Western Union 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

6060

Statement of Income reflects charges incurred prior to

the Spin-off from First Data and its affiliates for these

services of $152.4 million for the year ended December 31,

2006. Included in these charges are amounts recognized

for stock-based compensation expense, as well as net

periodic benefit income associated with the Company’s

pension plans.

Included in “Interest income from First Data, net” in

the Consolidated Statement of Income for the year ended

December 31, 2006 was interest income of $37.4 million

earned on notes receivable from First Data subsidiaries

and interest expense of $1.7 million incurred on notes

payable to First Data which were settled in connection

with the Spin-off. Certain of the notes receivable were

euro denominated, and as such, the Company had related

foreign currency swap agreements to mitigate the foreign

exchange impact to the Company on such notes. Included

in “Foreign exchange effect on notes receivable from First

Data, net” in the Consolidated Statement of Income during

the year ended December 31, 2006 are foreign exchange

gains of $10.1 million from the revaluation of these euro

denominated notes receivable and related foreign cur-

rency swap agreements.

During the period from January 1, 2006 through

September 29, 2006, the Company recognized commis-

sion revenues from a First Data subsidiary in connection

with its money order business of $23.6 million. Subsequent

to the Spin-off, the Company continues to recognize com-

mission revenue from this First Data subsidiary.

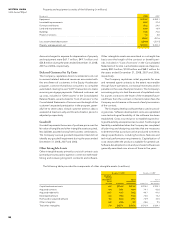

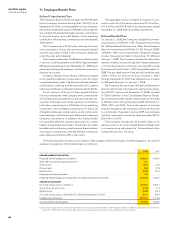

Other Related Party Transactions

The Company has ownership interests in certain of its

agents accounted for under the equity method of account-

ing. The Company pays these agents, as it does its other

agents, commissions for money transfer and other services

provided on the Company’s behalf. Commissions paid

to these agents for the years ended December 31, 2008,

2007 and 2006 totaled $305.9 million, $256.6 million

and $212.2 million, respectively. For those agents where

an ownership interest was acquired during the year, only

amounts paid subsequent to the investment date have

been reflected as a related party transaction.

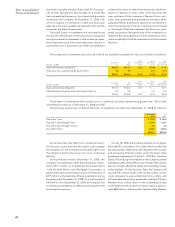

6. Commitments and Contingencies

In the normal course of business, Western Union is subject

to claims and litigation. Management of Western Union

believes such matters involving a reasonably possible

chance of loss will not, individually or in the aggregate,

result in a material adverse effect on Western Union’s

financial position, results of operations and cash flows.

Western Union accrues for loss contingencies as they

become probable and estimable.

On September 25, 2008, the Company was served

with a purported class action complaint alleging that

Western Union willfully and negligently violated the Fair

and Accurate Credit Transactions Act of 2003 (“FACTA”)

by providing debit and credit card expiration dates on

electronically printed receipts for transactions initiated

on the Company’s website. On November 12, 2008, the

Company received notification that the class action com-

plaint was voluntarily dismissed.

The Company has $77.0 million in outstanding letters

of credit and bank guarantees at December 31, 2008

with expiration dates through 2015, certain of which con-

tain a one-year renewal option. The letters of credit and

bank guarantees are primarily held in connection with

lease arrangements and certain agent agreements. The

Company expects to renew the letters of credit and bank

guarantees prior to expiration in most circumstances.

Pursuant to the separation and distribution agree-

ment with First Data in connection with the Spin-off (see

Note 1), First Data and the Company are each liable for,

and agreed to perform, all liabilities with respect to their

respective businesses. In addition, the separation and

distribution agreement also provides for cross-indemnities

principally designed to place financial responsibility for the

obligations and liabilities of the Company’s business with

the Company and financial responsibility for the obliga-

tions and liabilities of First Data’s retained businesses with

First Data. The Company also entered into a tax allocation

agreement that sets forth the rights and obligations of First

Data and the Company with respect to taxes imposed on

their respective businesses both prior to and after the

Spin-off as well as potential tax obligations for which the

Company may be liable in conjunction with the Spin-off

(see Note 10).

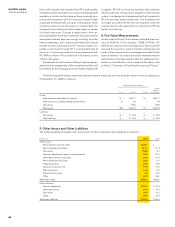

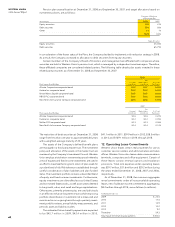

7. Investment Securities

Investment securities, classified within “Settlement assets”

in the Consolidated Balance Sheets, consist primarily

of high-quality state and municipal debt instruments.

Substantially all of the Company’s investment securities

were marketable securities during all periods presented.

The Company is required to maintain specific high-quality,

investment grade securities and such investments are

restricted to satisfy outstanding settlement obligations

in accordance with applicable state regulations. Western

Union does not hold financial instruments for trading pur-

poses. All investment securities are classified as available-

for-sale and recorded at fair value. Investment securities

are exposed to market risk due to changes in interest

rates and credit risk. Western Union regularly monitors

credit risk and attempts to mitigate its exposure by mak-

ing high-quality investments. At December 31, 2008, the

significant majority of the Company’s investment securities

had credit ratings of “AA-” or better from a major credit

rating agency.

Unrealized gains and losses on available-for-sale secu-

rities are excluded from earnings and presented as a

component of accumulated other comprehensive income

or loss, net of related deferred taxes. Proceeds from the

sale and maturity of available-for-sale securities during

the years ended December 31, 2008, 2007 and 2006

were $2,811.5 million, $177.7 million and $62.6 million,

respectively.

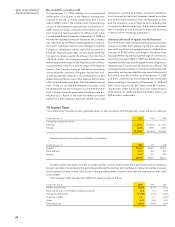

During 2008, the Company increased its investment

securities primarily through the addition of various state

and municipal variable rate demand note securities which

can be put (sold at par) typically on a daily basis with settle-

ment periods ranging from the same day to one week,

but that have maturity dates ranging from 2012 to 2046.

Generally, these securities are used by the Company for