Western Union 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Pan African money transfer opportunity, and I am very excited about the potential in South Africa.

We also had several competitive takeaways during the year, including Bank Pekao with 900 locations

in Poland, The Vietnam Post which has nearly 3,000 locations, and Bank Danamon a leading

Indonesian Bank. The decisions by these new agents to work with Western Union are a clear

dem onstration of the value and service proposition we offer. Importantly, we also re-signed

a notable number of existing agents including the Banco do Brazil, the State Bank of India, Ahold,

two of our largest U.S. check cashers PLS Check Cashers and Multi-State Financial Services,

and A&P, among others.

We understand the importance of continuing to deliver strong operating margins. We took

significant steps in 2008 to ensure that we have a cost structure that will allow for operating

leverage as revenue reaccelerates. We completed a global organizational realignment of our

C2C business that streamlines our operations into two regional structures down from three.

By streamlining our management structure, consolidating sales forces and reducing operating costs,

we are closer to the market and able to operate in a more profitable and more nimble manner.

Additionally, we improved our cost structure by relocating, outsourcing and/or consol-

idating certain operations. The expansion of our Global Service Centers in Costa Rica and the

Philippines has helped create efficiencies in the business by consolidating the back office services.

These important steps, together with our focus on lowering the cost of distribution,

are designed to make our model even more scalable.

m a r ke t p lace d y na mi c s : r esi l ie n c e o f r e mi t ta nc e s

Global migration patterns and remittance flows are drivers of our long-term growth. According to

the Migration and Development Brief published by the World Bank in November 2008, remittances

have historically been resilient to downturns, as they are sent by the cumulated flows of migrants

from previous years, not only by new migrants. Though remittance flows are projected to decline

in 2009, the World Bank expects remittances to developing countries to grow up to 6% in 2010.

These dynamics are important to our consumer-to-consumer business. There are an

estimated 200 million cross-border migrants and we estimate that there are even more people who

have migrated within a country(2)

. We believe this mobile workforce will continue seeking employment

opportunities throughout the world. This population will not only need to transfer cash home,

but they will ultimately need other services. Western Union is very well positioned to service the

existing and expanding needs of our consumers.

Our mobile money transfer initiative, an emerging and longer-term market opportunity

that enables customers to send cross-border remittances directly from their mobile phones or to

other mobile phones, continues to make progress. Western Union most recently formed an alliance

with Vodafone, the world’s leading international mobile communications group. This partnership

adds to the relationships we already have with Orascom Telecom, Globe Telecom, Smart

Communications and the GSM Association. We believe we are well positioned to succeed over

the next three to five years as consumer acceptance of mobile money transfers emerges and the

technology standardizes.

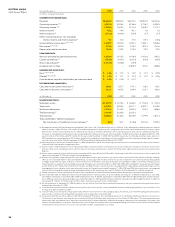

Western Union

Estimated Share

of Cross-Border

Remittance Market(1)

06 07 08

14.0%

15.5%

16.7%