Western Union 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

Notes to Consolidated Financial Statements

redemption history and trends, measured on a quarterly basis.

Revenue is deferred for the portion of points expected to be

ultimately redeemed for discounts in a manner that refl ects the

consumer’s progress toward earning such discounts. Costs associ-

ated with the redemption of merchandise are refl ected in operating

expenses in the Consolidated Statements of Income.

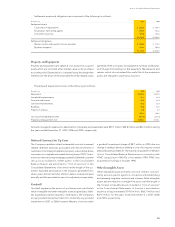

Cost of Services

Cost of services consists of costs directly associated with providing

services to consumers, and is primarily comprised of commissions

paid to agents, which are recognized at the time of sale. Most

agents outside the U.S. also receive additional commissions

based on a portion of the foreign exchange revenue associated

with money transfer transactions. Other costs included in costs

of services include personnel, software, equipment, telecom-

munications, bank fees, depreciation and amortization, and other

operating expenses incurred in connection with providing money

transfers and other payment services.

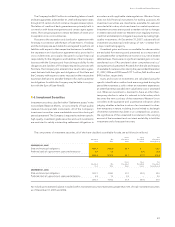

Advertising Costs

Advertising costs are charged to operating expenses as incurred

or at the time the advertising fi rst takes place. Advertising costs

for the years ended December 31, 2007, 2006 and 2005 were

$264.2 million, $261.4 million and $243.3 million, respectively.

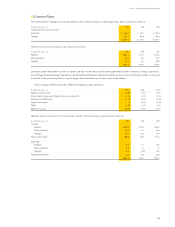

Income Taxes

For periods subsequent to the Spin-off, Western Union fi les its

own U.S. federal and state income tax returns. Western Union

fi les its own separate tax returns in foreign jurisdictions for periods

prior to and subsequent to the Spin-off, and foreign taxes are

paid in each respective jurisdiction locally.

Prior to the Spin-off, Western Union’s taxable income was

included in the consolidated U.S. federal income tax return of

First Data and also in a number of state income tax returns fi led

with First Data on a combined or unitary basis. Western Union’s

provision for income taxes was computed as if it were a separate

tax-paying entity for periods prior to the Spin-off, and federal

and state income taxes payable were remitted to First Data prior

to the Spin-off.

Western Union accounts for income taxes under the liability

method, which requires that deferred tax assets and liabilities be

determined based on the expected future income tax conse-

quences of events that have been recognized in the consolidated

fi nancial statements. Deferred tax assets and liabilities are rec-

ognized based on temporary differences between the fi nancial

statement carrying amounts and tax bases of assets and liabilities

using enacted tax rates in effect in the years in which the temporary

differences are expected to reverse.

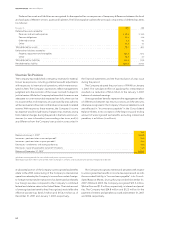

The Company adopted the provisions of Financial Accounting

Standards Board (“FASB”) Interpretation No. 48, “Accounting for

Uncertainty in Income Taxes” (“FIN 48”), on January 1, 2007. FIN

48 addresses the determination of how tax benefi ts claimed or

expected to be claimed on a tax return should be recorded in

the consolidated fi nancial statements. Under FIN 48, the Company

recognizes the tax benefi ts from an uncertain tax position only

when it is more likely than not, based on the technical merits of

the position, that the tax position will be sustained upon examina-

tion, including the resolution of any related appeals or litigation.

The tax benefi ts recognized in the consolidated fi nancial state-

ments from such a position are measured as the largest benefi t

that has a greater than fi fty percent likelihood of being realized

upon ultimate resolution. As a result of the implementation of

FIN 48, the Company recognized an increase in the liability for

unrecognized tax benefi ts plus associated accrued interest and

penalties of $0.6 million, which was accounted for as a reduction

to the January 1, 2007 balance of retained earnings.

Foreign Currency Translation

The U.S. dollar is the functional currency for all of Western

Union’s businesses except certain investments and subsidiaries

located primarily in Ireland and Argentina. Foreign currency

denominated assets and liabilities for those entities for which

the local currency is the functional currency are translated into

United States dollars based on exchange rates prevailing at the

end of the period. Revenues and expenses are translated at

average exchange rates prevailing during the period. The effects

of foreign exchange gains and losses arising from the translation

of assets and liabilities of those entities where the functional

currency is not the United States dollar are included as a com-

ponent of “Accumulated other comprehensive loss.” Foreign

currency translation gains and losses on assets and liabilities of

foreign operations in which the United States dollar is the func-

tional currency are recognized in operations.

Derivative Financial Instruments

Western Union utilizes derivative instruments to mitigate foreign

currency and interest rate risk. The Company recognizes all

derivative instruments in the “Other assets” and “Other liabilities”

captions in the accompanying Consolidated Balance Sheets at

their fair value. All cash fl ows associated with derivatives are

included in cash fl ows from operating activities in the Consol-

idated Statements of Cash Flows other than those previously

designated as cash fl ow hedges that were determined to not

qualify for hedge accounting as described in Note 12.

||

CASH FLOW HEDGES —

Changes in the fair value of derivatives

that are designated and qualify as cash fl ow hedges in accor-

dance with Statement of Financial Accounting Standards

(“SFAS”) No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” as amended and interpreted (“SFAS No.

133”) are recorded in “Accumulated other comprehensive

loss.” Cash fl ow hedges consist of foreign currency hedging

of forecasted sales, as well as, from time to time, hedges of

anticipated fi xed rate debt issuances. Derivative fair value

changes that are captured in Accumulated other comprehen-

sive loss are reclassifi ed to earnings in the same period or

periods the hedged item affects earnings, to the extent the

change in the fair value of the instrument is effective in offset-

ting the change in fair value of the hedged item. The portion

of the change in fair value that is either considered ineffective

or is excluded from the measure of effectiveness is recognized

immediately in “Derivative gains/(losses), net.”