Western Union 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6161

Notes to Consolidated

Financial Statements

short-term liquidity needs and are held for short peri-

ods of time, typically less than 30 days. As a result, this

has increased the frequency of purchases and proceeds

received by the Company. At December 31, 2008, 53%

of the Company’s investments in state and municipal

debt securities were variable rate demand notes and the

remainder are fixed rate securities.

Gains and losses on investments are calculated using

the specific-identification method and are recognized

during the period the investment is sold or when an invest-

ment experiences an other-than-temporary decline in

value below cost or amortized cost. When an investment

is deemed to have an other-than-temporary decline in

value it is reduced to its fair value, which becomes the

new cost basis of the investment. Western Union con-

siders both qualitative and quantitative indicators when

judging whether a decline in value of an investment is

other-than-temporary in nature, including, but not limited

to, the length of time the investment has been in an unre-

alized loss position, the significance of the unrealized loss

relative to the carrying amount of the investment and our

intent and ability to hold the investment until a forecasted

recovery.

Actual maturities may differ from contractual maturi-

ties because issuers may have the right to call or prepay

the obligations or the Company may have the right to put

the obligation back to the issuer prior to its contractual

maturity.

During the year ended December 31, 2008, the

Company recognized an other-than-temporary impair-

ment of $1.7 million on its preferred stock investments

in the Federal Home Loan Mortgage Corporation, a

government sponsored enterprise, and a realized loss of

$2.9 million on the later sale of these investments during

the year ended December 31, 2008, for a total impact of

$4.6 million. As of December 31, 2008, the Company has

no remaining investments in preferred stock of government

sponsored enterprises.

On July 18, 2008, the Company entered into an agree-

ment with IPS, a subsidiary of First Data, which modified the

existing business relationship with respect to the issuance

and processing of money orders. Under the terms of the

agreement, beginning on October 1, 2009 (the “Transition

Date”), IPS will assign and transfer to the Company certain

operating assets used by IPS to issue money orders and an

amount of cash sufficient to satisfy all outstanding money

order liabilities. On the Transition Date, the Company will

assume IPS’s role as issuer of the money orders, includ-

ing its obligation to pay outstanding money orders, and

will terminate the existing agreement whereby IPS pays

Western Union a fixed return on the outstanding money

order balances (which vary from day to day but approxi-

mate $800 million). Following the Transition Date, Western

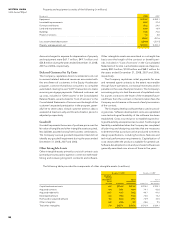

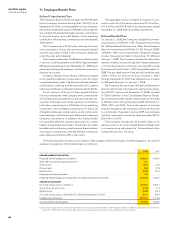

The components of investment securities, all of which are classified as available-for-sale, are as follows (in millions):

Gross Gross Net

Amortized Fair Unrealized Unrealized Unrealized

December 31, 2008 Cost Value Gains Losses Gains/(Losses)

State and municipal obligations $400.1 $401.7 $2.5 $(0.9) $ 1.6

Debt securities issued by foreign governments 4.0 3.9 — (0.1) (0.1)

$404.1 $405.6 $2.5 $(1.0) $ 1.5

Gross Gross Net

Amortized Fair Unrealized Unrealized Unrealized

December 31, 2007 Cost Value Gains Losses Gains/(Losses)

State and municipal obligations $187.3 $188.0 $0.7 $ — $ 0.7

Preferred stock of a government sponsored enterprise 6.9 5.8 — (1.1) (1.1)

$194.2 $193.8 $0.7 $(1.1) $(0.4)

There were no investments with a single issuer or individual securities representing greater than 10% of total

investment securities as of December31, 2008 and 2007.

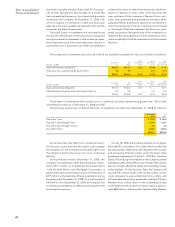

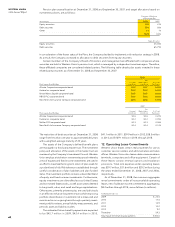

The following summarizes contractual maturities of investment securities as of December31, 2008 (in millions):

Amortized Fair

Cost Value

Due within 1 year $ 45.9 $ 46.2

Due after 1 year through 5 years 127.8 128.7

Due after 5 years through 10 years 2.4 2.5

Due after 10 years 228.0 228.2

$404.1 $405.6