Western Union 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

WESTERN UNION 2007 Annual Report

Exclusive of discounts and the fair value of the interest rate swap,

maturities of borrowings as of December 31, 2007 are $838.2

million in 2008, $1.0 billion in 2011 and $1.5 billion thereafter.

There are no contractual maturities on borrowings during 2009

and 2010.

The Company’s obligations with respect to its outstanding

borrowings, as described below, rank equally.

Commercial Paper Program

On November 3, 2006, the Company established a commercial

paper program pursuant to which the Company may issue unse-

cured commercial paper notes (the “Commercial Paper Notes”)

in an amount not to exceed $1.5 billion outstanding at any time.

The Commercial Paper Notes may have maturities of up to 397

days from date of issuance. Interest rates for borrowings are

based on market rates at the time of issuance. The Company’s

commercial paper borrowings at December 31, 2007 and 2006

had weighted-average interest rates of approximately 5.5% and

5.4%, respectively, and a weighted-average initial terms of 36

days and 17 days, respectively.

Revolving Credit Facility

On September 27, 2006, the Company entered into a fi ve-year

unsecured revolving credit facility, which includes a $1.5 billion

revolving credit facility, a $250.0 million letter of credit sub-facility

and a $150.0 million swing line sub-facility (the “Revolving Credit

Facility”). The Revolving Credit Facility contains certain covenants

that, among other things, limit or restrict the ability of the Company

and other signifi cant subsidiaries to grant certain types of security

interests, incur debt or enter into sale and leaseback transac-

tions. The Company is also required to maintain compliance with

a consolidated interest coverage ratio covenant.

On September 28, 2007, the Company entered into an

amended and restated credit agreement, the primary purpose

of which was to extend the maturity by one year from its original

fi ve-year $1.5 billion facility entered into in 2006. No other material

changes were made in the amended and restated facility. As of

December 31, 2007, the Company had no outstanding borrow-

ings and had approximately $1.2 billion available for borrowings

under this agreement.

Interest due under the Revolving Credit Facility is fi xed for

the term of each borrowing and is payable according to the terms

of that borrowing. Generally, interest is calculated using LIBOR

plus an interest rate margin (19 basis points as of December 31,

2007 and 2006). A facility fee is also payable quarterly on the

total facility, regardless of usage (6 basis points as of December

31, 2007 and 2006). The facility fee percentage is determined

based on our credit rating assigned by Standard & Poor’s Ratings

Services (“S&P”) and/or Moody’s Investor Services, Inc. (“Moody’s”).

In addition, to the extent the aggregate outstanding borrowings

under the Revolving Credit Facility exceed 50% of the related

aggregate commitments, a utilization fee based upon such ratings

is payable to the lenders on the aggregate outstanding borrow-

ings (5 basis points as of December 31, 2007 and 2006).

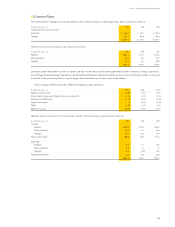

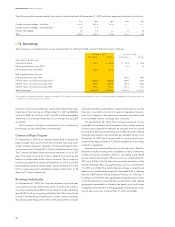

The following table summarizes the fair value of derivatives held at December 31, 2007 and their expected maturities (in millions):

Total 2008 2009 2010 2011

Foreign currency hedges — cash fl ow $(33.1) $(25.8) $(7.3) $ — $ —

Foreign currency hedges — undesignated 0.4 0.4 — — —

Interest rate hedges 3.6 0.6 1.4 1.0 0.6

Total $(29.1) $(24.8) $(5.9) $1.0 $0.6

||

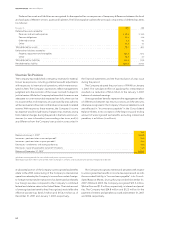

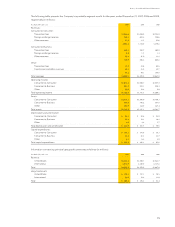

13. Borrowings

The Company’s outstanding borrowings at December 31, 2007 and 2006 consist of the following (in millions):

December 31, 2007 December 31, 2006

Carrying Value Fair Value Carrying Value Fair Value

Due in less than one year:

Commercial paper $ 338.2 $ 338.2 $ 324.6 $ 324.6

Note payable due January 2007 — — 3.0 3.0

Floating rate notes, due 2008 500.0 495.2 — —

Due in greater than one year:

Floating rate notes, due 2008 — — 500.0 499.8

5.400% notes, net of discount, due 2011(a) 1,002.8 1,012.0 999.0 986.3

5.930% notes, net of discount, due 2016 999.7 1,001.2 999.7 992.2

6.200% notes, net of discount, due 2036 497.3 473.1 497.2 471.4

Total borrowings $3,338.0 $3,319.7 $3,323.5 $3,277.3

(a) During the second quarter 2007, the Company entered into a $75.0 million interest rate swap related to these notes. For further information regarding the interest rate swap, refer

to Note 12, “Derivative Financial Instruments.”