Western Union 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WESTERN UNION

2008 Annual Report

5050

1. Formation of the Entity and Basis of

Presentation

The Western Union Company (“Western Union” or the

“Company”) is a leader in global money transfer, provid-

ing people with fast, reliable and convenient ways to send

money around the world. The Western Union® brand is

globally recognized. The Company’s services are available

through a network of agent locations in more than 200

countries and territories. Each location in the Company’s

agent network is capable of providing one or more of the

Company’s services.

The Western Union business consists of the following

segments:

º

CONSUMER-TO-CONSUMER—money transfer services

between consumers, primarily through a global net-

work of third-party agents using the Company’s multi-

currency, real-time money transfer processing systems.

This service is available for international cross-border

transfers—that is, the transfer of funds from one coun-

try to another—and, in certain countries, intra-country

transfers—that is, money transfers from one location to

another in the same country.

ºCONSUMER-TO-BUSINESS—the processing of payments

from consumers to businesses and other organizations

that receive consumer payments, including utilities,

auto finance companies, mortgage servicers, financial

service providers and government agencies, referred

to as “billers,” through Western Union’s network of

third-party agents and various electronic channels.

The segment’s revenue was primarily generated in the

United States during all periods presented.

All businesses that have not been classified into the con-

sumer-to-consumer or consumer-to-business segments are

reported as “Other” and include the Company’s money

order and prepaid services businesses. The Company’s

money orders are issued by Integrated Payment Systems

Inc. (“IPS”), a subsidiary of First Data Corporation (“First

Data”), to consumers at retail locations primarily in the

United States and Canada. See Note 7, “Investment

Securities” for discussion regarding the agreement exe-

cuted between the Company and IPS on July 18, 2008

whereby the Company will assume the responsibility for

issuing money orders effective October 1, 2009. Western

Union also markets a Western Union branded prepaid

MasterCard® card, a Western Union branded prepaid

Visa® card, and provides top-up services for third parties

that allow consumers to pay in advance for mobile phone

and other services.

There are legal or regulatory limitations on transferring

certain assets of the Company outside of the countries

where these assets are located, or which constitute undis-

tributed earnings of affiliates of the Company accounted

for under the equity method of accounting. However, there

are generally no limitations on the use of these assets

within those countries. As of December 31, 2008, the

amount of net assets subject to these limitations totaled

approximately $193 million.

Various aspects of the Company’s services and busi-

nesses are subject to United States federal, state and local

regulation, as well as regulation by foreign jurisdictions,

including certain banking and other financial services

regulations.

Spin-off from First Data

On January 26, 2006, the First Data Board of Directors

announced its intention to pursue the distribution of 100%

of its money transfer and consumer payments businesses

and its interest in a Western Union money transfer agent,

as well as related assets, including real estate, through

a tax-free distribution to First Data shareholders (the

“Separation” or “Spin-off”). Effective on September 29,

2006, First Data completed the separation and the distri-

bution of these businesses by distributing The Western

Union Company common stock to First Data shareholders

(the “Distribution”). Prior to the Distribution, the Company

had been a segment of First Data.

In connection with the Spin-off, the Company reported

a $4.1 billion dividend to First Data in the accompanying

consolidated statements of stockholders’ (deficiency)/

equity/net investment in The Western Union Company,

consisting of the issuance of $3.4 billion in debt and a

cash payment to First Data of $100.0 million. The remain-

ing dividend was comprised of cash, consideration for

an ownership interest held by a First Data subsidiary in a

Western Union agent which had already been reflected

as part of the Company, settlement of net intercompany

receivables (exclusive of certain intercompany notes as

described in the following paragraph), and transfers of

certain liabilities, net of assets. Since the amount of the

dividend exceeded the historical cost of the Company’s

net assets at the time of the Spin-off, a capital deficiency

resulted.

The Company also settled certain intercompany notes

receivable and payable with First Data along with related

interest and currency swap agreements associated with

such notes as part of the Spin-off. The net settlement of

the principal and related swaps resulted in a net cash

inflow of $724.0 million to the Company’s cash flows from

financing activities. The net settlement of interest on such

notes receivable and payable of $40.7 million was reflected

in cash flows from operating activities in the Company’s

Consolidated Statement of Cash Flows.

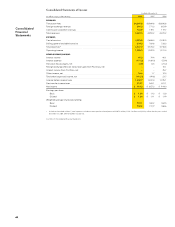

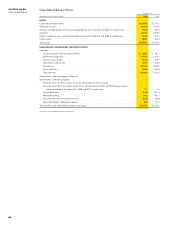

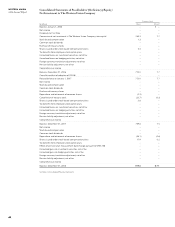

Notes to

Consolidated

Financial

Statements