Western Union 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

5252

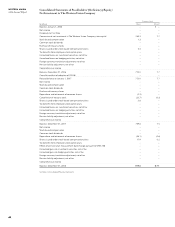

Earnings Per Share

The calculation of basic earnings per share is computed

by dividing net income available to common stockholders

by the weighted-average number of shares of common

stock outstanding for the period. Prior to September 29,

2006, all outstanding shares of Western Union were

owned by First Data. Accordingly, for the period prior

to the completion of the Distribution on September 29,

2006, basic and diluted earnings per share are computed

using Western Union’s shares outstanding as of that date.

Unvested shares of restricted stock are excluded from

basic shares outstanding. Diluted earnings per share sub-

sequent to September 29, 2006 reflects the potential

dilution that could occur if outstanding stock options at

the presented date are exercised and shares of restricted

stock have vested, using the treasury stock method.

The treasury stock method assumes proceeds from the

exercise price of stock options, the unamortized com-

pensation expense and assumed tax benefits of options

and restricted stock are available to acquire shares at an

average price throughout the year, and therefore, reduce

the dilutive effect throughout the year.

As of December 31, 2008, 2007 and 2006, there were

8.0 million, 10.4 million and 4.9 million, respectively, out-

standing options to purchase shares of Western Union

stock excluded from the diluted earnings per share calcu-

lation under the treasury stock method as their effect was

anti-dilutive. Prior to the September 29, 2006 spin-off date,

there were no potentially dilutive instruments outstand-

ing. Of the 43.6 million outstanding options to purchase

shares of common stock of the Company, approximately

47% are held by employees of First Data.

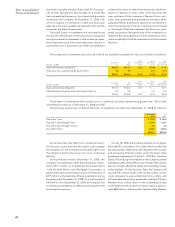

Fair Value Measurements

Effective January 1, 2008, the Company determines the

fair market values of its financial assets and liabilities, as

well as non-financial assets and liabilities that are recog-

nized or disclosed at fair value on a recurring basis, based

on the fair value hierarchy established in SFAS No. 157,

“Fair Value Measurements” (“SFAS No. 157”). The stan-

dard describes three levels of inputs that may be used to

measure fair value.

ºLEVEL 1: Quoted prices in active markets for identical

assets or liabilities. Western Union’s financial instru-

ments that base fair value determinations on Level 1

inputs are not material.

º

LEVEL 2:

Observable inputs other than Level 1 prices

such as quoted prices for similar assets or liabilities;

quoted prices in markets that are not active; or other

inputs that are observable or can be corroborated by

observable market data for substantially the full term

of the assets or liabilities. Most of Western Union’s

assets or liabilities fall within Level 2 and include state

and municipal debt instruments, other foreign invest-

ment securities, and derivative assets and liabilities.

Western Union utilizes pricing services to value its

Level 2 financial instruments. For most of these assets,

the Company utilizes pricing services that use multiple

prices as inputs to determine daily market values.

º

LEVEL 3: Unobservable inputs that are supported by

little or no market activity and that are significant to

the fair value of the assets or liabilities. Level 3 assets

and liabilities include items where the determination of

fair value requires significant management judgment

or estimation. The Company currently has no Level 3

assets or liabilities that are measured at fair value on

a recurring basis.

Pursuant to the Financial Accounting Standards Boards

(“FASB”) Staff Position No. 157-2, “Effective Date of FASB

Statement No. 157” (“FSB No. 157-2”), the effective date

of SFAS No. 157 for certain non-financial assets and liabili-

ties that are measured at fair value but are recognized or

disclosed at fair value on a non-recurring basis has been

deferred to fiscal years beginning after November 15,

2008. The Company is primarily impacted by this deferral

as it relates to non-financial assets and liabilities initially

measured at fair value in a business combination (but not

measured at fair value in subsequent periods) and fair value

measurements in impairment testing. The Company will

adopt these remaining provisions of SFAS No. 157 effec-

tive January 1, 2009. The Company does not expect the

impact to be significant on its financial position, results of

operations and cash flows.

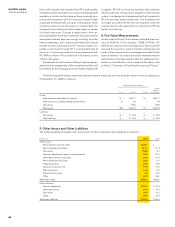

Except as it pertains to an investment redemption

discussed in Note 9, carrying amounts for Western Union

financial instruments, including cash and cash equiva-

lents, settlement cash and cash equivalents, settlement

receivables, settlement obligations, borrowings under the

commercial paper program and other short-term notes

payable, approximate fair value due to their short maturi-

ties. Investment securities, included in settlement assets,

and derivative financial instruments are carried at fair value

and included in Note 8, “Fair Value Measurements.” Fixed

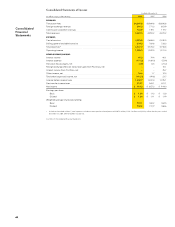

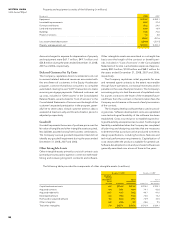

The following table provides the calculation of diluted weighted-average shares outstanding, and only considers

the potential dilution for stock options, restricted stock awards and restricted stock units for the periods subsequent

to the spin-off date of September 29, 2006 (in millions):

For the Year Ended December 31, 2008 2007 2006

Basic weighted-average shares 730.1 760.2 764.5

Common stock equivalents 8.1 12.7 4.1

Diluted weighted-average shares outstanding 738.2 772.9 768.6