Western Union 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

37

The measurement date for our pension plans is September

30. Thus, during the third quarter of each year, management

reviews and, if necessary, adjusts the assumptions associated

with its pension plans. During 2008, in connection with the adop-

tion of SFAS No. 158, “Employers Accounting for Defi ned Benefi t

Pension and Other Postretirement Plans, An Amendment of SFAS

No. 87, 88, 106 and 132(R)” (“SFAS No. 158”), the measurement

dates for our pension plans will be changed to December 31.

The calculation of the funded status and net periodic benefi t

income is dependent upon two primary assumptions: 1) expected

long-term return on plan assets; and 2) discount rate. Our expected

long-term return on plan assets was 7.50% for 2007 and 2006.

If actual asset returns exceed the expected return on plan assets

by 100 basis points, the plans’ funded status would improve by

$4 million. The discount rate assumption for the company’s

benefi t obligation was 6.02% and 5.61% for 2007 and 2006,

respectively. A 100 basis point change in the discount rate would

change the funded status by $33 million. Due to the frozen status

of our plans, a 100 basis point change in these assumptions

would not be signifi cant to the net periodic benefi t income or

expense of our plans.

||

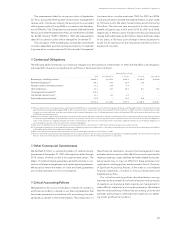

Contractual Obligations

The following table summarizes our contractual obligations to third parties as of December 31, 2007 and the effect such obligations

are expected to have on our liquidity and cash fl ows in future periods (in millions).

Payments Due by Period

Total Less than 1 Year 1-3 Years 3-5 Years After 5 Years

Borrowings, including interest(a) $4,986.3 $1,010.4 $286.1 $1,230.2 $2,459.6

Purchase obligations(b) 126.1 50.2 42.9 33.0 —

Foreign currency forward contracts(c) 37.2 28.8 8.4 — —

Operating leases 85.1 22.7 26.8 16.1 19.5

Unrecognized tax benefi ts(d) 276.2 — — — —

Capitalized contract costs(e) 14.3 14.1 0.2 — —

Estimated pension funding(f) 27.6 — 15.0 12.6 —

$5,552.8 $1,126.2 $379.4 $1,291.9 $2,479.1

(a) We have estimated our interest payments based on i) projected LIBOR rates in calculating interest on commercial paper borrowings and Floating Rate Notes, ii) projected commercial

paper borrowings outstanding throughout 2008, and the assumption that no such amounts will be outstanding on or after December 31, 2008, and iii) the assumption that no debt

issuances or renewals will occur upon the maturity dates of our fi xed and fl oating rate notes. Our fl oating rate notes mature in November 2008 and we plan to refi nance these notes

in 2008 with new fi nancing sources.

(b) Many of our contracts contain clauses that allow us to terminate the contract with notice, and with or without a termination penalty. Termination penalties are generally an amount

less than the original obligation. Certain contracts also have an automatic renewal clause if we do not provide written notifi cation of our intent to terminate the contract. Obligations

under certain contracts are usage-based and are, therefore, estimated in the above amounts. Historically, we have not had any signifi cant defaults of our contractual obligations or

incurred signifi cant penalties for termination of our contractual obligations.

(c) Represents the liability position of our foreign currency forward contracts as of December 31, 2007, which will fl uctuate based on market conditions.

(d) The timing of cash payments on unrecognized tax benefi ts, including accrued interest and penalties, is inherently uncertain because the ultimate amount and timing of such liabilities

is affected by factors which are variable and outside our control.

(e) Represents accrued and unpaid initial payments for new and renewed agent contracts as of December 31, 2007.

(f) We have estimated our pension plan funding requirements using assumptions that are consistent with pension legislation enacted during 2006. The actual minimum required

amounts each year will vary based on the actual discount rate and asset returns when the funding requirement is calculated.

||

Other Commercial Commitments

We had $62.0 million in outstanding letters of credit and bank

guarantees at December 31, 2007, with expiration dates through

2015, certain of which contain a one-year renewal option. The

letters of credit and bank guarantees are held primarily in con-

nection with lease arrangements and certain agent agreements.

We expect to renew the letters of credit and bank guarantees

prior to their expiration in most circumstances.

||

Critical Accounting Policies

Management’s discussion and analysis of results of operations

and fi nancial condition is based on our fi nancial statements that

have been prepared in accordance with accounting principles

generally accepted in the United States. The preparation of

these fi nancial statements requires that management make

estimates and assumptions that affect the amounts reported for

revenues, expenses, assets, liabilities and other related disclosures.

Actual results may or may not differ from these estimates. Our

signifi cant accounting policies are discussed in Note 2, Summary

of Signifi cant Accounting Policies, of the notes to consolidated

financial statements, included in, Financial Statements and

Supplementary Data.

Our critical accounting policies, described below, are very

important to the portrayal of our fi nancial position and our results

of operations and applying them requires our management to

make diffi cult, subjective and complex judgments. We believe

that the understanding of these key accounting policies and

estimates are essential in achieving more insight into our operat-

ing results and fi nancial condition.