or criminal actions or an unfavorable reso-

lution of the case described above could adversely affect

our business, financial position and results of operations.

Revenue and transaction growth in the APAC region

for the year ended December 31, 2008 compared to the

same period in 2007 was driven by strong inbound growth

to the region, especially to the Philippines. China revenue

and transactions grew at 13% and 11% for the year ended

December 31, 2008 compared to the corresponding

period in 2007, respectively. Revenue growth rates slowed

to China during the third quarter of 2008, with revenue

declining in the fourth quarter of 2008 compared to the

same period in 2007, in part due to the weakening eco-

nomic situation described previously and the decline in

high revenue transactions from small entrepreneurs that

typically make purchases in China.

Foreign exchange revenue increased for the year ended

December 31, 2008 compared to the same period in the

prior year due to an increase in cross-currency transactions

primarily as a result of growth in international consumer-

to-consumer transactions. As described above, foreign

exchange revenue also benefited during the year ended

December 31, 2008 compared to 2007 from the exchange

rate between other currencies against the United States

dollar, despite the negative impact of currency rate fluc-

tuations in the fourth quarter of 2008.

We have historically implemented and will likely imple-

ment future strategic fee reductions and actions to reduce

foreign exchange spreads, where appropriate, taking into

account growth opportunities and competitive factors. Fee

decreases and foreign exchange actions generally reduce

margins, but are done in anticipation that they will result

in increased transaction volumes and increased revenues

over time. During the year ended December 31, 2008, fee

decreases and foreign exchange actions have occurred at

a significantly lower rate than in previous years. Such fee

decreases and foreign exchange actions have impacted

our annual consolidated revenue on average approximately

3% during 2006 and 2007 and approximately 1% in 2008.

26