Western Union 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

66

11. Employee Benefit Plans

Defined Contribution Plans

The Company’s Board of Directors approved The Western

Union Company Incentive Savings Plan (“401(k)”) as of

September 29, 2006, covering eligible non-union employ-

ees on the United States payroll of Western Union after the

spin-off date. Employees that make voluntary contributions

to this plan receive up to a 4% Western Union matching

contribution. All matching contributions are immediately

100% vested.

The Company has a 401(k) plan covering its former

union employees. Due to the restructuring and related

activities discussed in Note 3, the Company’s expenses

under this plan are immaterial.

The Company administers 16 defined contribution plans

in various countries globally on behalf of approximately

600 employee participants as of December 31, 2008. Such

plans have vesting and employer contribution provisions

that vary by country.

In addition, Western Union’s Board of Directors adopted

a non-qualified deferred compensation plan for highly

compensated employees. The plan provides tax-deferred

contributions, matching and the restoration of Company

matching contributions otherwise limited under the 401(k).

Prior to the spin-off from First Data, eligible full-time

non-union employees of the Company were covered under

a First Data sponsored defined contribution incentive sav-

ings plan. Employees who made voluntary contributions

to this plan, received up to a 3% Western Union matching

contribution, service related contributions of 1.5% to 3%

of eligible employee compensation, certain other addi-

tional employer contributions, and additional discretionary

Company contributions. In addition, First Data provided

non-qualified deferred compensation plans for certain

highly compensated employees. These plans provided

tax-deferred contributions, matching and the restoration

of Company contributions under the defined contribution

plans otherwise limited by IRS or plan limits.

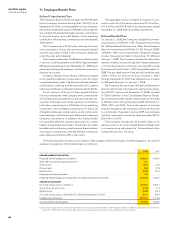

The aggregate amount charged to expense in con-

nection with all of the above plans was $12.5 million,

$11.6 million and $10.8 million during the years ended

December 31, 2008, 2007 and 2006, respectively.

Defined Benefit Plans

On January 1, 2008, the Company adopted the remain-

ing provisions of SFAS No. 158, “Employers Accounting

for Defined Benefit Pension and Other Postretirement

Plans—An Amendment of SFAS No. 87, 88, 106 and 132(R)”

(“SFAS No. 158”), which required the Company to change

its plan measurement date to December 31 effective

January 1, 2008. The Company elected the alternative

transition method, and accordingly, the Company prepared

a 15-month projection of net periodic benefit income

for the period from October 1, 2007 through December 31,

2008. The pro-rated portion of net periodic benefit income

of $0.1 million for the period from October 1, 2007

through December 31, 2007 was reflected as an increase

to “Retained earnings” on January 1, 2008.

The Company has two frozen defined benefit pension

plans for which it had a recorded unfunded pension obliga-

tion of $107.1 million as of December 31, 2008, included

in “Other liabilities” in the Consolidated Balance Sheets.

No contributions were made to these plans by First Data

or Western Union during the years ended December 31,

2008, 2007 and 2006. Due to the impact of recently

enacted legislation, the Company will not be required

to contribute to these plans during 2009, but estimates

it will be required to contribute approximately $20 to

$25 million in 2010.

The Company recognizes the funded status of its

pension plans in its Consolidated Balance Sheets with

a corresponding adjustment to “Accumulated other

comprehensive loss,” net of tax.

66

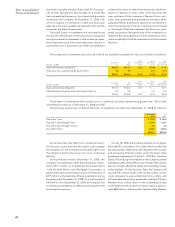

The following table provides a reconciliation of the changes in the pension plans’ benefit obligations, fair value of

assets and a statement of the funded status (in millions):

2008 2007

CHANGE IN BENEFIT OBLIGATION

Projected benefit obligation at October1, $ 426.0 $459.0

SFAS 158 measurement date adjustment (a) 6.1 —

Interest costs 24.4 24.6

Actuarial gain (5.6) (12.5)

Benefits paid (54.9) (45.1)

Employee termination benefits 2.8 —

Projected benefit obligation at December31, 2008 and September30, 2007 $ 398.8 $426.0

CHANGE IN PLAN ASSETS

Fair value of plan assets at October1, $ 398.4 $406.1

Actual return on plan assets (51.8) 37.4

Benefits paid (54.9) (45.1)

Fair value of plan assets at December31, 2008 and September30, 2007 291.7 398.4

Funded status of the plan $(107.1) $ (27.6)

Accumulated benefit obligation $ 398.8 $426.0

(a) Represents the adjustment to retained earnings of $0.1 million for the period from October1, 2007 through December31, 2007. This adjustment consists of interest

costs of $6.1 million, offset by $6.2 million which represents the expected return on plan assets less amortization of the actuarial loss.