Western Union 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78

WESTERN UNION 2007 Annual Report

The assumptions used to calculate the fair value of options

granted will be evaluated and revised, as necessary, to refl ect

market conditions and the Company’s historical experience and

future expectations. The calculated fair value is recognized as

compensation cost in the Company’s fi nancial statements over

the requisite service period of the entire award. Compensation

cost is recognized only for those options expected to vest, with

forfeitures estimated at the date of grant and evaluated and

adjusted periodically to refl ect the Company’s historical experi-

ence and future expectations. Any change in the forfeiture

assumption will be accounted for as a change in estimate, with

the cumulative effect of the change on periods previously reported

being refl ected in the fi nancial statements of the period in which

the change is made. In the future, as more historical data is avail-

able to calculate the volatility of Western Union stock and the

actual terms Western Union employees hold options, expected

volatility and expected term may change which could substantially

change the grant-date fair value of future stock option awards

and, ultimately, the recorded compensation expense.

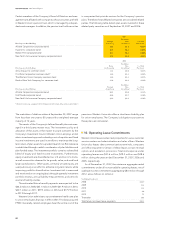

||

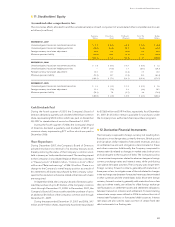

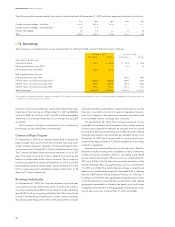

15. Segments

The Company classifi es its businesses into two reportable seg-

ments: consumer-to-consumer and consumer-to-business.

Operating segments are defi ned by SFAS No. 131, “Disclosures

About Segments of an Enterprise and Related Information,” as

components of an enterprise about which separate fi nancial

information is available that is evaluated regularly by the chief

operating decision maker (“CODM”) in deciding where to allocate

resources and in assessing performance.

||

The consumer-to-consumer reporting segment provides

money transfer services between consumers, primarily through

a global network of third-party agents using our multi-currency,

real-time money transfer processing systems.

|| The consumer-to-business reporting segment provides

payments from consumers to billers through a network of

third-party agents and other various electronic channels,

including the telephone and the internet. The segment’s

revenue was primarily generated in the United States for all

periods presented.

The consumer-to-consumer reporting segment is viewed as one

global network where a money transfer can be sent from one

location to another, anywhere in the world. The segment is man-

aged as four regions, primarily to coordinate agent network

management and marketing activities. The Company’s CODM

makes decisions regarding resource allocation and monitors

performance based on specifi c corridors within and across these

regions, but also reviews total revenue and operating profi t of

each region. Each region and corridor offer the same services

distributed by the same agent network, have the same types

of customers, are subject to similar regulatory requirements,

are processed on the same system, and have similar economic

characteristics, allowing the geographic regions to be aggregated

into one reporting segment. Consumer-to-consumer segment

revenue typically increases sequentially from the fi rst quarter

to the fourth quarter each year and declines from the fourth

quarter to the fi rst quarter of the following year. This seasonal

fl uctuation is related to the holiday season in various countries

in the fourth quarter.

All businesses that have not been classifi ed into consumer-

to-consumer or consumer-to-business, primarily the Company’s

money order and prepaid services businesses, and certain

expenses incurred in connection with the Spin-off are reported

as “Other.” The Company previously operated internet auction

payments, messaging and international prepaid cellular top-up

businesses. These three businesses represented aggregated

revenues in 2006 and 2005 of $4.1 million and $28.9 million,

respectively. Aggregate operating income related to the shut

down or disposed of businesses, including a gain on the sale of

assets related to our internet auction payments business, for the

year ended December 31, 2006 was $0.1 million. The aggregate

operating loss associated with such businesses in the year ended

December 31, 2005 was $(16.2) million. Due to the immaterial

nature of these three businesses, they have not been presented

separately as discontinued operations.

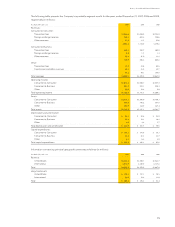

The Company’s reportable segments are reviewed separately

below because each reportable segment represents a strategic

business unit that offers different products and serves different

markets. The business segment measurements provided to, and

evaluated by, the Company’s CODM are computed in accordance

with the following principles:

|| The accounting policies of the reportable segments are the

same as those described in the summary of signifi cant account-

ing policies.

|| Corporate and other overhead is allocated to the segments

primarily based on a percentage of the segments’ revenue.

||

Expenses incurred in connection with the development of

certain new service offerings, including costs to develop

mobile money transfer and micro-lending services, and non-

recurring costs incurred to effect the Spin-off are not allocated

to the segments.

|| All items not included in operating income are excluded.