Western Union 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4747

Consolidated

Financial Statements

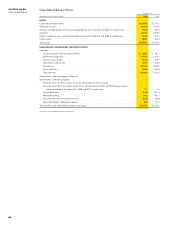

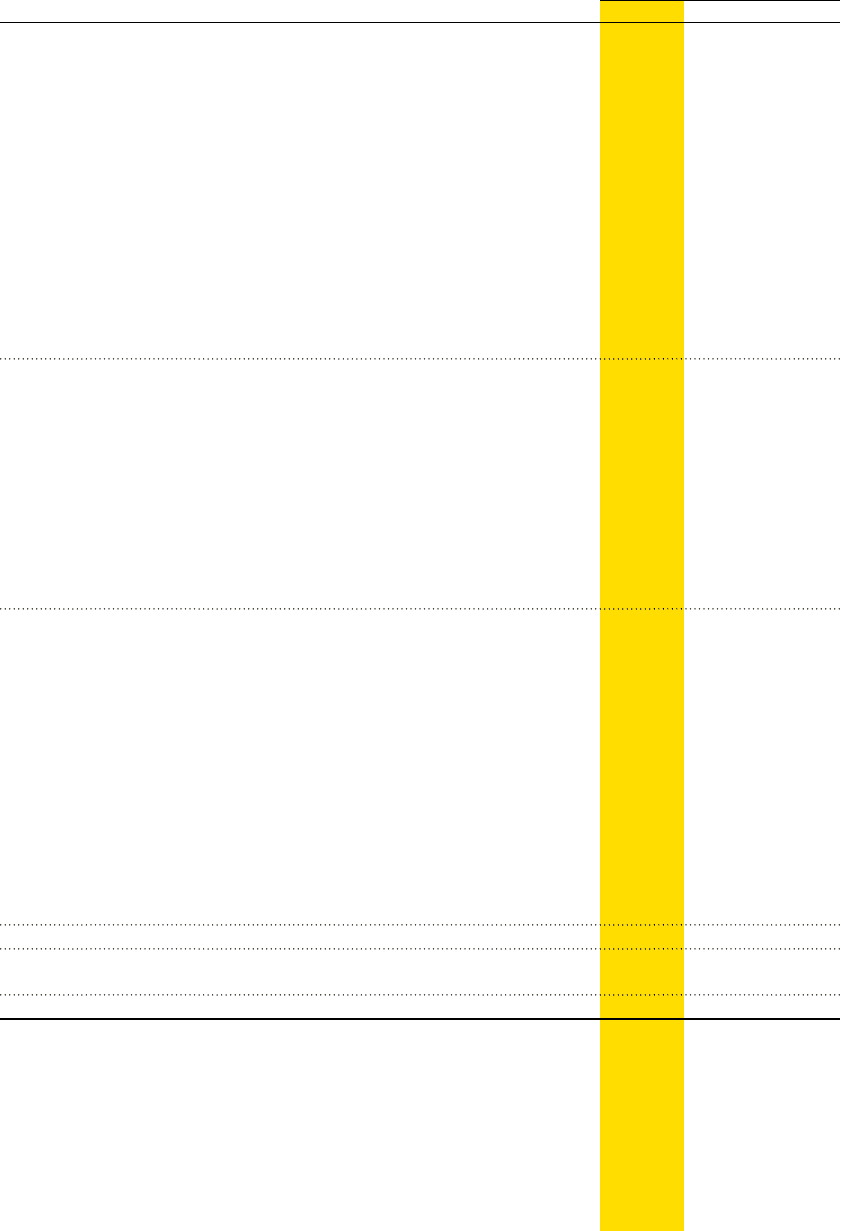

Consolidated Statements of Cash Flows

Year Ended December 31,

(in millions) 2008 2007 2006

CASH FLOWS FROM OPERATING ACTIVITIES

Net income $ 919.0 $ 857.3 $ 914.0

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 61.7 49.1 34.8

Amortization 82.3 74.8 68.7

Deferred income tax provision 15.9 4.2 12.9

Realized gain on derivative instruments — — (4.1)

Stock compensation expense 26.3 50.2 23.3

Other non-cash items, net 42.9 14.6 24.3

Increase/(decrease) in cash, excluding the effects of acquisitions and dispositions,

resulting from changes in:

Other assets 6.9 16.2 (60.7)

Accounts payable and accrued liabilities 35.2 43.4 59.8

Income taxes payable 91.2 15.3 63.4

Other liabilities (27.5) (21.6) (27.5)

Net cash provided by operating activities 1,253.9 1,103.5 1,108.9

CASH FLOWS FROM INVESTING ACTIVITIES

Capitalization of contract costs (82.8) (80.9) (124.1)

Capitalization of purchased and developed software (17.0) (27.7) (14.4)

Purchases of property and equipment (53.9) (83.5) (63.8)

Notes receivable issued to agents (1.0) (6.1) (140.0)

Repayments of notes receivable issued to agents 41.9 32.0 20.0

Acquisition of businesses, net of cash acquired (42.8) — (66.5)

Increase in receivable for securities sold (298.1) — —

Cash received on maturity of foreign currency forwards — — 4.1

Purchase of equity method investments — (35.8) —

Net cash used in investing activities (453.7) (202.0) (384.7)

CASH FLOWS FROM FINANCING ACTIVITIES

Net (repayments)/proceeds from commercial paper (255.3) 13.6 324.6

Net (repayments)/proceeds from net borrowings under credit facilities — (3.0) 3.0

Proceeds from issuance of borrowings 500.0 — 4,386.0

Principal payments on borrowings (500.0) — (2,400.0)

Proceeds from exercise of options 300.5 216.1 80.8

Cash dividends to public stockholders (28.4) (30.0) (7.7)

Common stock repurchased (1,314.5) (726.8) (19.9)

Advances from affiliates of First Data — — 160.2

Repayments of notes payable to First Data — — (154.5)

Additions to notes receivable from First Data — — (7.5)

Proceeds from repayments of notes receivable from First Data — — 776.2

Dividends to First Data — — (2,953.9)

Net cash (used in)/provided by financing activities (1,297.7) (530.1) 187.3

Net change in cash and cash equivalents (497.5) 371.4 911.5

Cash and cash equivalents at beginning of year 1,793.1 1,421.7 510.2

Cash and cash equivalents at end of year $ 1,295.6 $1,793.1 $ 1,421.7

SUPPLEMENTAL CASH FLOW INFORMATION

Interest paid (prior to the September29, 2006 spin-off,

amounts were paid primarily to First Data) $ 171.6 $ 185.8 $ 26.4

Income taxes paid (prior to the September29, 2006 spin-off,

amounts were paid primarily to First Data) 230.3 340.9 271.6

Notes issued in conjunction with dividend to First Data,

net of debt issue costs and discount — — 995.1

Net liabilities transferred from First Data in connection

with the September29, 2006 spin-off — — 148.2

See Notes to Consolidated Financial Statements.