Western Union 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

6262

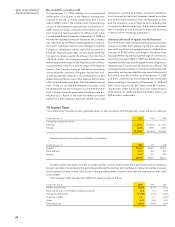

Union will invest the cash received from IPS in high-quality,

investment grade securities in accordance with applicable

regulations, which are the same as those currently gov-

erning the investment of the Company’s United States

originated money transfer principal. In anticipation of the

Company’s exposure to fluctuations in interest rates, the

Company has entered into interest rate swaps on certain

of its fixed rate notes. Through a combination of the rev-

enue generated from these investment securities and the

anticipated interest expense savings resulting from the

interest rate swaps, the Company estimates that it should

be able to retain subsequent to the Transition Date, on a

pretax income basis through 2011, a comparable rate of

return as it is receiving under its current agreement with

IPS. Refer to Note 14 for additional information on the

interest rate swaps.

Subsequent to the Transition Date, all revenue gener-

ated from the management of the investment portfolio will

be retained by the Company and none will be shared with

its agents. IPS will continue to provide to the Company

clearing services necessary for payment of the money

orders in exchange for the payment by the Company to

IPS of a per-item administrative fee. The Company will

no longer provide to IPS the services required under the

original money order agreement or receive from IPS the

fee for such services.

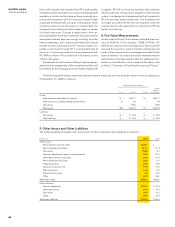

8. Fair Value Measurements

As discussed in Note 2, the Company adopted the provi-

sions of SFAS No. 157 on January 1, 2008. SFAS No. 157

defines fair value as the exchange price that would be

received for an asset or paid to transfer a liability (an exit

price) in the principal or most advantageous market for the

asset or liability in an orderly transaction between market

participants on the measurement date. For additional infor-

mation on how Western Union measures fair value, refer

to Note 2, “Summary of Significant Accounting Policies.”

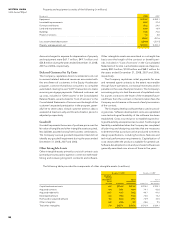

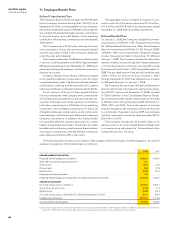

The following table reflects assets and liabilities that are measured and carried at fair value on a recurring basis as

of December 31, 2008 (in millions):

Fair Value Measurement Using

Assets/

Liabilities

Level1 Level2 Level3 at Fair Value

Assets

State and municipal debt instruments $ — $401.7 $ — $401.7

Debt securities issued by foreign governments 0.1 3.8 — 3.9

Derivatives — 116.8 — 116.8

Total assets $0.1 $522.3 $ — $522.4

Liabilities

Derivatives $ — $ 10.8 $ — $ 10.8

Total liabilities $ — $ 10.8 $ — $ 10.8

9. Other Assets and Other Liabilities

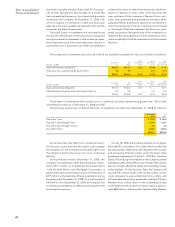

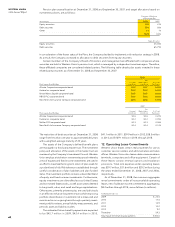

The following table summarizes the components of other assets and other liabilities (in millions):

December 31, 2008 2007

Other assets:

Receivable for securities sold $298.1 $ —

Equity method investments 213.1 211.3

Derivatives 116.8 8.1

Amounts advanced to agents, net of discounts 69.3 93.1

Deferred customer set up costs 34.6 41.9

Receivables from First Data 26.3 9.1

Prepaid expenses 20.6 19.8

Accounts receivable, net 19.8 22.5

Debt issue costs 14.0 13.5

Prepaid commissions 3.0 22.5

Other 42.5 56.2

Total other assets $858.1 $498.0

Other liabilities:

Pension obligations $107.1 $ 27.6

Deferred revenue 59.4 74.2

Derivatives 10.8 37.2

Other 20.7 43.9

Total other liabilities $198.0 $182.9