Western Union 2008 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

to overall earnings per share. Transactions in the euro,

which represent the majority of the Company’s foreign

currency denominated business, benefited revenue by

$82 million and operating income by $19 million during

the year. The benefit in the first three quarters of 2008

was slightly offset by the negative impact to consumer-to-

consumer transaction fee and foreign exchange revenue

in the fourth quarter of 2008 due to the strengthening of

the United States dollar relative to certain other currencies,

including the euro. However, the impact to our operating

income was positive to the fourth quarter of 2008 due

to our derivative hedges. If exchange rates between the

United States dollar and other currencies remain constant

with those experienced at the end of 2008, or if other cur-

rencies continue to weaken against the United States dol-

lar, we expect a negative impact on our revenue in 2009.

However, the impact to earnings per share is expected to

be less due to the impact of translation on our expenses

and our hedging program.

The fluctuation in the exchange rate between the

euro and the United States dollar (which contributed to

the majority of the impact of translating foreign currency

denominated revenues and expenses into United States

dollars) for the year ended December 31, 2007 resulted

in a benefit to consumer-to-consumer transaction fee and

foreign exchange revenue of $79 million, over the previous

year, net of foreign currency hedges, that would not have

occurred had there been a constant exchange rate. For

the year ended December 31, 2007 the related benefit

to operating income was $12 million.

Our Asia Pacific (“APAC”) region also experienced

strong transaction and revenue growth during the years

ended December 31, 2008 and 2007 compared to the cor-

responding previous periods, including growth contributed

by the inbound market of the Philippines. Revenue growth

slowed in APAC during the fourth quarter 2008 compared

to the same period in 2007, in part due to the weakening

global economy described previously and the decline in

high revenue transactions from small entrepreneurs that

typically make purchases in China.

Within our Americas region (which includes North

America, Latin America, the Caribbean, and South

America), our United States to Mexico, United States out-

bound and transactions in our domestic (between and

within the United States and Canada) businesses continued

to be impacted by the overall weakening in the United

States economy. The immigration debate and market

softness, in part due to the slowdown in the construction

industry, began adversely impacting the United States

businesses in the second quarter of 2006. We responded

to these factors by launching distribution, pricing, advertis-

ing, promotion and community outreach initiatives in 2006

and 2007. Although the United States businesses revenue

decline experienced in 2008 moderated compared with

2007, we experienced increased revenue declines in the

fourth quarter of 2008 compared to the third quarter of

2008, due to the weakening in the United States economy.

Foreign exchange revenue increased for the years

ended December 31, 2008 and 2007 over the correspond-

ing previous periods, due to an increase in cross-currency

transactions primarily as a result of growth in international

consumer-to-consumer transactions. As described above,

foreign exchange revenue also benefited during the year

ended December 31, 2008 compared to 2007 from the

strengthening of other currencies most notably the euro,

against the United States dollar.

We have historically implemented and will likely imple-

ment future strategic fee reductions and actions to reduce

foreign exchange spreads, where appropriate, taking into

account growth opportunities and competitive factors.

Fee decreases and foreign exchange actions generally

reduce margins, but are done in anticipation that they will

result in increased transaction volumes and increased rev-

enues over time. Such fee decreases and foreign exchange

actions have impacted our annual consolidated revenue

on average approximately 3% during 2006 and 2007 and

approximately 1% in 2008.

Pago Fácil, which was acquired in December 2006, con-

tributed $67.7 million and $3.6 million of revenue for the

years ended December 31, 2007 and 2006, respectively,

and also contributed to consolidated revenue growth in

2007 compared to 2006.

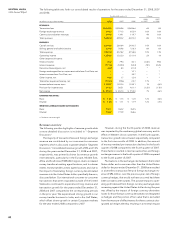

Operating expenses overview

The following factors impacted both cost of services and

selling, general and administrative expenses during the

periods presented:

º

RESTRUCTURING AND REL ATED ACTIVITIES—In 2008, we

incurred restructuring and related expenses in conjunc-

tion with the decision to close our facilities in Missouri

and Texas, including the elimination of approximately

650 positions held by union employees and certain

management positions in these same facilities, as well

as other reorganizations. The $82.9 million of expenses

incurred in 2008 were offset by operating expense

savings of approximately $10 million in 2008 and are

expected to be offset by approximately $40 million

annually beginning in 2009.

º

2007 STOCK COMPENSATION CHARGE—

At the time of the

spin-off, First Data converted stock options, restricted

stock awards, and restricted stock units (collectively,

“stock-based awards”) of First Data stock held by

Western Union and First Data employees. Both Western

Union and First Data employees received converted

Western Union stock-based awards. All converted

stock-based awards, which had not vested prior to

September 24, 2007, were subject to the terms and

conditions applicable to the original First Data stock-

based awards, including change of control provisions

which require full vesting upon a change of control of

First Data. Accordingly, upon the completion of the

acquisition of First Data on September 24, 2007 by

an affiliate of KKR, all of these remaining converted

unvested Western Union stock-based awards vested.

In connection with this accelerated vesting, we incurred

a non-cash pretax charge of $22.3 million during the

third quarter of 2007. Approximately one-third of this

charge was recorded within “cost of services” and

two-thirds was recorded within “selling, general and

administrative expenses” in the consolidated state-

ments of income.

21

Management’s

Discussion and

Analysis of Financial

Condition and

Results of Operations