Western Union 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

1414

Competition

We face robust competition in the highly-fragmented

consumer-to-consumer money transfer industry. We com-

pete with a variety of money transfer service providers,

including:

º

GLOBAL MONEY TRANSFER PROVIDERS— Global money

transfer providers allow consumers to send money to

a wide variety of locations, in both their home coun-

tries and abroad.

º

REGIONAL MONEY TRANSFER PROVIDERS—Regional money

transfer providers, or “niche” players, provide the same

services as global money transfer providers, but focus

on a small group of corridors or services within one

region, such as North America to the Caribbean, Central

or South America, or Western Europe to North Africa.

º

BANKS—

Banks of all sizes compete with us in a number

of ways, including bank wire services and card-based

services. We believe that banks offer consumers wire

transfer services and other money transfer methods

as an incentive to those consumers to purchase other

services and products.

º

INFORMAL NETWORKS—

Informal networks enable people

to transfer funds without formal mechanisms, such as

receipts, and often without compliance with govern-

ment reporting requirements. We believe that such

networks comprise a significant share of the market.

º

ELECTRONIC COMMERCE— Online money transfer ser-

vices allowing consumers to send and receive money

electronically using the internet.

º

ALTERNATIVE CHANNELS—Alternative channels for send-

ing and receiving money include mail and commer-

cial courier services, money transfers using mobile

phones, and card-based options, such as ATM cards

and stored-value cards.

The most significant competitive factors in consumer-to-

consumer remittances relate to brand recognition, trust

and reliability, distribution network, consumer experience

and price.

For additional details regarding our consumer-to-

consumer segment, including financial information regard-

ing our international and United States operations, see

Management’s Discussion and Analysis of Financial

Condition and Results of Operations and our financial

statements and the notes to those statements included

elsewhere in this Annual Report.

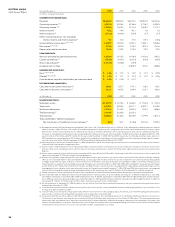

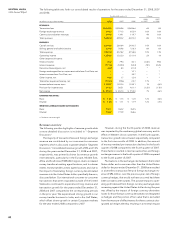

Consumer-to-Business Segment

We provide a portfolio of electronic and cash payment

options that provide consumers with fast and convenient

ways to make one-time or recurring payments to billers.

Revenues from this segment represented 14% of our

revenue in 2008.

Operations

Our revenue in this segment is derived primarily from trans-

action fees paid by the consumer or the biller. These fees

are typically less than the fees charged in our consumer-

to-consumer segment. In order to make an electronic

payment, the consumer or biller initiates a transaction

over the telephone or the internet which we process using

the consumer’s credit card, debit card or ACH. In order

to make a cash payment, the consumer goes to an agent

location and makes the payment to the agent. In addition,

we generate revenue from upfront enrollment fees received

for our Equity Accelerator service, and we earn investment

income on funds received from services sold in advance

of settlement with payment recipients. The segment’s

revenue was primarily generated in the United States for

all periods presented. No individual biller accounted for

greater than 10% of this segment’s revenue during all

periods presented.

Services

Our consumer-to-business services strive to give consum-

ers choices as to the payment channel and method of

payment, and include the following:

ELECTRONIC PAYMENTS. Consumers use our Speedpay

service principally in the United States to make payments

to a variety of billers using credit cards, debit cards and

ACH. Payments are initiated over the telephone or the

internet.

Our Equity Accelerator service is provided in the mort-

gage service industry, enabling consumers to make mort-

gage payments by ACH. It is marketed as a convenient

way for homeowners to schedule additional recurring

principal payments on their mortgages. Consumers who

enroll in this service make mortgage payments based on

an accelerated program, which results in interest savings

and a lower mortgage balance.

CASH PAYMENTS. Consumers use our Quick Collect ser-

vice to send funds to businesses and government agencies

across the United States and Canada, using cash and, in

certain locations, a debit card. This service is also offered

in other select international locations, and is referred to

as Quick Pay

SM

in those locations. We also offer Quick

Cash®, a cash disbursement service used by businesses

and government agencies to send money to employees

or individuals with whom they have accounts or other

business relationships.

Consumers use our Convenience Pay service to send

payments by cash or check from a smaller number of

Convenience Pay agent locations primarily to utilities and

telecommunication providers.

In addition, Pago Fácil provides a walk-in bill payment

service in Argentina under the Pago Fácil brand. In the

fourth quarter of 2008, Western Union began offering a

walk-in, cash bill payment service that will provide con-

sumers in Peru and Panama with a way to pay for services

such as mobile phone, utilities and other recurring bills.

Distribution and Marketing Channels

Our electronic payment services are available primarily

through the telephone and the internet, while our cash-

based services are available through our agent networks.

Billers market our services to consumers in a number of

ways, and we market our services directly to consumers

using a variety of means, including advertising mate-

rials and promotional activities at our agent locations.

Consumers can also participate in the Western Union

Gold Card program when using our Quick Collect service

to make cash payments to billers.