Western Union 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

5656

Western Union accounts for income taxes under the

liability method, which requires that deferred tax assets

and liabilities be determined based on the expected future

income tax consequences of events that have been recog-

nized in the consolidated financial statements. Deferred

tax assets and liabilities are recognized based on tempo-

rary differences between the financial statement carry-

ing amounts and tax bases of assets and liabilities using

enacted tax rates in effect in the years in which the tem-

porary differences are expected to reverse.

The Company adopted the provisions of FASB

Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (“FIN 48”), on January 1, 2007. FIN 48 addresses the

determination of how tax benefits claimed or expected to

be claimed on a tax return should be recorded in the con-

solidated financial statements. Under FIN 48, the Company

recognizes the tax benefits from an uncertain tax position

only when it is more likely than not, based on the technical

merits of the position, that the tax position will be sustained

upon examination, including the resolution of any related

appeals or litigation. The tax benefits recognized in the

consolidated financial statements from such a position are

measured as the largest benefit that has a greater than

fifty percent likelihood of being realized upon ultimate

resolution. As a result of the implementation of FIN 48,

the Company recognized an increase in the liability for

unrecognized tax benefits plus associated accrued inter-

est and penalties of $0.6 million, which was accounted for

as a reduction to the January 1, 2007 balance of retained

earnings.

Foreign Currency Translation

The U.S. dollar is the functional currency for all of Western

Union’s businesses except certain investments and sub-

sidiaries located primarily in Ireland, Argentina and Peru.

Foreign currency denominated assets and liabilities for

those entities for which the local currency is the functional

currency are translated into United States dollars based

on exchange rates prevailing at the end of the period.

Revenues and expenses are translated at average exchange

rates prevailing during the period. The effects of foreign

exchange gains and losses arising from the translation of

assets and liabilities of those entities where the functional

currency is not the United States dollar are included as a

component of “Accumulated other comprehensive loss.”

Foreign currency translation gains and losses on assets

and liabilities of foreign operations in which the United

States dollar is the functional currency are recognized in

operations.

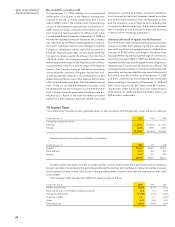

Derivatives

Western Union utilizes derivatives to mitigate foreign cur-

rency and interest rate risk. The Company recognizes all

derivatives in the “Other assets” and “Other liabilities” cap-

tions in the accompanying Consolidated Balance Sheets

at their fair value. All cash flows associated with deriva-

tives are included in cash flows from operating activities

in the Consolidated Statements of Cash Flows other than

those previously designated as cash flow hedges that

were determined to not qualify for hedge accounting as

described in Note 14.

º

CASH FLOW HEDGES—Changes in the fair value of deriv-

atives that are designated and qualify as cash flow

hedges in accordance with SFAS No. 133, “Accounting

for Derivative Instruments and Hedging Activities,”

as amended and interpreted (“SFAS No. 133”) are

recorded in “Accumulated other comprehensive

loss.” Cash flow hedges consist of foreign currency

hedging of forecasted revenues, as well as, from time

to time, hedges of anticipated fixed rate debt issu-

ances. Derivative fair value changes that are captured in

Accumulated other comprehensive loss are reclassified

to revenues in the same period or periods the hedged

item affects earnings. The portion of the change in fair

value that is excluded from the measure of effective-

ness is recognized immediately in “Derivative (losses)/

gains, net.”

º

FAIR VALUE HEDGES—

Changes in the fair value of deriva-

tives that are designated as fair value hedges of fixed

rate debt in accordance with SFAS No. 133 are recorded

in interest expense. The offsetting change in value

attributable to changes in the benchmark interest rate of

the related debt instrument is also recorded in interest

expense consistent with the related derivative’s change.

º

UNDESIGNATED —

Derivative contracts entered into to

reduce the variability related to (a) settlement assets

and obligations, generally with maturities of a few

days up to one month, and (b) certain foreign currency

denominated cash positions, generally with maturities

of less than one year, are not designated as hedges

for accounting purposes and, as such, changes in their

fair value are included in “Cost of services” consistent

with foreign exchange rate fluctuations on the related

settlement assets and obligations or cash positions.

The Company also had certain other foreign currency

swap arrangements with First Data, prior to September 29,

2006, to mitigate the foreign exchange impact on

certain euro denominated notes receivable with First Data.

These foreign currency swaps did not qualify for hedge

accounting and, accordingly, the fair value changes of

these agreements were reported in the accompanying

Consolidated Statements of Income as “Foreign exchange

effect on notes receivable from First Data, net.” The fair

value of these swaps were settled in cash along with the

related notes receivable in connection with the Spin-off.

The fair value of the Company’s derivatives is derived

from standardized models that use market based inputs

(e.g., forward prices for foreign currency).

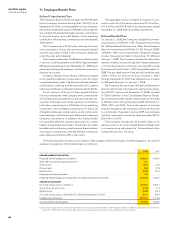

Stock-Based Compensation

The Company currently has a stock-based compensation

plan that provides for the granting of Western Union stock

options, restricted stock awards and restricted stock units

to employees and other key individuals who perform ser-

vices for the Company. In addition, the Company has a

stock-based compensation plan that provides for grants

of Western Union stock options and stock unit awards

to non-employee directors of the Company. Prior to the

Spin-off, employees of Western Union participated in First

Data’s stock-based compensation plans.