Western Union 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

29

Revenues

2007 COMPARED TO 2006

The primary driver of consumer-to-consumer revenue growth

are transaction fees and foreign exchange revenue. Consumer-

to-consumer money transfer revenue growth of 9% for the year

ended December 31, 2007 over the same period in 2006 was

driven by our international business. However, the growth

experienced by our international business has been partially

offset by revenue declines in our domestic and Mexico busi-

nesses in 2007.

International revenue growth of 15% for the year ended

December 31, 2007 compared to the corresponding period in

2006, resulted from a 20% increase in volume of international

money transfer transactions. Our international transactions that

were originated outside of the United States also continued to

display strong transaction and revenue growth for the year ended

December 31, 2007.

The key strategic inbound markets of India and China con-

tinued to grow, with revenue growth of 44% and 37%, respectively,

on transaction growth of approximately 75% and 25%, respec-

tively, and these two markets combined represented approximately

5% of Western Union consolidated revenues for the year ended

December 31, 2007.

Fluctuations in the exchange rate between the euro and the

United States dollar have resulted in benefi ts of $78.8 million

and $11.5 million in 2007 and 2006, respectively, over the previ-

ous year. These benefi ts to consumer-to-consumer revenue would

not have occurred had there been a constant exchange rate, and

was net of the impact of our foreign currency hedges.

The United States to Mexico, United States domestic and the

United States outbound businesses were adversely impacted by

various factors in the United States for the year ended December

31, 2007. These factors, which began in the second quarter 2006

and are discussed in more detail below, include the immigration

debate, and market softness, in part due to the slowdown in the

construction industry. We responded to these factors by launching

distribution, pricing, advertising, promotion and community

outreach initiatives. We have not seen transaction and revenue

growth rates return to levels prior to 2006. We believe this is due

primarily to market softness in the United States, in part due to

a slow down in the construction industry.

Although domestic transactions decreased for the year ended

December 31, 2007 over the corresponding period in 2006, due

primarily to the factors described above and the decline in trans-

actions initiated on our website and through the telephone, as

described below, the decline in domestic transactions began to

moderate during each sequential quarter in 2007. Domestic

revenue declined at a higher rate than transactions, due in part to

the impact of price decreases and lower principal amounts sent.

Transactions and revenues for money transfers initiated on

our website and through the telephone declined for the year

ended December 31, 2007 compared to the same period in

2006. Transactions initiated in the United States have been, and

we anticipate will continue to be, impacted by tightened controls

implemented beginning in early 2007 by Western Union, card

issuing banks and card associations in response to credit and

debit card fraud in the United States. These tightened controls

have directly impacted our consumers’ ability to use their debit

and credit cards to send money on our website and through the

telephone, decreasing the volume of transactions. Card issuing

banks and card associations have begun to allow more consumer

transactions to be processed, in part in response to Western

Union’s own increased scrutiny of these transactions. However,

we anticipate transaction growth will continue to be impacted

by these factors and consumer perceptions of their ability to

transact on the website and through the telephone as a result of

the additional controls that have been implemented.

While Mexico transactions grew for the year ended December

31, 2007 compared to the year ended December 31, 2006,

revenue declined due to price reductions taken in early 2007.

However, Mexico revenue and transaction growth rates began

to converge during each sequential quarter in 2007 as there were

no signifi cant pricing reductions after the early part of 2007.

Foreign exchange revenue increased for the year ended

December 31, 2007 compared to the same period in the prior

year due to an increase in the international business resulting in

increased cross-currency transactions, partially offset by reduced

foreign exchange rate spreads in selected markets.

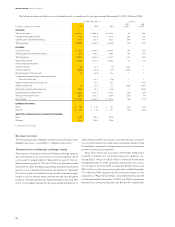

Year Ended December 31,

2006 2005

2007 2006 (excluding Vigo) 2005 (excluding Vigo)

Consumer-to-consumer transaction growth/(decline):

International(a) 20% 29% 24% 27% 26%

Domestic(b) (4)% (1)% (2)% 5% 5%

Mexico(c) 4% 35% 6% 28% 21%

Consumer-to-consumer revenue growth/(decline):

International(a) 15% 17% 15% 16% 15%

Domestic(b) (10)% (3)% (3)% 4% 4%

Mexico(c) (4)% 29% 7% 33% 27%

(a) Represents transactions between and within foreign countries (excluding Canada and Mexico), transactions originated in the United States or Canada and paid elsewhere, and

transactions originated outside the United States or Canada and paid in the United States or Canada. Excludes all transactions between or within the United States and Canada and

all transactions to and from Mexico as refl ected in (b) and (c) below.

(b) Represents all transactions between and within the United States and Canada.

(c) Represents all transactions to and from Mexico.