Western Union 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6363

Notes to Consolidated

Financial Statements

Receivable for securities sold

On September 15, 2008, Western Union requested

redemption of its shares in the Reserve International

Liquidity Fund, Ltd., a money market fund, (the “Fund”)

totaling $298.1 million. The Company had not received any

portion of the redemption payment prior to December 31,

2008, and accordingly, reclassified the total amount due

from “Cash and cash equivalents” to “Other assets” in the

Consolidated Balance Sheet as of December 31, 2008. At

the time the redemption request was made, the Company

was informed by the Reserve Management Company,

the Fund’s investment advisor (the “Manager”), that the

Company’s redemption trades would be honored at a

$1.00 per share net asset value. On January 30, 2009, the

Company received a partial distribution from the Fund

of $193.6 million. The Company expects to receive the

remaining payment based on the maturities of the underly-

ing investments in the Fund and the status of the litigation

process. The Company believes that due to uncertainty

surrounding the outcome of litigation facing the Fund,

as well as potential variability in the ultimate amount and

related timing of the recovery of this balance, the fair value

of this financial asset may be less than the related carrying

value. There is a risk that the redemption process could

be delayed and that the Company could receive less than

the $1.00 per share net asset value should pro-rata dis-

tribution occur. Based on net asset information provided

by the Fund, the Company’s exposure related to pro-rata

distribution could be $12 million, excluding settlement

costs incurred by the Fund. However, based on written

and verbal representations from the Manager to date

and the Company’s current legal position regarding the

Company’s redemption priority, the Company believes

that it is entitled to such funds, and is vigorously pursuing

collection of the remaining distribution.

Amounts advanced to agents, net of discounts

From time to time, the Company makes advances and loans

to agents. In 2006, the Company signed a six year agree-

ment with one of its existing agents which included a four

year loan of $140.0 million to the agent. The terms of the

loan agreement require that a percentage of commissions

earned by the agent (64% in 2009) be withheld by us as

repayment of the loan and the agent remains obligated to

repay the loan if commissions earned are not sufficient. The

Company imputes interest on this below-market rate note

receivable, and has recorded the note net of a discount of

$3.0 million and $22.5 million as of December 31, 2008

and 2007, respectively. The remaining loan receivable

balance relating to this agent as of December 31, 2008 and

2007, net of discount, was $47.0 million and $67.5 million,

respectively. Other advances and loans outstanding as

of December 31, 2008 and 2007 were $22.3 million and

$25.6 million, respectively.

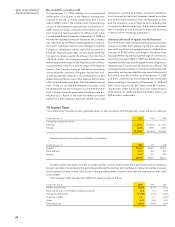

10. Income Taxes

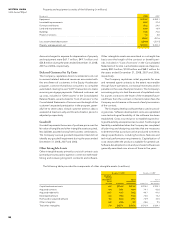

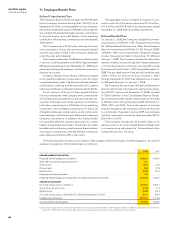

The components of pretax income, generally based on the jurisdiction of the legal entity, are as follows (in millions):

Year Ended December 31, 2008 2007 2006

Components of pretax income:

Domestic $ 416.3 $ 529.3 $ 707.1

Foreign 822.4 693.1 628.0

$1,238.7 $1,222.4 $1,335.1

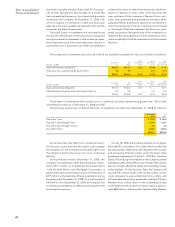

The provision for income taxes is as follows (in millions):

Year Ended December 31, 2008 2007 2006

Federal $234.8 $287.7 $331.1

State and local 30.3 26.3 34.5

Foreign 54.6 51.1 55.5

$319.7 $365.1 $421.1

Domestic taxes have been incurred on certain pre-tax income amounts that were generated by the Company’s

foreign operations. Accordingly, the percentage obtained by dividing the total federal, state and local tax provision

by the domestic pretax income, all as shown in the preceding tables, may be higher than the statutory tax rates in the

United States.

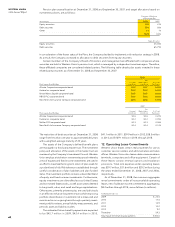

The Company’s effective tax rates differ from statutory rates as follows:

Year Ended December 31, 2008 2007 2006

Federal statutory rate 35.0% 35.0% 35.0%

State income taxes, net of federal income tax benefits 1.3% 1.7% 2.0%

Foreign rate differential (11.4)% (7.7)% (6.3)%

Federal tax credits —% —% (0.3)%

Other 0.9% 0.9% 1.1%

Effective tax rate 25.8% 29.9% 31.5%