Western Union 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

3030

top-up businesses, which were shut down or disposed of

in early 2006. Revenue remained relatively constant for the

year ended December 31, 2007, due to moderate growth

in our money order and prepaid services businesses, offset

by the loss of revenue from our shut-down or disposed

of businesses, which generated revenue for a portion of

2006, while neither business generated revenue in 2007.

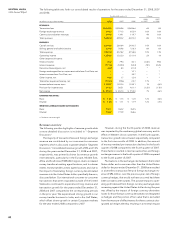

Operating Income

2008 COMPARED TO 2007

For the year ended December 31, 2008, the decrease in

operating income was driven by operating income declines

related to our money order business, costs incurred to

develop mobile money transfer services and our prepaid

business within the United States, offset by increased

revenue and related profits from our prepaid services

business outside of the United States.

2007 COMPARED TO 2006

For the year ended December 31, 2007, the increase in

operating income was driven by modest growth from our

prepaid services.

Further financial information relating to each of our

segments’ external revenue, operating profit measures

and total assets is set forth in Note 17 to our consolidated

financial statements.

Capital Resources and Liquidity

Our primary source of liquidity has been cash generated

from our operating activities, derived primarily from net

income, and fluctuations in working capital. Our work-

ing capital is affected by the timing of interest payments

on our outstanding borrowings, timing of income tax

payments, and collections on receivables, among other

items. The majority of our interest payments are due in

the second and fourth quarters which results in a decrease

in the amount of cash provided by operating activities in

those quarters, and a corresponding increase to the first

and third quarters.

Our future cash flows generated from operating activi-

ties could be impacted by a variety of factors, some of

which are out of our control, including changes in eco-

nomic conditions, especially those impacting the migrant

population, and changes in income tax laws or the status

of income tax audits.

A significant portion of our cash flows from operating

activities has been generated from subsidiaries, some

of which are regulated entities. These subsidiaries may

transfer all excess cash to the parent company for gen-

eral corporate use, except for assets subject to legal or

regulatory restrictions. Such assets include those located

in countries outside of the United States containing restric-

tions from being transferred outside of those countries

and cash and investment balances that are maintained by

our regulated subsidiary to secure certain money transfer

obligations initiated in the United States in accordance

with applicable state regulations in the United States.

Significant changes in the regulatory environment

for money transmitters could impact our primary source

of liquidity.

On December 5, 2008, we entered into a senior,

unsecured, 364-day term loan in an aggregate principal

amount of $500 million (the “Term Loan”) with a syndicate

of lenders. The Term Loan was used for general corporate

purposes, including the repayment of commercial paper

utilized to retire $500 million of floating rate notes that

came due on November 17, 2008. As market conditions

allow, we intend to refinance our Term Loan in 2009 with

new financing sources. Based on market conditions at

the time such re-financing occurs, we may not be able to

obtain new financing under similar conditions as histori-

cally reported.

Taking into account our projected share repurchases,

dividends, our pending acquisition, capital expenditures,

and debt service during 2009, we believe our cash flows

generated from operating activities and available financ-

ing sources will provide us with an adequate source of

liquidity to meet the needs of our business.

Cash and Investment Securities

As of December 31, 2008, we have cash and cash equiva-

lents of $1.3 billion. Our foreign entities held $597.9 million

of our cash and cash equivalents at December 31, 2008.

Our ongoing cash management strategies to fund our

business needs could cause United States and foreign

cash balances to fluctuate.

Repatriating foreign funds to the United States would,

in many cases, result in significant tax obligations because

most of these funds have been taxed at relatively low

foreign tax rates compared to our combined federal and

state tax rate in the United States. We expect to use foreign

funds to expand and fund our international operations

and to acquire businesses internationally.

On September 15, 2008, we requested redemption

of our shares in the Reserve International Liquidity Fund,

Ltd. (the “Fund”), a money market fund, totaling $298.1

million. We did not receive any portion of the redemption

payment prior to December 31, 2008, and accordingly,

we have reclassified the total amount due from “Cash and

cash equivalents” to “Other assets” in the consolidated

balance sheet as of December 31, 2008. This surplus cash

was not required or used for daily operations. At the time

the redemption request was made, we were informed by

the Reserve Management Company, the Fund’s invest-

ment advisor (the “Manager”), that our redemption trades

would be honored at a $1.00 per share net asset value.

On January 30, 2009, we received a partial distribution

from the Fund of $193.6 million. We expect to receive

the remaining redemption amount based on written and

verbal representations from the Manager to date and our

current legal position regarding our redemption priority.

We expect to receive the remaining payment based on

the maturities of the underlying investments in the Fund

and the outcome of the litigation process. There is a risk

the redemption process could be delayed and that we

could receive less than the $1.00 per share net asset value,

should a pro-rata distribution occur. Based on net asset

information provided by the Fund, our exposure related

to pro-rata distribution could be $12 million, excluding

settlement costs incurred by the Fund. We believe that,