Western Union 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Western Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

Notes to Consolidated Financial Statements

Stock Option Activity

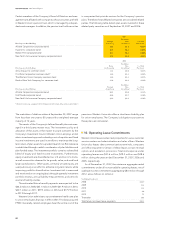

A summary of Western Union stock option activity relating to Western Union and First Data employees for the year ended December

31, 2007 is as follows (options and aggregate intrinsic value in millions):

Year Ended December 31, 2007

Weighted-Average Aggregate

Weighted-Average Remaining Intrinsic

Options Exercise Price Contractual Term Value

Outstanding at January 1, 73.8 $17.84

Granted 0.7 21.77

Exercised (13.6) 15.62

Cancelled/forfeited (1.5) 21.05

Outstanding at December 31, 59.4 $18.32 5.9 $377.1

Western Union options exercisable at December 31, 54.7 $18.21 5.6 $354.7

The Company received $211.8 million and $80.8 million in cash

proceeds related to the exercise of stock options during the years

ended December 31, 2007 and 2006, respectively. Upon the

exercise of stock options, shares of common stock are issued

from authorized common shares. The Company maintains a share

repurchase program (Note 11).

The Company’s calculated pool of excess tax benefi ts available

to absorb write-offs of deferred tax assets in subsequent periods

was approximately $10.6 million as of December 31, 2007. The

Company realized total tax benefi ts during the years ended

December 31, 2007 and 2006 from stock option exercises of

$10.7 million and $1.9 million, respectively.

The total intrinsic value of stock options exercised during the

years ended December 31, 2007, 2006 and 2005 was $91.0

million, $42.1 million and $6.9 million, respectively.

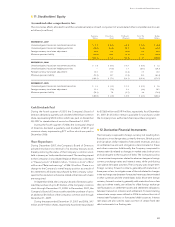

Restricted Stock Awards and Restricted Stock Units

A summary of Western Union activity for restricted stock awards and units relating to Western Union and First Data employees for

the year ended December 31, 2007 is listed below (awards/units in millions):

Year Ended December 31, 2007

Number Weighted-Average

Outstanding Grant-Date Fair Value

Non-vested at January 1, 2007 3.0 $19.80

Granted 0.1 21.86

Vested (1.9) 19.94

Forfeited (0.2) 19.70

Non-vested at December 31, 2007 1.0 $19.39

Stock-Based Compensation

The following table sets forth the total impact on earnings for

stock-based compensation expense recognized in the Consoli-

dated Statements of Income resulting from stock options, restricted

stock awards, restricted stock units and ESPP rights for Western

Union employees for the year ended December 31, 2007 and

2006 (in millions, except per share data). Although Western Union

has not adopted an employee stock purchase plan, the Company’s

employees were allowed to participate in First Data’s ESPP prior

to the Spin-off. A benefi t to earnings is refl ected as a positive and

a reduction to earnings is refl ected as a negative.

Year Ended December 31, 2007 2006

Stock-based compensation expense impact on income before income taxes $(50.2) $(30.1)

Income tax benefi t from stock-based compensation expense 15.1 9.7

Net income impact $(35.1) $(20.4)

Earnings per share:

Basic $(0.05) $(0.03)

Diluted $(0.05) $(0.03)