Western Union 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

48

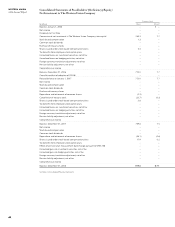

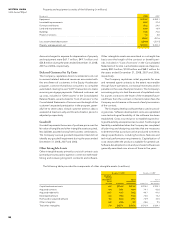

Consolidated Statements of Stockholders’ (Deficiency)/Equity/

Net Investment in The Western Union Company

Common Stock

(in millions) Shares Amount

Balance, January1, 2006 — $ —

Net income — —

Dividends to First Data — —

Conversion of net investment in The Western Union Company into capital 765.3 7.7

Stock-based compensation 1.3 —

Common stock dividends — —

Purchase of treasury shares — —

Shares issued under stock-based compensation plans 5.4 —

Tax benefits from employee stock option plans — —

Unrealized losses on investment securities, net of tax — —

Unrealized losses on hedging activities, net of tax — —

Foreign currency translation adjustment, net of tax — —

Pension liability adjustment, net of tax — —

Comprehensive income

Balance, December31, 2006 772.0 7.7

Cumulative effect of adoption of FIN48 — —

Revised balance at January1, 2007 772.0 7.7

Net income — —

Stock-based compensation — —

Common stock dividends — —

Purchase of treasury shares — —

Repurchase and retirement of common shares (2.3) —

Cancellation of treasury stock (22.7) (0.2)

Shares issued under stock-based compensation plans 2.8 —

Tax benefits from employee stock option plans — —

Unrealized losses on investment securities, net of tax — —

Unrealized losses on hedging activities, net of tax — —

Foreign currency translation adjustment, net of tax — —

Pension liability adjustment, net of tax — —

Comprehensive income

Balance, December31, 2007 749.8 7.5

Net income — —

Stock-based compensation — —

Common stock dividends — —

Repurchase and retirement of common shares (58.1) (0.6)

Shares issued under stock-based compensation plans 17.9 0.2

Tax benefits from employee stock option plans — —

Effects of pension plan measurement date change pursuant to SFAS 158 — —

Unrealized gains on investment securities, net of tax — —

Unrealized gains on hedging activities, net of tax — —

Foreign currency translation adjustment, net of tax — —

Pension liability adjustment, net of tax — —

Comprehensive income

Balance, December31, 2008 709.6 $ 7.1

See Notes to Consolidated Financial Statements.

48