Western Union 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

28

Operating income

2008 COMPARED TO 2007

Consumer-to-consumer operating income increased for

the year ended December 31, 2008 compared to 2007,

primarily driven by higher revenue and related profits

from increased transactions internationally and lower

stock-based compensation expenses. Of the $22.3 million

accelerated stock-based compensation vesting charge in

2007 taken in connection with the change in control of

First Data, that did not recur in 2008, $18.9 million was

allocated to this segment in 2007. During the year ended

December 31, 2008 compared to 2007, the operating

income increase was partially offset by revenue declines

in our United States businesses, and higher employee

compensation expenses. The ongoing shift in our business

mix reflecting stronger growth in our international busi-

ness, which carries lower profit margins than in our United

States originated business, also impacted consumer-

to-consumer operating income during the year ended

December 31, 2008. As described earlier in the revenues

overview and due to the same factors, operating income

growth for the consumer-to-consumer segment was lower

in the fourth quarter of 2008 than that experienced in the

previous nine months.

Consumer-to-consumer operating income margin also

increased during the year ended December 31, 2008

compared to 2007, primarily due to lower stock-based

compensation expense, as described above. This increase

was partially offset by revenue declines in our United

States businesses and the ongoing shift in our business

mix reflecting stronger growth in our international busi-

ness, which carries lower profit margins than in our United

Revenues

2008 COMPARED TO 2007

During the year ended December 31, 2008, overall revenue

was flat compared to the corresponding period in 2007, as

revenue growth in the Pago Fácil business was offset by a

decline in United States cash-based bill payment revenue.

The consumer-to-business segment, including the United

States electronic-based bill payments business which

experienced flat revenues year over year, was adversely

impacted in the last half of 2008 due to the weakening

economy in the United States. Some consumers who are

likely to use our services are having difficulty paying their

bills and are unable to obtain credit in any form, resulting

in us handling fewer bill payments.

States originated business as noted earlier. However, we

have been experiencing a convergence between interna-

tional operating profits margins and profit margins of our

United States originated businesses.

2007 COMPARED TO 2006

The consumer-to-consumer segment’s operating income

increased by 1% for the year ended December 31, 2007

compared to the corresponding period in 2006. This

increase was primarily driven by increased revenue in our

international business. Operating income during the year

ended December 31, 2007 was impacted by the ongoing

shift in our business mix reflecting stronger growth in our

international business, which carries lower profit margins

than in our United States originated businesses. However,

we have been experiencing a convergence between inter-

national operating profit margins and profit margins of our

United States originated businesses. Operating income

during the year ended December 31, 2007 was adversely

impacted by incremental public company expenses which

are incremental to both costs allocated by First Data prior

to the spin-off and presumed overhead allocations from

First Data had we remained part of First Data. Such incre-

mental public company expenses include salaries, benefits,

equipment, supplies and other costs incurred in connection

with operating as a separate public company. In addition,

we recognized an accelerated non-cash stock compensa-

tion charge of $22.3 million taken in connection with the

change in control of First Data, of which 85% was allocated

to the consumer-to-consumer segment.

2007 COMPARED TO 2006

Transaction growth of 62% and revenue growth of 13%

in the year ended December 31, 2007 compared to the

same period in 2006 primarily resulted from the acquisi-

tion of Pago Fácil and growth in electronic bill payments,

partially offset by slight declines in United States cash-

based bill payments.

In December 2006, we acquired the remaining 75%

interest in Pago Fácil. Prior to the acquisition, we held a

25% interest in Pago Fácil. This acquisition contributed

$67.7 million and $3.6 million in revenue for the years

ended December 31, 2007 and 2006, respectively, of which

28

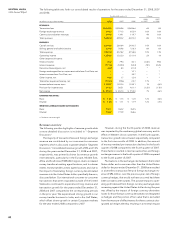

Consumer-to-Business Segment

The following table sets forth our consumer-to-business segment results of operations for the years ended December31,

2008, 2007 and 2006.

Years Ended December 31, % Change

2008 2007

(dollars and transactions in millions) 2008 2007 2006 vs.2007 vs.2006

REVENUES:

Transaction fees $668.1 $665.5 $593.7 — 12%

Other revenues 51.7 54.4 42.5 (5)% 28%

Total revenues $719.8 $719.9 $636.2 — 13%

Operating income $199.4 $223.7 $223.3 (11)% —

Operating margin 28% 31% 35%

KEY INDICATORS:

Consumer-to-business transactions 412.1 404.5 249.4 2% 62%