Western Union 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

accumulated other comprehensive income or loss until

settlement (i.e. spot rate changes), the remaining por-

tion of changes in value are recognized in income as they

occur. The significant volatility in the fluctuation in foreign

currency forward rates compared to spot rates primarily

related to the euro has resulted in charges of $6.9 million

in the year ended December 31, 2008 compared to gains

of $8.3 million in 2007.

Prior to September 29, 2006, we did not have any

forward contracts that qualified as hedges, and therefore

the unrealized gains and losses on these contracts were

reflected within this line item in the consolidated state-

ments of income prior to that date. Our foreign currency

forward contracts that did not qualify as hedges under

applicable derivative accounting rules were held primarily

in the euro and British pound and had maturities of one

year or less. Since these instruments did not qualify for

hedge accounting treatment, there was resulting volatil-

ity in our net income for the periods presented prior to

September 29, 2006. On September 29, 2006, we estab-

lished our foreign currency forward positions to qualify

for cash flow hedge accounting.

Foreign exchange effect on notes receivable from

First Data, net

All euro denominated notes receivable with First Data, and

related foreign currency swap agreements were settled

in connection with the spin-off on September 29, 2006.

Accordingly, no amounts related to the revaluation of

such notes or related swaps were recorded during the

years ended December 31, 2008 and 2007, explaining

the decrease from the year ended December 31, 2006.

No such amounts will be recognized in future periods.

Prior to the spin-off, the revaluation to fair market value

of these euro denominated notes receivable from First

Data and the related foreign currency swap arrangements

benefited income before income taxes for the year ended

December 31, 2006 by $10.1 million due to changes in the

value of the euro compared to the United States dollar.

Interest income from First Data, net

Interest income from First Data, net consists of interest

income earned on notes receivable from First Data, par-

tially offset by interest incurred on notes payable to First

Data. All notes receivable and payable were settled in

connection with the spin-off on September 29, 2006, and

accordingly, no such amounts were recognized during the

years ended December 31, 2008 and 2007.

Other income, net

Changes in other income, net during the years ended

December 31, 2008 and 2007 compared to the previous

corresponding years were primarily attributable to fluctua-

tions in equity earnings from equity method investments.

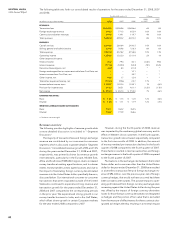

Income taxes

Our effective tax rates on pretax income were 25.8%, 29.9%

and 31.5% for the years ended December 31, 2008, 2007

and 2006, respectively. We continue to benefit from an

increasing proportion of profits being foreign-derived and

therefore taxed at lower rates than our combined federal

and state tax rates in the United States. In addition, the

decreasing effective tax rate in 2008 compared to 2007 is

also attributed to the implementation of foreign tax efficient

strategies consistent with our overall tax planning and the

favorable resolution of certain United States tax matters.

We have established contingency reserves for mate-

rial, known tax exposures, including potential tax audit

adjustments with respect to our international operations

restructured in 2003, whereby our income from certain

foreign-to-foreign money transfer transactions has been

taxed at relatively low foreign tax rates compared to our

combined federal and state tax rates in the United States.

As of December 31, 2008, the total amount of unrecog-

nized tax benefits is a liability of $397.0 million, includ-

ing accrued interest and penalties. Our reserves reflect

our judgment as to the resolution of the issues involved

if subject to judicial review. While we believe that our

reserves are adequate to cover reasonably expected tax

risks, there can be no assurance that, in all instances, an

issue raised by a tax authority will be resolved at a finan-

cial cost that does not exceed our related reserve. With

respect to these reserves, our income tax expense would

include (i) any changes in tax reserves arising from material

changes during the period in facts and circumstances (i.e.

new information) surrounding a tax issue, and (ii) any dif-

ference from our tax position as recorded in the financial

statements and the final resolution of a tax issue during

the period. Such resolution could materially increase or

decrease income tax expense in our consolidated financial

statements in future periods.

The United States Internal Revenue Service (“IRS”)

completed its examination of the United States federal

consolidated income tax returns of First Data for 2003

and 2004, of which we are a part, and issued a Notice of

Deficiency in December 2008. The Notice of Deficiency

alleges significant additional taxes, interest and penalties

owed with respect to a variety of adjustments involving us

and our subsidiaries, and we generally have responsibility

for taxes associated with these potential Western Union-

related adjustments under the tax allocation agreement

with First Data executed at the time of the spin-off. We

agree with a number of the adjustments in the Notice of

Deficiency; however, we do not agree with the Notice

of Deficiency regarding several substantial adjustments

representing total alleged additional tax and penalties

due of approximately $114 million. As of December 31,

2008, interest on the alleged amounts due for unagreed

adjustments would be approximately $23 million. A sub-

stantial part of the alleged amounts due for these unagreed

adjustments relates to our international restructuring, which

took effect in the fourth quarter 2003, and, accordingly,

the alleged amounts due related to such restructuring

largely are attributable to 2004. We expect to contest those

adjustments with which we do not agree with by filing a

petition in the United States Tax Court. We believe our

overall reserves are adequate, including those associated

with adjustments alleged in the Notice of Deficiency. If

the IRS’ position in the Notice of Deficiency is sustained,

our tax provision related to 2003 and later years would

materially increase.

23

Management’s

Discussion and

Analysis of Financial

Condition and

Results of Operations