Western Union 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

WESTERN UNION 2007 Annual Report

December 31, 2007 and 2006, respectively. Revenue growth for

the year ended December 31, 2007 compared to the same period

in 2006, excluding Pago Fácil, was 4%. Transaction growth, exclud-

ing Pago Fácil, was 1% during the year ended December 31,

2007, compared to the same period in 2006.

For the year ended December 31, 2007, other consumer-to-

business segment revenue increased compared to the corre-

sponding period in 2006 due to higher investment income on

settlement asset balances as well as higher enrollment fees from

increased participation in our recurring mortgage payment

service program.

2006 COMPARED TO 2005

Transaction and revenue growth in the year ended December

31, 2006 compared to the same period in 2005 also resulted

from strong transaction growth in electronic bill payments, and

to a lesser extent, the acquisition of Pago Fácil described above.

The growth rates in 2006 compared to 2005 also benefi ted from

cash bill payments experiencing a slight revenue growth for the

year ended December 31, 2006 versus a decline in 2005 as our

Western Union Convenience Pay® or “Convenience Pay” business

benefi ted from the addition of a large new biller client in the

third quarter of 2005 which had a positive impact to transaction

and revenue growth rates for the year ended December 31, 2006

compared to the same period in 2005.

Other consumer-to-business segment revenue increased for

the year ended December 31, 2006 compared to the year ended

December 31, 2005 due to higher enrollment fees from increased

participation in our recurring mortgage payment service program,

and higher investment income on settlement asset balances.

Operating income

Operating income for the consumer-to-business segment was

unchanged for the year ended December 31, 2007 compared

to the same period in 2006 because of the impact of Pago Fácil

and revenue growth in the segment’s electronic-based services

businesses, and was offset by incremental public company

expenses and the accelerated stock compensation charge taken

in connection with the change in control of First Data. Operating

income for the period grew at a lower rate than revenues as Pago

Fácil and the electronic-based services have lower operating

margins compared to those in the segment’s other services, as

well as the incremental public company expenses and acceler-

ated stock compensation charge noted above.

For the year ended December 31, 2006, operating income

increased at a slower rate than revenue growth over the same

period in 2005. The shift in the United States to electronic-based

products, as discussed above, negatively impacted operating

income. Also negatively impacting operating income were

incremental public company expenses, stock compensation

expenses incurred in connection with the adoption of SFAS No.

123R, and higher employee incentive compensation expenses

in 2006 than in 2005.

Other

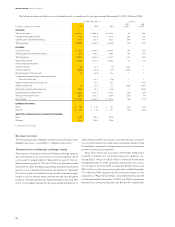

The following table sets forth other results for the years ended December 31, 2007, 2006 and 2005.

Year Ended December 31, % Change

2007 2006

(in millions) 2007 2006 2005 vs. 2006 vs. 2005

Revenues

$87.2 $89.1 $108.5 (2)% (18)%

Operating income $20.0 $18.4 $0.9 9% *

Operating income margin 23% 21% 1%

* Calculation not meaningful

Revenues

Our money order and prepaid services businesses, including

prepaid services acquired through our acquisition of Pago Fácil,

accounted for 100%, 94% and 70% of “Other” revenue in 2007,

2006 and 2005, respectively. We previously operated internet

auction payments, messaging and international prepaid cellular

top-up businesses, which were shut down or disposed of in 2005

and early 2006. Revenue remained relatively constant for the

year ended December 31, 2007, due to moderate growth in our

money order and prepaid services businesses, offset by the loss

of revenue from our shut-down or disposed of businesses, which

generated revenue for a portion of 2006, while none of those

businesses generated revenue in 2007. The decline in revenue

for these shut down businesses also contributed to the decrease

in the year ended December 31, 2006 compared to 2005 as these

businesses contributed to the entire year in 2005, but only a

portion of the year in 2006.

First Data, through its subsidiary Integrated Payment Systems,

issues our Western Union branded money orders. We do not

believe First Data’s announcement of its plan to exit its offi cial

check and money order business will have a signifi cant impact

on us, as First Data has a money order processing contract with

us through 2011. We believe we have adequate time to replace

the services currently provided by First Data.