Western Union 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

$64.4 million and $3.6 million related to our consumer-to-

business segment in the years ended December 31, 2007

and 2006, respectively. Revenue growth for the year ended

December 31, 2007 compared to the same period in 2006,

excluding Pago Fácil, was 4%. Transaction growth, exclud-

ing Pago Fácil, was 1% during the year ended December 31,

2007, compared to the same period in 2006.

Operating income

2008 COMPARED TO 2007

Operating income for the consumer-to-business seg-

ment decreased for the year ended December 31, 2008

compared to 2007 primarily due to operating income

declines in the United States-based bill payments busi-

nesses, partially offset by growth in Pago Fácil payments.

Operating income margins also declined as United States

electronic-based and Pago Fácil payments, which cumu-

latively represented a higher percentage of consumer-

to-business revenues in 2008 compared to 2007, have

lower operating margins than the declining higher mar-

gin United States cash-based bill payments business.

Partially offsetting operating income declines for the year

ended December 31, 2008 compared to 2007 was lower

stock-based compensation expenses as described in the

“consumer-to-consumer” operating income discussion.

2007 COMPARED TO 2006

Operating income for the consumer-to-business segment

was unchanged for the year ended December 31, 2007

compared to the same period in 2006 because of the

impact of Pago Fácil and revenue growth in the segment’s

electronic-based services businesses, and was offset by

incremental public company expenses and the accelerated

stock compensation charge taken in connection with the

change in control of First Data. Operating income for the

period grew at a lower rate than revenues as Pago Fácil

and the electronic-based services have lower operating

margins compared to the higher margin United States

cash-based bill payments business, as well as the incre-

mental public company expenses and accelerated stock

compensation charge noted above.

29

Management’s

Discussion and

Analysis of Financial

Condition and

Results of Operations

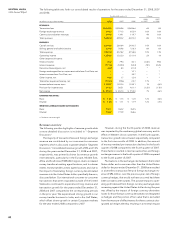

Other

The following table sets forth other results for the years ended December31, 2008, 2007 and 2006.

Years Ended December 31, % Change

2008 2007

(dollars and transactions in millions) 2008 2007 2006 vs.2007 vs.2006

Revenues $90.6 $87.2 $89.1 4% (2)%

Operating income $15.8 $20.0 $18.4 (21)% 9%

Operating income margin 17% 23% 21%

Revenues

2008 COMPARED TO 2007

Revenue increased for the year ended December 31, 2008

over the same period in 2007 due to revenue growth in

our prepaid services business generated outside of the

United States.

First Data, through its subsidiary Integrated Payment

Systems Inc. (“IPS”), issues our Western Union branded

money orders, pursuant to a five-year agreement that was

executed in conjunction with the spin-off. On July 18, 2008,

we entered into an agreement with IPS which modified the

existing business relationship with respect to the issuance

and processing of money orders. Under the terms of that

agreement beginning on October 1, 2009 (the “Transition

Date”), IPS will assign and transfer to us certain operating

assets used by IPS to issue money orders and an amount

of cash sufficient to satisfy all outstanding money order

liabilities. On the Transition Date, we will assume IPS’s

role as issuer of the money orders, including its obligation

to pay outstanding money orders and will terminate the

existing agreement whereby IPS pays us a fixed return on

the outstanding money order balances (which vary from

day to day but approximate $800 million). Following the

Transition Date, we will invest the cash received from IPS

in high-quality, investment grade securities in accordance

with applicable regulations, which are the same as those

currently governing the investment of our United States

originated money transfer principal. In anticipation of our

exposure to fluctuations in interest rates, we have entered

into interest rate swaps on certain of our fixed rate notes.

Through a combination of the revenue generated from

these investment securities and the anticipated interest

expense savings resulting from these interest rate swaps,

we estimate that we should be able to retain subsequent

to the Transition Date, on a pretax income basis through

2011, a comparable rate of return as we are receiving

under our current agreement with IPS. However, revenue

may be lower.

Subsequent to the Transition Date, all revenue gener-

ated from the management of the investment portfolio will

be retained by us and none will be shared with our agents.

IPS will continue to provide to us clearing services neces-

sary for payment of the money orders in exchange for the

payment by us to IPS of a per-item administrative fee. We

will no longer provide to IPS the services required under

the original money order agreement or receive from IPS

the fee for such services.

2007 COMPARED TO 2006

Our money order and prepaid services businesses, includ-

ing prepaid services acquired through our acquisition

of Pago Fácil, accounted for 100% and 94% of “Other”

revenue in 2007 and 2006, respectively. We previously

operated messaging and international prepaid cellular