Western Union 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

Factors that we believe are important to our long-term

success include accelerating profitable growth in our

existing consumer-to-consumer business, expanding

and globalizing our consumer-to-business segment and

increasing the number of bill payment options, innovat-

ing to provide new products and services to our target

consumer, and improving our profitability by leveraging

our scale, reducing costs and effectively utilizing capital.

Significant factors affecting our financial position and

results of operations include:

º

Transaction volume is the primary generator of revenue

in our businesses. Transaction volume in our consumer-

to-consumer segment is affected by, among other

things, the size of the international migrant population

and individual needs to transfer funds in emergency

situations. As noted elsewhere in this Annual Report,

a reduction in the size of the migrant population, inter-

ruptions in migration patterns or reduced employ-

ment opportunities including those resulting from any

changes in immigration laws, economic development

patterns or political events, could adversely affect our

transaction volume. For discussion on how these fac-

tors have impacted us in recent periods, refer to the

consumer-to-consumer segment discussion below.

º

Revenue is also impacted by changes in the fees we

charge consumers, the amount of money sent, and

by the variance in the exchange rate set by us to the

consumer and the rate at which we or our agents are

able to acquire currency. We intend to continue to

implement strategic pricing reductions, actions to

reduce foreign exchange spreads, where appropriate,

taking into account growth opportunities and including

competitive factors. Decreases in our fees or foreign

exchange spreads generally reduce margins, but are

done in anticipation that they will result in increased

transaction volumes and increased revenues over time.

º

As mentioned above, revenue is impacted by the princi-

pal per transaction. In 2008, our consumer-to-consumer

principal per transaction increased 3% over the prior

year. However, in the fourth quarter 2008 versus the

comparable period in the prior year, consumer-to-

consumer principal per transaction declined 4%, a

trend we expect to continue in 2009.

º

The weakening economy in the United States has

adversely impacted our consumer-to-consumer and

consumer-to-business segments throughout the

year and the more recent global economic crisis has

adversely impacted our fourth quarter 2008 results

and continues to impact us.

º

We continue to face robust competition in both our

consumer-to-consumer and consumer-to-business seg-

ments from a variety of money transfer and consumer

payment providers. We believe the most significant

competitive factors in the consumer-to-consumer seg-

ment relate to brand recognition, trust and reliability,

distribution network, consumer experience and price

and in the consumer-to-business segment relate to

brand recognition, trust and reliability, convenience,

speed, variety of payment methods and price.

º

Regulation of the money transfer industry is increasing.

The number and complexity of regulations around the

world and the pace at which regulation is changing are

factors that pose significant challenges to our business.

We continue to implement policies and programs and

adapt our business practices and strategies to help

us comply with current legal requirements, as well as

with new and changing legal requirements affecting

particular services, or the conduct of our business in

general. Our activities include dedicated compliance

personnel, training and monitoring programs, gov-

ernment relations and regulatory outreach efforts,

and support and guidance to the agent network on

compliance programs. These efforts increase our costs

of doing business.

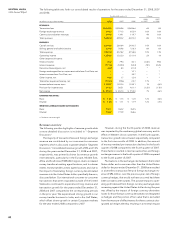

The Separation of Western Union from First Data

On January 26, 2006, the First Data Board of Directors

announced its intention to pursue the distribution of 100%

of its money transfer and consumer payments businesses

related assets, through a tax-free distribution to First Data

shareholders. Effective on September 29, 2006, First Data

completed the separation and the distribution of these

businesses (the “Distribution”). Prior to the Distribution,

our company had been a segment of First Data.

Subsequent to the spin-off from First Data, we have

recognized higher interest expense as a result of the debt

that was issued to effect the spin-off. We have also recorded

higher expenses related to being a stand-alone company,

as further described below in “Basis of Presentation.”

Basis of Presentation

The financial statements in this Annual Report for periods

ending on or after the Distribution are presented on a con-

solidated basis and include the accounts of our company

and its majority-owned subsidiaries. The financial state-

ments for the periods presented prior to the Distribution

are presented on a combined basis and represent those

entities that were ultimately transferred to our company in

connection with the spin-off. All significant intercompany

accounts and transactions between our company’s seg-

ments have been eliminated. The historical consolidated

statements of income include expense allocations for cer-

tain corporate functions historically provided to Western

Union by First Data, including treasury, tax, accounting and

reporting, mergers and acquisitions, risk management,

legal, internal audit, procurement, human resources, inves-

tor relations and information technology. If possible, these

allocations were made on a specific identification basis.

Otherwise, the expenses related to services provided to

Western Union by First Data were allocated to Western

Union based on the relative percentages, as compared

to First Data’s other businesses, of headcount or other

appropriate methods depending on the nature of each

item of cost to be allocated. Pursuant to a transition ser-

vices agreement we entered into with First Data prior to

the spin-off, First Data provided Western Union with certain

of these services at prices agreed upon by First Data and

Western Union. The transition services agreement expired

on September 29, 2007. The costs historically allocated

to us by First Data for the services provided to us were

lower than the costs we have incurred and will continue

to incur following the spin-off.

17

Management’s

Discussion and

Analysis of Financial

Condition and

Results of Operations