Western Union 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

23

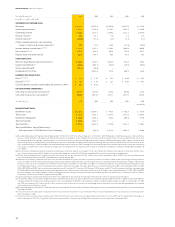

TRANSACTION FEES —

Transaction fees are charged to consumers

for sending money transfers and consumer-to-business payments.

Consumer-to-consumer transaction fees generally vary according

to the principal amount of the money transfer and the locations

from and to which the funds are sent. Transaction fees repre-

sented 81% of Western Union’s total consolidated revenues for

the year ended December 31, 2007, and are most refl ective of

our performance.

FOREIGN EXCHANGE REVENUE — In certain consumer money

transfer transactions involving different send and receive curren-

cies, we generate revenue based on the difference between the

exchange rate set by us to the consumer and the rate at which

we or our agents are able to acquire currency. Foreign exchange

revenue growth has historically been driven principally by growth

in international cross-currency transactions. Foreign exchange

revenue represented approximately 16% of Western Union’s total

consolidated revenues for the year ended December 31, 2007.

COMMISSION AND OTHER REVENUES — Commission and other

revenues represented approximately 3% of our total consolidated

revenue for the year ended December 31, 2007. Commission

and other revenues consist of commissions we receive in con-

nection with the sale of money orders, enrollment fees received

when consumers enroll in our Equity Accelerator® program (a

recurring mortgage payment service program), revenue recorded

for reimbursable costs incurred to operate payment services

programs and investment income primarily derived from interest

generated on money transfer and payment services settlement

assets as well as realized net gains and losses from such assets.

COST OF SERVICES — Cost of services includes the costs directly

associated with providing services to consumers, including com-

missions paid to agents and billers, personnel expenses, software

maintenance costs, equipment, telecommunications costs, bank

fees, infrastructure costs to provide the resources and materials

necessary to offer money transfer and other payment services

(including reimbursable costs), depreciation and amortization

expense, and other operating expenses.

SELLING, GENERAL AND ADMINISTRATIVE —

Selling, general and

administrative, or “SG&A,” primarily consists of salaries, wages

and related expenses paid to sales and administrative personnel,

as well as certain advertising and promotional costs and other

selling and administrative expenses. Prior to September 29, 2006,

the date of the spin-off, SG&A also included allocations of general

corporate overhead costs from First Data.

INTEREST EXPENSE — Interest expense represents interest

in curred in connection with outstanding borrowings payable to

third parties.

INTEREST INCOME —

Interest income consists of interest earned

on cash balances not required to satisfy settlement obligations

and in connection with loans made to several agents.

INTEREST INCOME FROM FIRST DATA, NET — Interest income from

First Data, net consists of interest income earned on notes receiv-

able from First Data, net of interest expense incurred on notes

payable to First Data. All notes receivable and payable were

settled in connection with the spin-off on September 29, 2006.

DERIVATIVE GAINS/(LOSSES), NET —

Derivative gains and losses

include realized and unrealized gains and losses associated with

certain foreign currency forward contracts that did not qualify as

hedges under derivative accounting rules prior to September

29, 2006, and the portion of the change in fair value that is con-

sidered ineffective or is excluded from the measure of effectiveness

related to contracts designated as accounting hedges entered

into on or after September 29, 2006. Derivative gains and losses

do not include fl uctuations in foreign currency forward contracts

intended to mitigate exposures on settlement activities of our

money transfer business or on certain foreign currency denomi-

nated cash positions. Gains and losses associated with those

foreign currency forward contracts are included in operating

expenses, consistent with exchange rate fl uctuations on the

related settlement assets, obligations and cash positions.

FOREIGN EXCHANGE EFFECT ON NOTES RECEIVABLE FROM FIRST

DATA, NET — Certain of the notes receivable from First Data in our

consolidated balance sheets prior to September 29, 2006, the

spin-off date, were repayable in euros, and certain of those euro

denominated notes also had foreign currency swap agreements

associated with them. These notes receivable were translated

based on current exchange rates between the euro and the

United States dollar, and changes in fair value of the related

foreign currency swap agreements were recorded based on

current market valuations. The effect of translation adjustments

and recording the foreign currency swaps to market is refl ected

in our consolidated statements of income as foreign exchange

effect on notes receivable from First Data. All notes receivable

and payable with First Data were settled in connection with the

spin-off on September 29, 2006.

OTHER INCOME, NET —

Other income, net is comprised primarily

of equity earnings from equity investments and other income

and expenses.

||

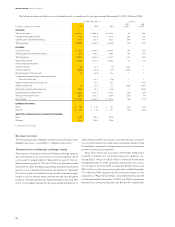

Results of Operations

The following discussion of our results of operations refers to the

year ended December 31, 2007 compared to the same period

in 2006 and the year ended December 31, 2006 compared to

the same period in 2005. The results of operations should be

read in conjunction with the discussion of our segment results

of operations, which provide more detailed discussions concern-

ing certain components of the consolidated statements of income.

All signifi cant intercompany accounts and transactions between

our company’s segments have been eliminated.