Western Union 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WESTERN UNION

2008 Annual Report

24

Earnings per share

During the years ended December 31, 2008, 2007 and

2006, basic earnings per share were $1.26, $1.13 and

$1.20, respectively, and diluted earnings per share were

$1.24, $1.11 and $1.19, respectively. All issued and out-

standing shares of Western Union common stock until the

spin-off on September 29, 2006, consisting of 100 shares,

were held by First Data. Accordingly, for all periods pre-

sented prior to the spin-off date of September 29, 2006,

basic and diluted earnings per share were computed

using our basic shares outstanding as of the spin-off date.

Unvested shares of restricted stock are excluded from

basic shares outstanding. Diluted earnings per share

reflects the potential dilution that could occur if outstanding

stock options on the presented dates are exercised and

shares of restricted stock have vested. As of December 31,

2008, 2007 and 2006, there were 8.0 million, 10.4 million

and 4.9 million, respectively, of outstanding options to

purchase shares of Western Union stock excluded from the

diluted earnings per share calculation under the treasury

stock method as their effect is anti-dilutive. The treasury

stock method assumes proceeds from the exercise price

of stock options, the unamortized compensation expense

and assumed tax benefits of options and restricted stock

are available to acquire shares at an average price through-

out the year, and therefore, reduce the dilutive effect

throughout the year. Of the 43.6 million, 59.4 million and

73.8 million outstanding options to purchase shares of

our common stock as of December 31, 2008, 2007 and

2006, respectively, approximately 47%, 58% and 60%,

respectively, are held by employees of First Data.

Diluted earnings per share increased during the year

ended December 31, 2008 compared to 2007 due to

the increased net income as a result of the previously

described factors and lower weighted-average diluted

shares outstanding. The lower number of diluted shares

outstanding was driven by stock repurchases exceeding

stock option exercises in 2008 compared to 2007.

Diluted earnings per share decreased during the year

ended December 31, 2007 compared to the previous

period due to the decrease in net income as a result of the

previously described factors and the increase in diluted

shares outstanding. Prior to the September 29, 2006

spin-off date, there were no potentially dilutive instruments

outstanding and, accordingly, the potentially dilutive shares

arising in connection with the spin-off had minimal impact

to 2006 due to the impact of weighting. In 2007, the dilu-

tive shares outstanding were outstanding for a full year.

Segment Discussion

We manage our business around the consumers we serve

and the types of services we offer. Each of our two seg-

ments addresses a different combination of consumer

groups, distribution networks and services offered. Our

segments are consumer-to-consumer and consumer-to-

business, as described earlier. Businesses not considered

part of these segments are categorized as “Other.”

The business segment measurements provided to, and

evaluated by, our CODM are computed in accordance

with the following principles:

º

The accounting policies of the reporting segments

are the same as those described in the summary of

significant accounting policies.

º

Corporate and other overhead is allocated to the seg-

ments primarily based on a percentage of the seg-

ments’ revenue.

º

Expenses incurred in connection with the development

of certain new service offerings, including costs to

develop mobile money transfer services, new prepaid

service offerings and non-recurring costs incurred to

effect the spin-off are included in “Other.”

º

Restructuring and related activities of $82.9 million

for the year ended December 31, 2008 have not been

allocated to the segments. While these items are iden-

tifiable to our segments, they are not included in the

measurement of segment operating profit provided to

the CODM for purposes of assessing segment perfor-

mance and decision making with respect to resource

allocation. For additional information on restructuring

and related activities refer to “Operating expenses

overview.”

º

All items not included in operating income are

excluded.

24

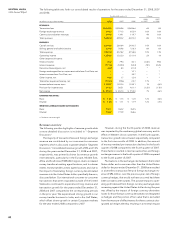

The following table sets forth the components of segment revenues as a percentage of the consolidated totals for the

years ended December31, 2008, 2007 and 2006.

Years Ended December 31, 2008 2007 2006

Consumer-to-consumer (a)

EMEASA 44% 40% 38%

Americas 34% 37% 41%

APAC 7% 6% 5%

Total Consumer-to-consumer 85% 83% 84%

Consumer-to-business 14% 15% 14%

Other 1% 2% 2%

Total 100% 100% 100%

(a) The geographic split is determined based upon the region where the money transfer is initiated and the region where the money transfer is paid. For transactions origi-

nated and paid in different regions, we split the revenue between the two regions, with each region receiving 50%. For money transfers initiated and paid in the same

region, 100% of the revenue is attributed to that region.